REAL ESTATE ANSWERS: What’s changing in the real estate world?

What’s changing in the real estate world? There was a big lawsuit filed in Missouri in 2019, that focused on the way buyers’ agents are paid. A settlement agreement was reached last month, and it has been all over the news recently. What’s it all about? Sellers have long negotiated a total commission with their agents, and that commission has been shared between the listing (seller’s) agent and the agent representing the buyer of the property. This is all spelled out clearly in the listing agreement we use in California – it has a field for the total commission to [...]

REAL ESTATE ANSWERS: What counts as a bedroom in real estate, and do more bedrooms add value?

What counts as a bedroom in real estate, and do more bedrooms add value? A bedroom in general is just a room where people sleep. For a room to count as a bedroom for real estate purposes, there are several requirements: (1) FLOOR SIZE. According to the standards used by appraisers, a habitable room must have a floor of at least 70 square feet in area and be at least 7 feet in any direction. So a 7’x10’ room is okay, but a 6’x12’ space, even though it’s 72 square feet, wouldn’t be counted as a room (or a bedroom) [...]

REAL ESTATE ANSWERS: How do actions by “the Fed” affect interest rates on home loans?

How do actions by “the Fed” affect interest rates on home loans? The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high [...]

REAL ESTATE ANSWERS: What’s going on in the home insurance market, and how does it affect current homeowners?

What’s going on in the home insurance market, and how does it affect current homeowners? In late May, State Farm, which is the largest issuer of homeowners’ policies in California, announced that it would not sell any new home insurance policies in California. In addition, Farmer's Insurance just announced that they will limit the number of new policies they sell here. Allstate also stopped issuing new policies in California last fall, so this is a significant trend. Why are these big insurers pulling away from California at this time? Major wildfires in recent years have resulted in surges in claims, [...]

REAL ESTATE ANSWERS: What is (or was!) the California “Dream For All” program?

What is (or was!) the California “Dream For All” program? There have been many programs over the years aimed at helping first-time buyers get into the expensive California housing market, but they have mostly been so restrictive that few people were able to use them. The less-restrictive “Dream For All” program from the California Housing Finance Agency is targeted to low and moderate income first-time buyers. It provides funds for down payment and closing costs through a shared appreciation loan of up to 20% of the purchase price. Here’s an example of how it can work. A qualifying buyer uses [...]

REAL ESTATE ANSWERS: How has the negotiating environment changed as the market has shifted?

How has the negotiating environment changed as the market has shifted? When the real estate market is at its strongest, there is not a vast amount of negotiation between buyers and sellers. Buyers make strong offers in competition, often waiving the inspection contingency, and many sellers choose to accept the best offer, rather than negotiate and risk de-stabilizing the transaction. When the market is more balanced, there are fewer offers on properties, and buyers may not feel that they have to make their best offer at the start. An accepted offer might also have an inspection contingency, so there may [...]

REAL ESTATE ANSWERS: How much difference do higher interest rates make for home sales in our area?

How much difference do higher interest rates make for home sales in our area? Over the spring, the Federal Reserve announced a plan for multiple interest rate hikes this year to try to get inflation under control, and we’ve seen three rate increases already this year. As I write this, interest rates on home loans are approaching 6%, up from about 3% at the start of the year. Interest rates are at their highest level in 10 years, and there may be additional increases to come. Increasing rates make a lot of difference in the purchasing power of individual buyers. [...]

REAL ESTATE ANSWERS: What is the right pricing strategy for my home?

What is the right pricing strategy for my home? In Berkeley and in the surrounding areas, it has long been the case that many properties are listed below what they’ll likely sell for. I’ll call this “low pricing.” Low pricing is a strategy intended to attract the attention of a wide range of buyers and to generate multiple offers. Most properties around here follow this strategy, but it’s not the only possibility. “Transparent” pricing is a newer term for the classic pricing strategy followed in most other areas. It refers to choosing a list price that is at a value [...]

REAL ESTATE ANSWERS: What is home fire hardening, and do I need to do it?

