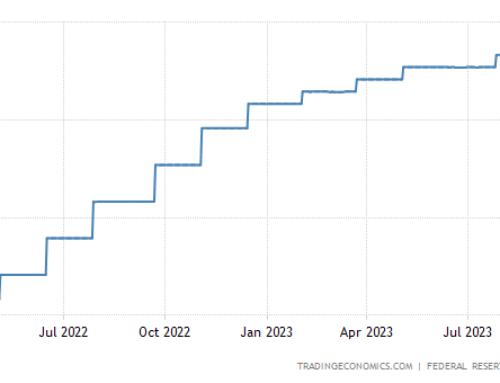

Looking at the market data for the second quarter of 2023, the theme seems to be “good news, bad news.” Let’s start with the bad. If you compare price results for the second quarter of this year to the second quarter of 2022, prices are, not surprisingly, down.

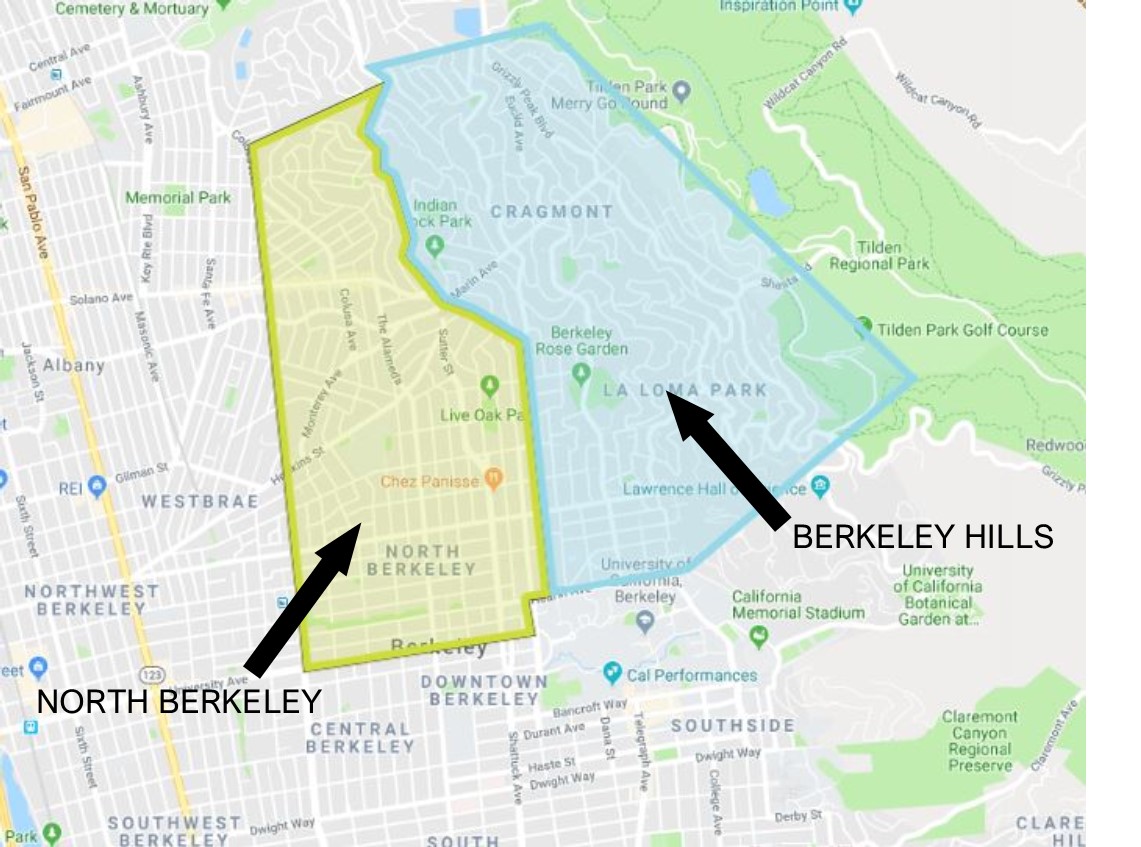

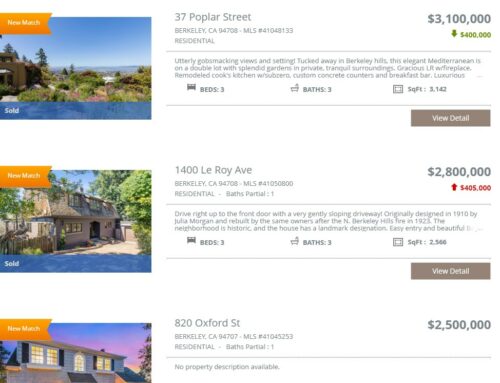

