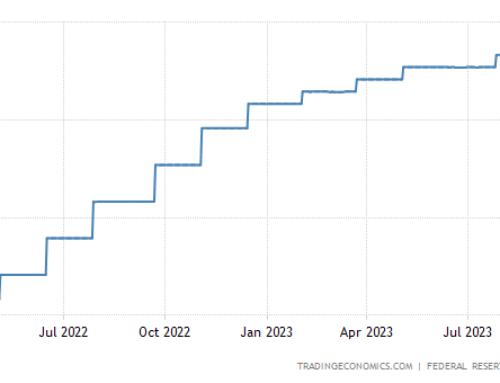

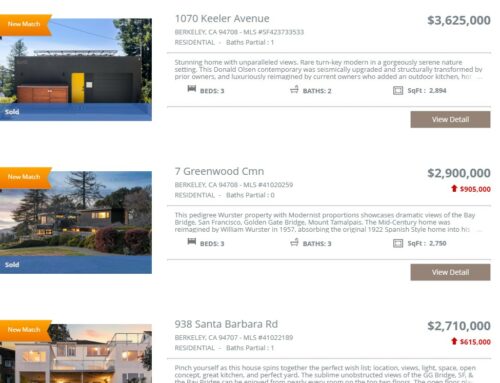

Last year was the craziest roller coaster I’ve ever seen in our local market. We started 2022 with an intense surge in buyer activity, but that surge was reversed by the summer and through the end of the year, as buyers adjusted to higher interest rates, concerns about the economy, and declines in the stock market.