What is home fire hardening, and do I need to do it? “We’ve learned from recent fires. Hardening your home and keeping the 5 feet closest to your house clear of flammable materials (including patio furniture and décor) greatly improves its chance of surviving a fire.” CALIFORNIA FIRE SAFE COUNCIL Fire hardening is making changes to an existing home to make it more resistant to wildfire. According to the Fire Safe Council, your home can catch fire in 3 main ways: from ember storms, where small pieces of burning material are blown in front of a fire (embers can apparently [...]

REAL ESTATE ANSWERS: How are property tax assessment transfer rules changing due to Prop. 19?

How are property tax assessment transfer rules changing due to Proposition 19? If you are one of the many people in California who at some point considered moving but decided not to because your property taxes would increase sharply, you could be in luck now. Proposition 19, which passed in the last election and goes into effect April 1, 2021, allows a homeowner who is 55 or older, severely disabled, or whose home was substantially damaged by wildfire or natural disaster to transfer their property tax assessment to a new replacement home with fewer restrictions than is currently the case. [...]

REAL ESTATE ANSWERS: What’s changing in the real estate world?

What’s changing in the real estate world?

There was a big lawsuit filed in Missouri in 2019, that focused on the way buyers’ agents are paid. A settlement agreement was reached last month, and it has been all over the news recently. What’s it all about?

Sellers have long negotiated a total commission with their agents, and that commission has been shared between the listing (seller’s) agent and the agent representing the buyer of the property. This is all spelled out clearly in the listing agreement we use in California – it has a field for the total commission to be paid, and a separate specific entry that says how much of that total will be paid to the buyer’s agent. The commission offered to the buyer’s agent has been a required field for any property entered into the Multiple Listing Service (MLS). The lawsuit argued in part that this requirement of compensation to the buyer’s agent in the MLS is an antitrust violation.

The settlement agreement has not yet been approved by the courts, but, if approved, it will lead to two changes in the way we do business. The first is that an offer of compensation to a buyer’s agent will no longer be a requirement for a listing to be in the MLS. Sellers can still pay the buyer’s agent, but that compensation will not be part of the MLS info. The second change is that there will always be a separate written agreement between buyers and the realtor® representing them.

The commission paid to the buyer’s agent can be paid by the seller, or by the buyer. This of course begs the question, why would a seller pay for a buyer to have representation?

The sale of a home is a huge and complicated transaction, involving large sums of money, and real estate is one of the most litigious sectors of the economy. As a seller, you don’t want the buyer to end up with buyer’s remorse, so it is extremely important that the buyer understands the process, and the property involved. This is the critical role of the buyer’s agent: not only to bring your property to the attention of buyers for whom it is a good fit and show it to them, but also to provide them with essential information and context about the property, the area, legal requirements, and local market conditions and values.

A smart seller will always want their buyer to have not only an agent, but a good agent. When a seller offers to pay the buyer’s agent’s compensation, they are (1) increasing the pool of possible buyers (because not all buyers will have the cash to cover the downpayment and closing costs, and also pay their agent); (2) increasing the odds that their escrow will close (because the buyer will have someone knowledgeable helping them understand the property and what the process and costs are, and shepherding them through the offer and escrow); and (3) reducing future risk.

REAL ESTATE ANSWERS: What counts as a bedroom in real estate, and do more bedrooms add value?

What counts as a bedroom in real estate, and do more bedrooms add value?

A bedroom in general is just a room where people sleep. For a room to count as a bedroom for real estate purposes, there are several requirements:

(1) FLOOR SIZE. According to the standards used by appraisers, a habitable room must have a floor of at least 70 square feet in area and be at least 7 feet in any direction. So a 7’x10’ room is okay, but a 6’x12’ space, even though it’s 72 square feet, wouldn’t be counted as a room (or a bedroom) on an appraisal.

(2) CEILING HEIGHT. At least 50% of the ceiling must be at least 7 feet high.

(3) ENTRANCE. There should be a door to the bedroom from the interior of the house.