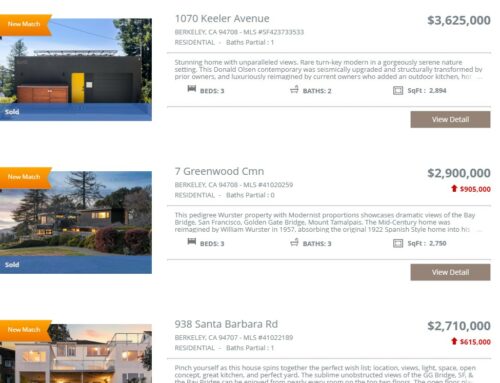

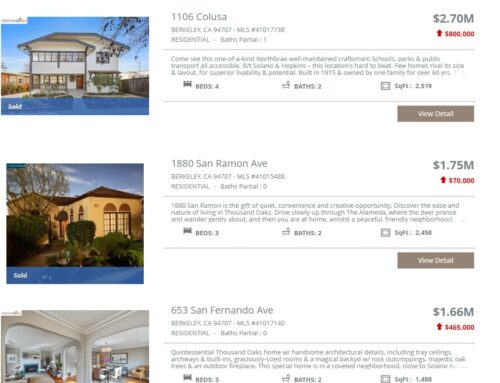

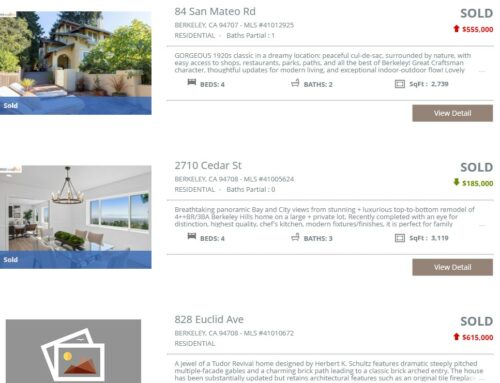

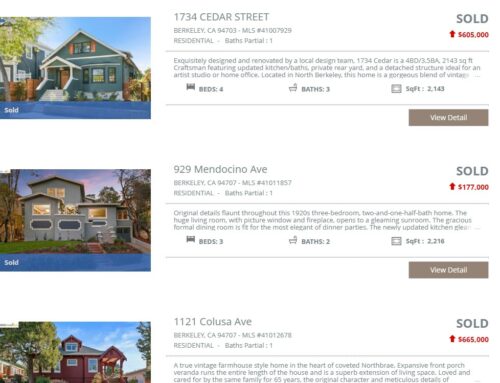

- The median sold price in the hills was $1,725,000 for the second quarter this year, which is down 12% from last year. The average sold price per square foot, $904, is 13% lower than it was for the same period last year.

