What’s going on in the home insurance market, and how does it affect current homeowners?

In late May, State Farm, which is the largest issuer of homeowners’ policies in California, announced that it would not sell any new home insurance policies in California. In addition, Farmer’s Insurance just announced that they will limit the number of new policies they sell here. Allstate also stopped issuing new policies in California last fall, so this is a significant trend.

Why are these big insurers pulling away from California at this time? Major wildfires in recent years have resulted in surges in claims, and climate change has made this much more likely to be the norm in coming years. Pandemic supply-chain issues and lingering inflation have meant that the cost of settling claims has gone up significantly. The cost of reinsurance, which is insurance that the companies get to protect themselves against excessive losses, has also gotten more expensive. The California Department of Insurance, though, limits companies’ ability to raise rates to cover higher costs and elevated risks, leading State Farm and Allstate to decide that it’s not worth selling new policies here.

Happily, this does not mean that existing State Farm and Allstate customers are losing their coverage. It does mean, though, that anyone looking for a new policy right now is going to find it more challenging, and more expensive. There are still lots of insurers selling policies in California, but there are fewer choices now. The remaining insurers are seeing increased demand for their products, which in theory would lead to higher prices. With pricing controlled by the California Department of Insurance, though, what we get are insurance companies that are much more selective in which properties they choose to insure.

This is not a good time to shop for a new or replacement homeowner’s insurance policy, so it’s also not a good time to do anything to give your existing insurer a reason to cancel. Be extra sure right now that the insurance bill is paid on time. If your insurance is paid by an outside party (such as a lender who collects money for taxes and insurance through an impound account, and makes those payments for you), it’s worth the effort to confirm that the payments are made on time, especially if your loan has been recently transferred to a new bank or servicer. If you are shopping for a new home, when you see one you like, you should plan to check insurability and get coverage quotes very early in the process.

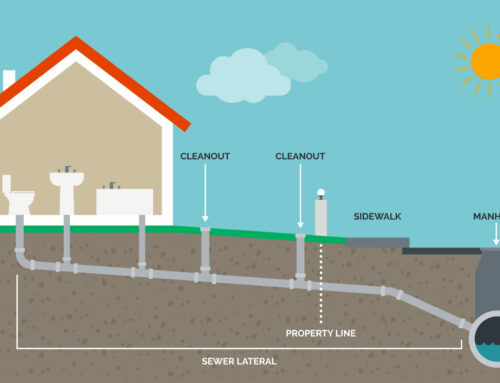

Insurance companies are paying much more attention to the condition of the homes they insure, including their roofs as well as their plumbing and electrical systems. Many companies will not issue a new policy for a home that has older electrical (such as knob and tube wiring, or fuses instead of circuit breakers). If you are planning to sell your home, it’s worth seriously considering work that will make the home more insurable, such as replacing a wood shake roof or knob and tube wiring. Your current insurance policy will (sadly) not be transferrable to the new owners, and buyers need to be able to get insurance to get a loan.