(4) EGRESS. There also needs to be an exit from the bedroom to the exterior. This can be a door to the outside, or it can be an exterior window. If it’s a window, it should be 24 to 44 inches from the floor, have an opening of at least 5.7 square feet, and it must be no less than 24 inches in vertical size and no less than 20 inches wide. (The point is to make it usable if someone needs to climb in or out in an emergency.)

Note that if you have an older home, built before these requirements were put in place and without the proper egress windows, the city is not going to knock on your door and require that you make the window openings larger. However, if you are doing a project that modifies the rough openings, you will be required to comply. And if you sell that home, it’s advisable to disclose that one or more “bedrooms” does not have an egress window.

Many people think that a bedroom has to have a closet. In California, that is not a requirement, although some local jurisdictions may have other requirements. Most buyers though do want to have a closet in or at least near each bedroom.

Do additional bedrooms always add value in a sale? Not necessarily. The first few bedrooms do add value to a typical Berkeley house, but only if the bedrooms are of reasonable size, and the remaining living space is of reasonable size for the number of bedrooms. Consider a 1000 square foot home with 5 bedrooms, for example. The bedrooms would have to be quite small, and there won’t be much living or storage space, which will make the property appealing to far fewer buyers. Even for a larger home, a 5-bedroom house doesn’t necessarily have more value (everything else being equal) than one with 4 bedrooms, as there are fewer buyers who need the 5th bedroom.

Bottom line: Bedroom count does matter for value, but only as part of the overall picture of a home and its function.

REAL ESTATE ANSWERS: How do actions by “the Fed” affect interest rates on home loans?

How do actions by “the Fed” affect interest rates on home loans?

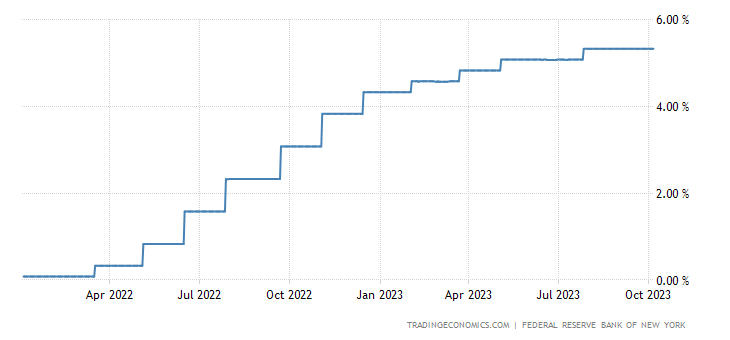

The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high unemployment. Since the start of 2022, they’ve been focused on eliminating the inflation that crept into the system during the main COVID years (2020-2021).

Interest rates on home loans are very long-term rates, since the typical home loan in the U.S. is a 30-year loan. They most closely track the rate on the 10-year Treasury note. Rates on home loans, like rates on 10-year Treasury notes, move up and down in response to economic conditions, changes in the return and relative riskiness of alternative assets, the availability of loanable funds, and current and expected future inflation rates. Rates on long term loans, like home loans, also depend on current and expected future short-term interest rates, so they are definitely affected by Fed policy.

In January of 2022, the Fed signaled that it was likely to start raising rates soon, setting off the real estate buying frenzy of early 2022, as buyers tried to get into the market before rates went up. The first rate increase by the Fed last year was in March of 2022, and by about this time last year, the target range for the federal funds rate was already up 3 percentage points, with more increases to come. By last fall, the Fed’s actions had resulted in a doubling of home loan rates, from the 3% range at the start of 2022, to about 6% in fall 2022. In the last year, the Fed has increased the target range for the federal funds rate 6 more times, for a total increase of 5.25% since the start of 2022. Today we’re looking at rates on homes loans that are approaching 8%.

When will interest rates go down again? Market rates are always bouncing around in response to new information, but we are unlikely to see a sustained reduction in interest rates until the Fed sees a need to stimulate the economy again, because inflation is low, and unemployment is increasing, or if they see a need to increase bank liquidity to keep the system functioning well.

REAL ESTATE ANSWERS: What’s going on in the home insurance market, and how does it affect current homeowners?