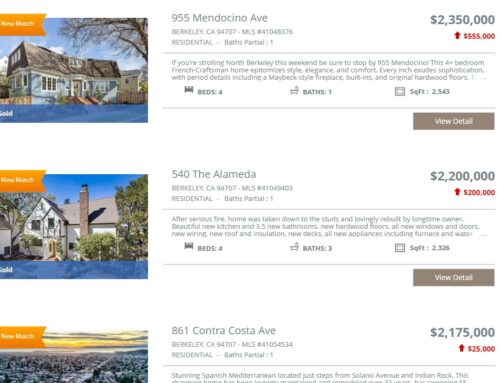

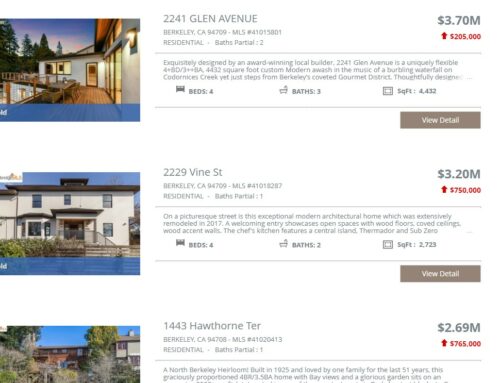

- In North Berkeley, the median sold price in the second quarter this year was $1,825,000, which is down 5% from last year. Average sold price per square foot was $1043, which is down only slightly (by less than 1%) compared to the same period in 2022.

Remember though, there was a crazy run-up in real estate prices in the first part of 2022, and we’re comparing this year’s results to those (briefly) high values. Last year’s bubble popped in the middle of 2022 due to rising interest rates. We find ourselves now basically back to the very respectable values we saw in 2021, before the crazy run-up.

The good news is, there are still a lot of buyers in the market, especially compared to the limited amount of inventory.

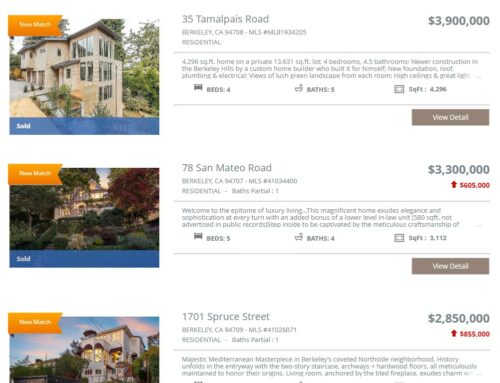

- In the hills, there were only 59 active listings for the second quarter this year, compared to 83 last year. 86% of the sales were over list price, meaning that there were multiple offers for most of the properties. Properties that went over list price sold on average for 22% over list. Most properties sold quickly, averaging just 21 days on the market. There were 35 sales in the second quarter, and only one property needed a price change before selling.

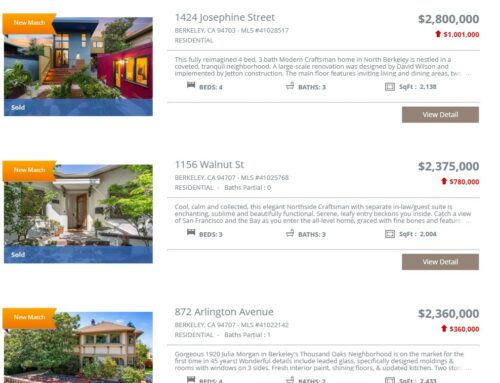

- The results were similar in North Berkeley. There number of active listings was low, at only 38 (compared to 43 for the second quarter of 2022). 90% of the sales were over list price, and those sold on average for 26% over list. Most of the 21 properties that sold went as soon as the sellers took offers, but two were on the market for more than 3 months. Those two properties needed price reductions before selling, and they pulled up the average number of days on the market to 28.

The market is not as searingly hot as it was at the start of last year, but we’re not seeing anything like the wave of foreclosures and short sales that happened during the last big down cycle in the market. In all of Berkeley, there was only one bank-owned (foreclosure) property that sold in the first half of 2023, and there were only 2 short sales. Compare this to the first six months of 2012, when 33 foreclosure properties sold, and there were 34 short sales.

The bottom line is, there was an adjustment in the market, but the sky is not falling. Low inventory has kept the market very competitive for desirable homes. Buyers are pickier now, so the right preparation and correct pricing are more critical than ever to a successful sale.