***

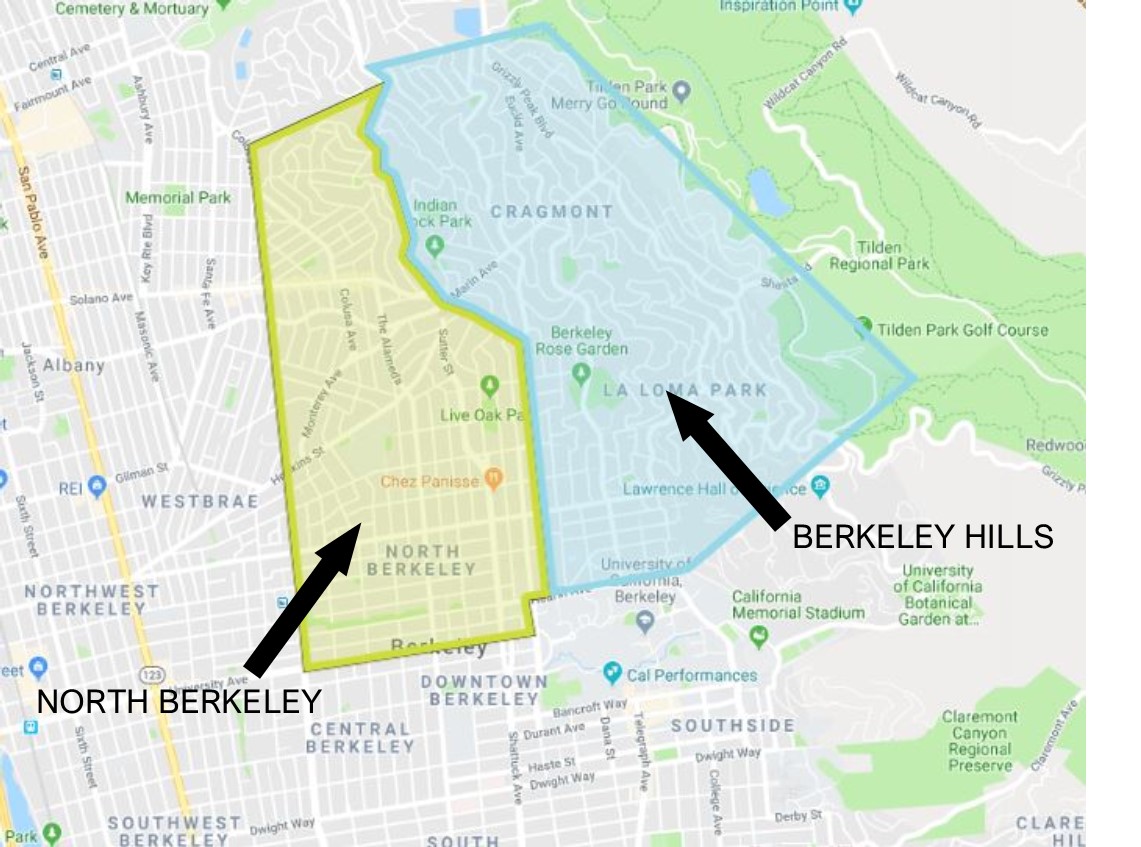

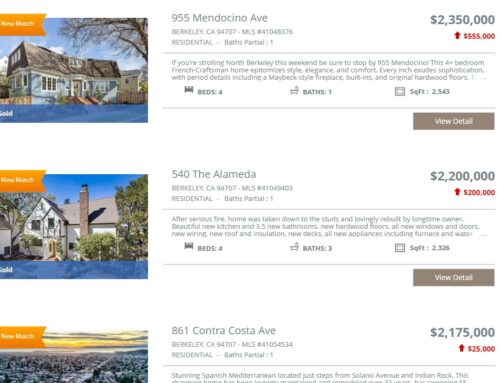

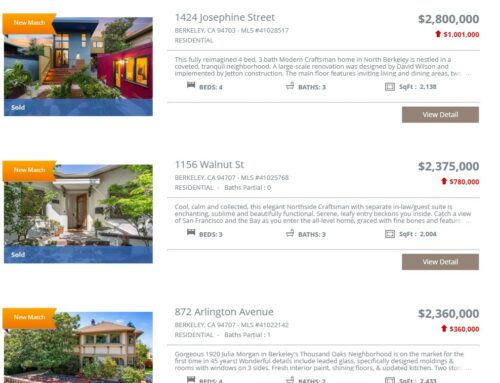

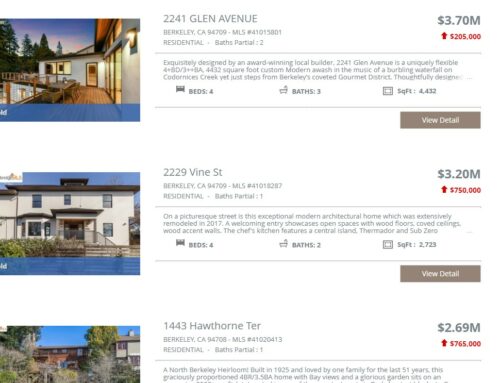

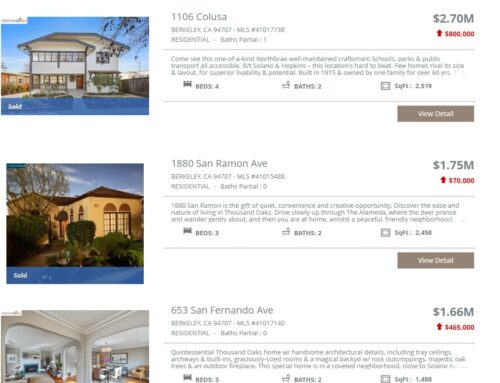

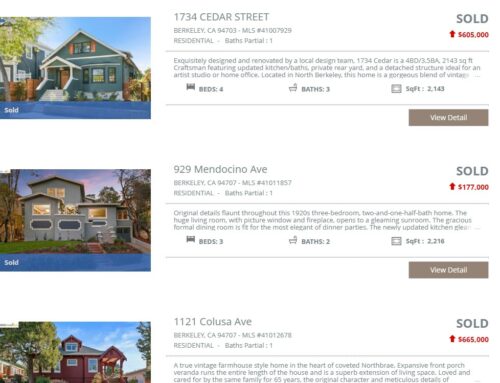

NORTH BERKELEY:

Looking at 2022 as a whole, the median sold price in North Berkeley was $1,650,000, which is unchanged from the previous year. Average sold price per square foot, at $1046, was up 7% compared to 2021. Properties in North Berkeley sold on average after 19 days on the market, which is pretty typical. Out of a total of 87 sales during the year, only 9 properties had price adjustments before selling (3 were price increases, and 6 were price reductions). 87% of the sales were at prices above list price, and those sold on average for 32% more than list.