What’s going on in the home insurance market, and how does it affect current homeowners?

In late May, State Farm, which is the largest issuer of homeowners’ policies in California, announced that it would not sell any new home insurance policies in California. In addition, Farmer’s Insurance just announced that they will limit the number of new policies they sell here. Allstate also stopped issuing new policies in California last fall, so this is a significant trend.

Why are these big insurers pulling away from California at this time? Major wildfires in recent years have resulted in surges in claims, and climate change has made this much more likely to be the norm in coming years. Pandemic supply-chain issues and lingering inflation have meant that the cost of settling claims has gone up significantly. The cost of reinsurance, which is insurance that the companies get to protect themselves against excessive losses, has also gotten more expensive. The California Department of Insurance, though, limits companies’ ability to raise rates to cover higher costs and elevated risks, leading State Farm and Allstate to decide that it’s not worth selling new policies here.

Happily, this does not mean that existing State Farm and Allstate customers are losing their coverage. It does mean, though, that anyone looking for a new policy right now is going to find it more challenging, and more expensive. There are still lots of insurers selling policies in California, but there are fewer choices now. The remaining insurers are seeing increased demand for their products, which in theory would lead to higher prices. With pricing controlled by the California Department of Insurance, though, what we get are insurance companies that are much more selective in which properties they choose to insure.

This is not a good time to shop for a new or replacement homeowner’s insurance policy, so it’s also not a good time to do anything to give your existing insurer a reason to cancel. Be extra sure right now that the insurance bill is paid on time. If your insurance is paid by an outside party (such as a lender who collects money for taxes and insurance through an impound account, and makes those payments for you), it’s worth the effort to confirm that the payments are made on time, especially if your loan has been recently transferred to a new bank or servicer. If you are shopping for a new home, when you see one you like, you should plan to check insurability and get coverage quotes very early in the process.

Insurance companies are paying much more attention to the condition of the homes they insure, including their roofs as well as their plumbing and electrical systems. Many companies will not issue a new policy for a home that has older electrical (such as knob and tube wiring, or fuses instead of circuit breakers). If you are planning to sell your home, it’s worth seriously considering work that will make the home more insurable, such as replacing a wood shake roof or knob and tube wiring. Your current insurance policy will (sadly) not be transferrable to the new owners, and buyers need to be able to get insurance to get a loan.

REAL ESTATE ANSWERS: What is (or was!) the California “Dream For All” program?

What is (or was!) the California “Dream For All” program?

There have been many programs over the years aimed at helping first-time buyers get into the expensive California housing market, but they have mostly been so restrictive that few people were able to use them. The less-restrictive “Dream For All” program from the California Housing Finance Agency is targeted to low and moderate income first-time buyers.

It provides funds for down payment and closing costs through a shared appreciation loan of up to 20% of the purchase price.

Here’s an example of how it can work. A qualifying buyer uses an approved lender, and gets a “regular” loan for 80% of the purchase price, combined with a 20% Dream For All shared appreciation loan. The buyer, in this example, only needs to have funds to cover closing costs (which might be, very roughly, 5% of the purchase price).

The buyer makes regular payments (principal plus interest) on the 80% loan, but there are no ongoing payments on the shared appreciation loan. Instead of paying interest on the Dream For All assistance funds, when the property is sold, the assistance funds are repaid, along with a share of the appreciation on the property. If the Dream For All assistance was 20% of the purchase price, the program gets 20% of the appreciation.

There are other programs out there for buyers without a lot of down payment money, where the borrower only needs to put around 3% of the purchase price down. In the Dream For All scenario, though, the monthly payment (on 80%, rather than 97% of the purchase price) is lower, and there is no mortgage insurance as long as the “regular” loan component is 80% or less of the value.

Here are some of the requirements of the Dream For All program:

- The property must be a 1-unit/single family home or a condo, purchased as the primary residence of the new owner.

- Non-occupant co-signers are not allowed.

- The maximum income to qualify in Alameda County is $282,000.

- You must be a first-time buyer, BUT they define a first-time buyer as someone who has not owned a home in California in the last three years.

