How do actions by “the Fed” affect interest rates on home loans?

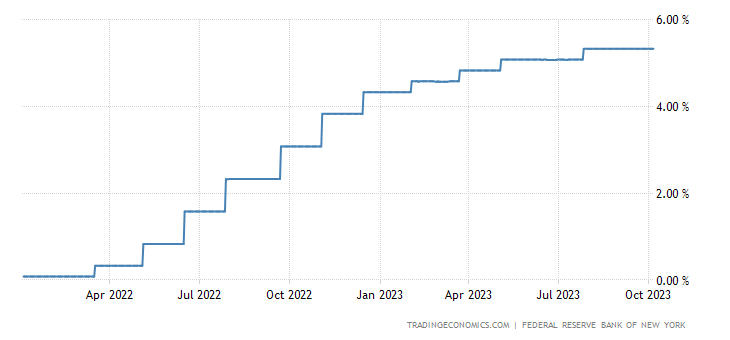

The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high unemployment. Since the start of 2022, they’ve been focused on eliminating the inflation that crept into the system during the main COVID years (2020-2021).

Interest rates on home loans are very long-term rates, since the typical home loan in the U.S. is a 30-year loan. They most closely track the rate on the 10-year Treasury note. Rates on home loans, like rates on 10-year Treasury notes, move up and down in response to economic conditions, changes in the return and relative riskiness of alternative assets, the availability of loanable funds, and current and expected future inflation rates. Rates on long term loans, like home loans, also depend on current and expected future short-term interest rates, so they are definitely affected by Fed policy.

In January of 2022, the Fed signaled that it was likely to start raising rates soon, setting off the real estate buying frenzy of early 2022, as buyers tried to get into the market before rates went up. The first rate increase by the Fed last year was in March of 2022, and by about this time last year, the target range for the federal funds rate was already up 3 percentage points, with more increases to come. By last fall, the Fed’s actions had resulted in a doubling of home loan rates, from the 3% range at the start of 2022, to about 6% in fall 2022. In the last year, the Fed has increased the target range for the federal funds rate 6 more times, for a total increase of 5.25% since the start of 2022. Today we’re looking at rates on homes loans that are approaching 8%.

When will interest rates go down again? Market rates are always bouncing around in response to new information, but we are unlikely to see a sustained reduction in interest rates until the Fed sees a need to stimulate the economy again, because inflation is low, and unemployment is increasing, or if they see a need to increase bank liquidity to keep the system functioning well.