How much difference do higher interest rates make for home sales in our area?

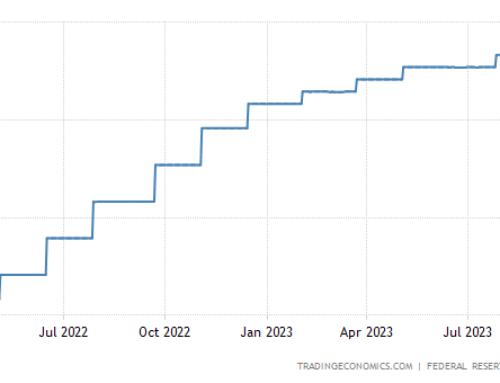

Over the spring, the Federal Reserve announced a plan for multiple interest rate hikes this year to try to get inflation under control, and we’ve seen three rate increases already this year. As I write this, interest rates on home loans are approaching 6%, up from about 3% at the start of the year. Interest rates are at their highest level in 10 years, and there may be additional increases to come.

Increasing rates make a lot of difference in the purchasing power of individual buyers. For sellers and property values in our market, where we have excess demand, the impact is not as extreme, but it does definitely affect the market.

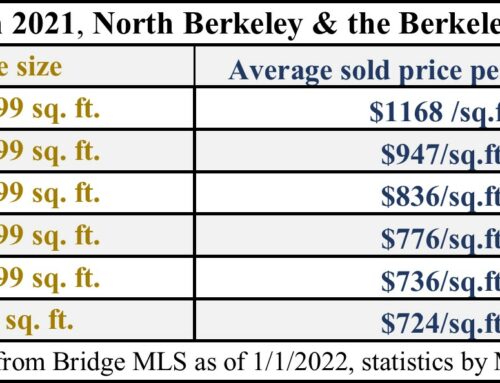

Consider individual buyers who are qualified for at most a $1 million dollar home loan (to choose a round number) when interest rates are 3%. This means that they are qualified, given their income and other debts, for a maximum monthly loan payment of $4216. When rates go up to 6%, assuming the buyers can afford that same payment, they now only qualify for a loan of $703K (so they can spend $297K less on a home, compared to when rates were at 3%). As a very rough rule of thumb, the maximum loan amount people can qualify for goes down about 10% each time the interest rate goes up by one percentage point.

Another way to think about this – a particular buyer might need something like $230K of household income to qualify for a $1M home loan when the interest rate is 3%. (The actual income requirement will depend on things like credit rating, other debt, etc.) When the interest rate rises to 6%, that same buyer would now need over $300K in income to qualify.

How do buyers respond to increasing interest rates? With less purchasing power, buyers need to adjust their expectations. They could look for a smaller home, a less expensive location, or a home that needs more repairs or improvements. Other buyers, who were not already planning to spend their max, might decide to go closer to their limit, and still buy the same thing.

In thinking about how higher interest rates affect our market as a whole, the crucial question is, will there be fewer buyers at particular price points after all this happens? In our market, we have had an excess of buyers at various price points, and a good number of cash buyers as well. Some buyers will need to move down a price category, but there should be other buyers (moving down from higher price points) to take their place. And yes, some buyers will be unwilling to compromise on their purchase and may choose not to buy now at all.

Overall, I would expect there to be somewhat fewer buyers in each price point. There was so much excess demand before, though, that there should still be enough buyers out there to keep the market stable.