- The maximum “regular” loan amount is $1,089,300, which means that, with 20% Dream For All assistance, the maximum purchase price would be $1,361,625.

- The buyer has to take a Homebuyer Education and Counseling course.

For more details, see www.calhfa.ca.gov/dream/.

Here’s the bad news — the program was so popular, that its funding, which was expected to last until early fall, ran out in not even 10 days! It’s unclear whether the state will provide additional funding, but if you know someone who might qualify and be interested, they should watch and be ready to act quickly if more funds are added.

REAL ESTATE ANSWERS: How has the negotiating environment changed as the market has shifted?

How has the negotiating environment changed as the market has shifted?

When the real estate market is at its strongest, there is not a vast amount of negotiation between buyers and sellers. Buyers make strong offers in competition, often waiving the inspection contingency, and many sellers choose to accept the best offer, rather than negotiate and risk de-stabilizing the transaction. When the market is more balanced, there are fewer offers on properties, and buyers may not feel that they have to make their best offer at the start. An accepted offer might also have an inspection contingency, so there may be further negotiations during the inspection period.

Most real estate negotiations are over dollar amounts (although timing and other terms can also be negotiated), but the same dollars can be factored into a contract in different ways: as a change in price, as a change in who is paying various closing costs, as a credit towards closing costs for the buyer, or as a buy-down of the buyer’s interest rate by the seller. Each of these possibilities affects the buyer’s and seller’s bottom lines differently, so a strong, creative negotiation strategy weighs the effects of each to find the right one or the right mix.

From a financial perspective, the seller’s goals are relatively simple. Sellers want to maximize their net proceeds, so they want the price as high as possible, and their costs as low as possible. The buyer side is much more complicated. Buyers want to minimize their cost for the purchase, so to keep the sale price and their closing costs as low as possible. Buyers also want to minimize their ongoing costs of ownership: their loan payments (if any) and their annual property taxes. In addition, buyers will consider the available cash they will have after the purchase to make needed repairs or improvements.

When I am negotiating for a seller client, my first step is aways to gather as much information as possible about the buyers and their circumstances. Are they getting a loan? Will they have plenty of cash on hand after the purchase for needed repairs? Is the monthly cost of ownership their primary constraint, or do they ultimately care the most about the overall purchase price? Will their lender allow credits toward closing costs? How much will a point paid on their loan reduce their monthly payment? Using that information, I can then consider all the various ways to structure potential contract changes, to find an option that will be the most attractive to the seller, while making the deal work for the buyer.

It is all quite complex, but it’s an important part of the process. One of the benefits of longevity in this business is having experience navigating markets of all different strengths. I guess that makes up for the extra wrinkles the years have also brought me!

REAL ESTATE ANSWERS: How much difference do higher interest rates make for home sales in our area?

How much difference do higher interest rates make for home sales in our area?

Over the spring, the Federal Reserve announced a plan for multiple interest rate hikes this year to try to get inflation under control, and we’ve seen three rate increases already this year. As I write this, interest rates on home loans are approaching 6%, up from about 3% at the start of the year. Interest rates are at their highest level in 10 years, and there may be additional increases to come.

Increasing rates make a lot of difference in the purchasing power of individual buyers. For sellers and property values in our market, where we have excess demand, the impact is not as extreme, but it does definitely affect the market.

Consider individual buyers who are qualified for at most a $1 million dollar home loan (to choose a round number) when interest rates are 3%. This means that they are qualified, given their income and other debts, for a maximum monthly loan payment of $4216. When rates go up to 6%, assuming the buyers can afford that same payment, they now only qualify for a loan of $703K (so they can spend $297K less on a home, compared to when rates were at 3%). As a very rough rule of thumb, the maximum loan amount people can qualify for goes down about 10% each time the interest rate goes up by one percentage point.

Another way to think about this – a particular buyer might need something like $230K of household income to qualify for a $1M home loan when the interest rate is 3%. (The actual income requirement will depend on things like credit rating, other debt, etc.) When the interest rate rises to 6%, that same buyer would now need over $300K in income to qualify.