The figures for the whole year are of course combining the results from the crazy spring and the much slower latter portion of the year. The fourth quarter data (for October through December 2022) is more indicative of where the market is now. In the fourth quarter, the median sold price for North Berkeley was $1,402,500, which is down 15% from the fourth quarter of the previous year. Average sold price per square foot was $1000, which is also down, but only slightly, by 0.5% compared to the same period in 2021. There was a big change in the number of properties listed for sale during the fourth quarter this year. There were only 20 properties on the market in North Berkeley, compared to 33 during the same period in 2021.

***

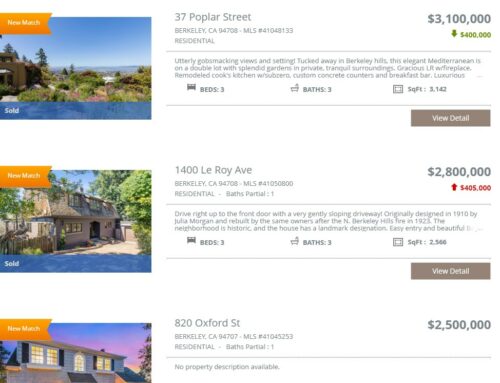

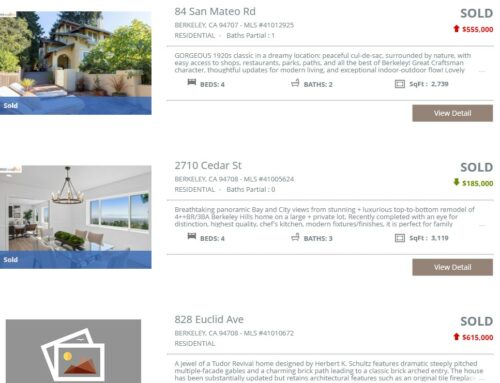

BERKELEY HILLS:

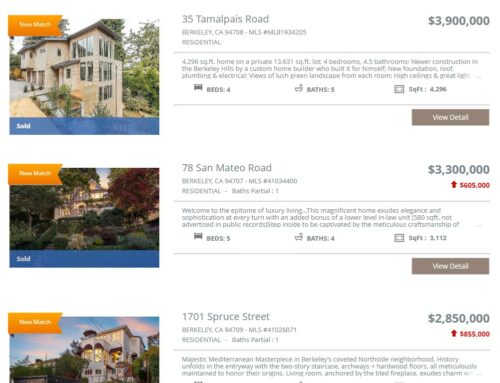

In the hills, the median sold price for 2022 as a whole was $1,870,000, which is up 10% from the previous year. Average sold price per square foot was $953, which is also higher, in this case up 11% compared to 2021. Properties in the hills sold on average after 19.6 days on the market, which is the quickest we’ve seen since 2016. There were not a lot of price changes in the hills either. Out of 181 sales, there were only 8 price increases and 7 price reductions. 81% of the sales were at prices above list price, and those sold on average for 33% more than list.

Looking at just the fourth quarter, the median sold price for the hills was $1,661,541, which is down 10% from the fourth quarter of the previous year. Average sold price per square foot was $815, which is also down, but only by 1% compared to the same period in 2021. There were 40 properties on the market in the hills—just under half the number of listings during the same period in 2021.

***

We start 2023 with interest rates about double what they were at the start of 2022. Rates are in the mid-6% range now, and they were in the low 3% range in January 2022. The higher rates have had a big impact on affordability, which reduces demand for properties. Supply though is also lower, because sellers are concerned about market conditions, and they also don’t want to give up existing low-interest loans and borrow at higher rates on a new property.

For people who would be buying their new home without a loan, this is actually a fantastic time to make a move. For those who would be trading a low-interest loan for one with a higher rate, keep in mind that more favorable pricing could more than offset higher interest costs.