How do buyers respond to increasing interest rates? With less purchasing power, buyers need to adjust their expectations. They could look for a smaller home, a less expensive location, or a home that needs more repairs or improvements. Other buyers, who were not already planning to spend their max, might decide to go closer to their limit, and still buy the same thing.

In thinking about how higher interest rates affect our market as a whole, the crucial question is, will there be fewer buyers at particular price points after all this happens? In our market, we have had an excess of buyers at various price points, and a good number of cash buyers as well. Some buyers will need to move down a price category, but there should be other buyers (moving down from higher price points) to take their place. And yes, some buyers will be unwilling to compromise on their purchase and may choose not to buy now at all.

Overall, I would expect there to be somewhat fewer buyers in each price point. There was so much excess demand before, though, that there should still be enough buyers out there to keep the market stable.

REAL ESTATE ANSWERS: What is the right pricing strategy for my home?

What is the right pricing strategy for my home?

In Berkeley and in the surrounding areas, it has long been the case that many properties are listed below what they’ll likely sell for. I’ll call this “low pricing.” Low pricing is a strategy intended to attract the attention of a wide range of buyers and to generate multiple offers. Most properties around here follow this strategy, but it’s not the only possibility.

“Transparent” pricing is a newer term for the classic pricing strategy followed in most other areas. It refers to choosing a list price that is at a value that the seller will accept for the home; the expectation is not that there will be a bidding war and the price will get bid up.

In deciding which of these strategies makes more sense for a particular property, the biggest consideration is whether there will be multiple interested buyers for the property. If you go with a low price and only get one offer, that offer may very well be at, or even below, the (low) list price. For this reason, for a property that is not something that a typical buyer is looking for (because of size, style, customization, etc.), or for properties in the upper price ranges (that are too expensive for most buyers), it makes sense to choose a transparent price. Listing a property low is only a good idea if there are likely to be multiple buyers bidding the price up.

For properties of broad interest, there are several reasons why the “price it low and generate bidding” strategy is beneficial. Multiple offers push up the price to the upper limit of what the buyers are willing to pay, so you know you’re getting top dollar. They also give the buyer with the winning offer confidence that the property is a good one (“If all these other people also want it, it must be good!”), and buyer confidence is important in holding deals together. Buyers may also waive contingencies they do not need and choose shorter time periods.

If you’re choosing a transparent price, the right price to choose is the market value of the home, determined by what other similar properties have sold for. If you’re pricing low, though, the inevitable question is “How low do you go?”

The most advantageous “low” list price is one that is similar to what other properties like yours are listed at. You want your home to look good relative to other homes that are for sale. If you list it at a price higher than similar properties, it will end up being compared by buyers to other homes that are bigger or otherwise more expensive, and it won’t compare favorably.

In normal times for this area, “low” list prices have been around 20-30% below market value. Lately, though, list prices are a lot further below market value. Why?

Sale prices/market values have shot up since the beginning of 2021, but typical list prices move more slowly. So far this year, homes are selling quite commonly for 30%, 40%, 50%, or even more above list price, up to double! Why haven’t list prices gone up as the market has risen? It’s a coordination problem. When other properties on the market are still choosing the same list prices as last year, a strategic seller will do the same, so that their home is compared by buyers to the right segment of the market.

REAL ESTATE ANSWERS: What is home fire hardening, and do I need to do it?

What is home fire hardening, and do I need to do it?

“We’ve learned from recent fires. Hardening your home and keeping the 5 feet closest to your house clear of flammable materials (including patio furniture and décor) greatly improves its chance of surviving a fire.” CALIFORNIA FIRE SAFE COUNCIL

Fire hardening is making changes to an existing home to make it more resistant to wildfire. According to the Fire Safe Council, your home can catch fire in 3 main ways: from ember storms, where small pieces of burning material are blown in front of a fire (embers can apparently travel more than a mile!) and create spot fires when they land; from radiant heat, where the heat from nearby burning plants or structures is so intense that it can ignite a house without direct contact (this is especially problematic in densely populated areas, where homes are close together); and from direct flame, which can enter a home when plants under windows burn, breaking the glass and allowing the fire inside the home.

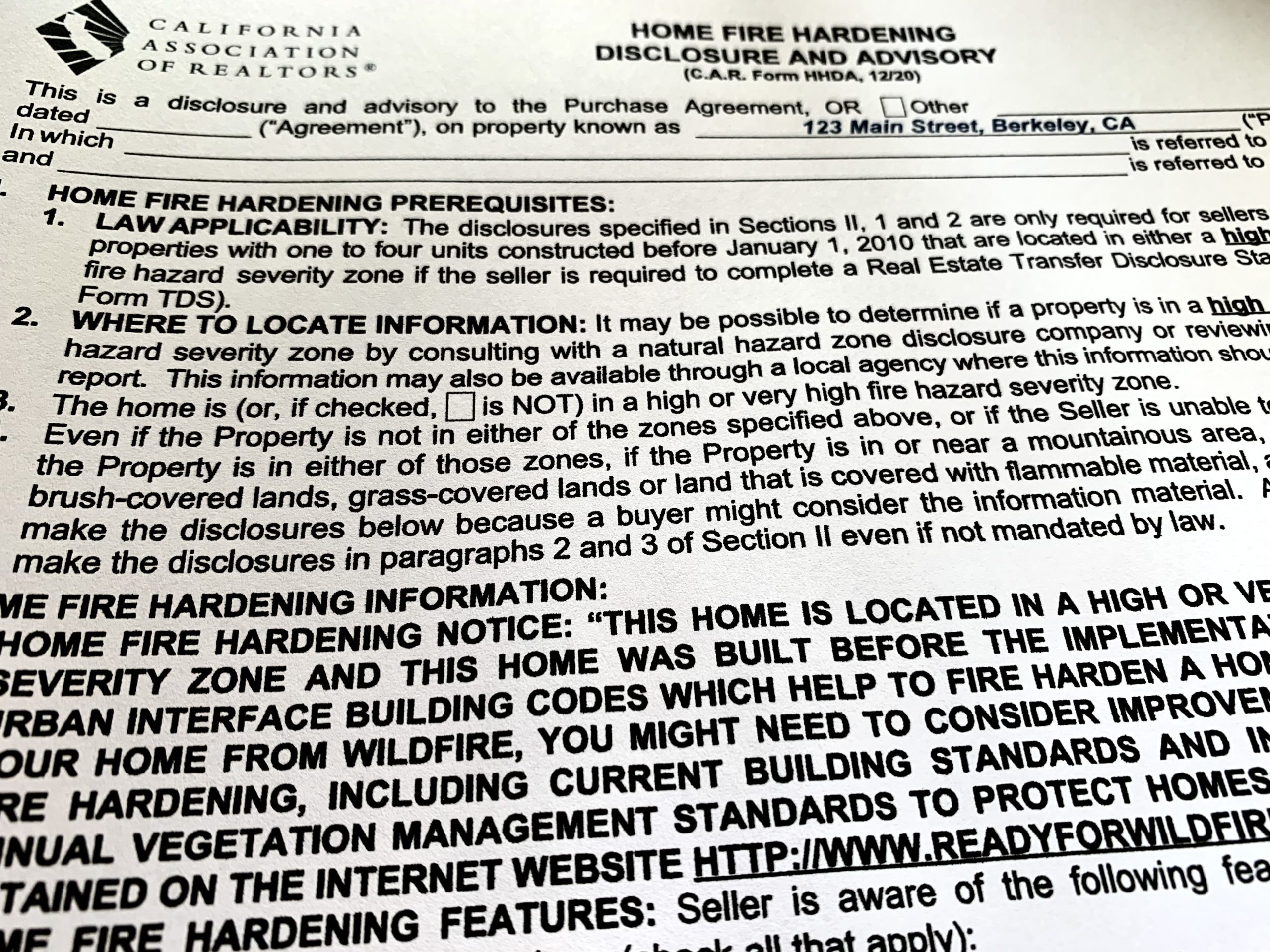

If your home was built in 2010 or later, your home should be pretty “hard”, because building codes were changed then to include hardening requirements. Most of the homes around here are much older than that, but even if you have an older house, you’re not required make changes for the sake of fire hardening. It is worth considering, though, given the massive fires we’ve seen around the state in recent years.

Since the start of 2021, there is a new disclosure requirement related to fire hardening for sellers of properties that are located in a high or very high fire hazard severity zone (and that were built before 2010). Sellers of those properties are required to disclose to buyers if a home has certain features that make it more susceptible to wildfire and flying embers. The features are: (1) eave, soffit, and roof ventilation where the vents have openings in excess of 1/8” or are not flame and ember resistant; (2) roof coverings made of untreated wood shingles or shakes; (3) combustible landscaping or other materials within 5 feet of the home or under the footprint of any attached deck; (4) single pane or non-tempered glass windows; (5) loose or missing bird stopping (which closes off the open ends of tiles on a tile roof) or roof flashing; and (6) rain gutters without metal or noncombustible gutter covers.

You’re only required to disclose vulnerabilities that you know of, and only if the property is in a high or very high fire hazard severity zone, and of course only if you’re selling. However, it’s a good starter list for all of us to consider for improving the fire safety of our homes, even if they’re not going to be for sale.

A state map showing fire hazard zones can be found at https://egis.fire.ca.gov/FHSZ/. You can zoom in on Berkeley and find a specific property, or look at the boundaries of what they consider the red VHFHSZ (Very High Fire Hazard Severity Zone) area.

For more information on fire hardening, check out ReadyForWildfire.org.

REAL ESTATE ANSWERS: How are property tax assessment transfer rules changing due to Prop. 19?

How are property tax assessment transfer rules changing due to Proposition 19?

If you are one of the many people in California who at some point considered moving but decided not to because your property taxes would increase sharply, you could be in luck now. Proposition 19, which passed in the last election and goes into effect April 1, 2021, allows a homeowner who is 55 or older, severely disabled, or whose home was substantially damaged by wildfire or natural disaster to transfer their property tax assessment to a new replacement home with fewer restrictions than is currently the case. Here are the main ways the rules will be different when it goes into effect:

(1) Currently, to be eligible for an assessment transfer, your new property must be either in the same county as the home you sell, or in one of the very few counties that allow transfers in from other counties. Under Prop. 19, your new residence can be anywhere in the state.

(2) Under the current rules, you can only transfer your assessed value one time. Under Prop. 19, you can transfer your assessed value up to three times (or potentially more for those who lost a home to fire).

(3) Under the current rules, your new property must be of “equal or lesser value,” or else you do not qualify for a transfer. Under Prop. 19, the new property can be of any value. If you pay more for your new home than what your old home sells for, you keep your old tax assessment for the portion of the new property up to the value of your old property, and the amount over is added to your tax base. Here’s an example. Suppose your old house sells for $1M, and the assessed value on that property was $500K. If you qualify for a transfer and buy a new home for $1.2M, the assessment on the new property will be $700K (your old assessment of $500K on the first $1M, plus the amount over the value of your old house, $200K). If you buy a property that is of equal or lesser value, you keep your old assessment with no adjustment. To complicate things a bit more, it may end up being the case (as it is now) that there is an inflation factor if you sell your old property first. Under current rules, you can actually spend 5% more than the sale price of your old property in the first year, or 10% more in the second year, and still keep your old assessed value. Whether this will be the case under Prop. 19 is yet to be completely determined.

There are, of course, some restrictions. To do an assessment transfer at all, you need to be 55 or over, severely disabled, or have lost a home to wildfire or natural disaster. You have to buy your replacement home within two years of the sale of your previous home, and both properties have to be your primary residences. You can, though, buy the new property before selling the old property, or vice versa.

Prop. 19 is a great opportunity, but if you’re thinking of taking advantage of it, be sure to talk to a qualified California real estate attorney and/or a professional tax advisor about how this applies to your specific situation. While you’re talking to your tax professional, make sure you also discuss what capital gains taxes may be triggered by a sale.