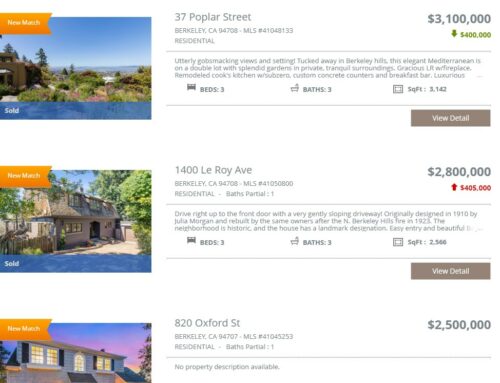

THE OUTLOOK: North Berkeley & the Berkeley Hills, Q1 2024 wrap-up

How is the market doing so far this year? It’s been mixed. Higher interest rates are definitely having an effect. Some properties are selling quickly with multiple offers, and others are not. In general, properties that are well-presented (with good preparation, good staging, and good marketing), and that are strategically priced compared to similar properties, are selling well. There are a good number of first-time buyers in the market, who typically shop for smaller/less expensive homes. There are also wealthy or high-income buyers, who can afford a purchase even at higher interest rates.

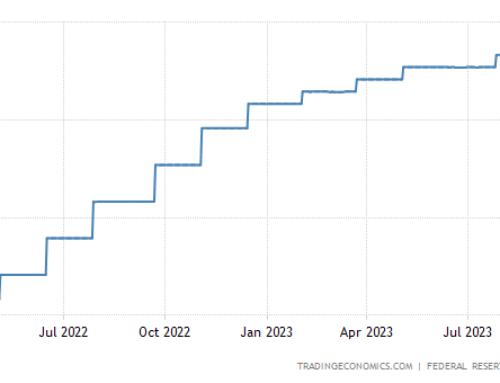

Move-up buyers—people who own a home now, but want to move to get more space—are rare these days. When move-up buyers do the math on a larger home, they see that a new home would be more expensive because of the extra space and higher property taxes; this is always true. Now, they would also likely be giving up a loan in the 3% range, for one at closer to 7%, which makes the extra cost of the larger home significantly higher. As a result, a lot of these potential buyers are not moving. This means that demand for the larger homes is lower, and it also means that there is less inventory of smaller “starter homes” for sale.

***

Berkeley Hills, first quarter 2024 results:

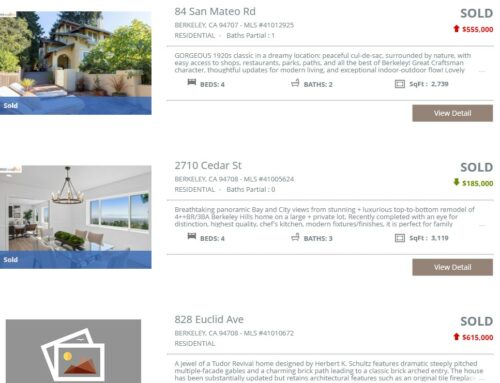

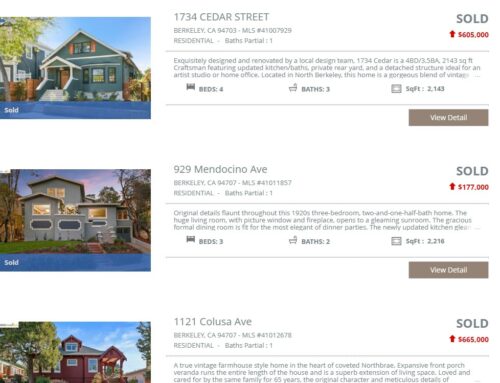

The Berkeley hills had 53 active listings in the first quarter, and 32 properties sold. 6 of the sold properties had price changes before selling, and average time on the market was on the high side, at 38 days. 75% of the sales were above list price, and those that went over sold, on average, 32% above list price.

In the hills, the median sold price for the first quarter (Q1) was $1,750,617. This is down 10% from Q1 last year. Average sold price per square foot is basically unchanged from this time last year, though, at $900.

***

North Berkeley, first quarter 2024 results:

North Berkeley has been doing quite well. The median sold price was $1,447,750 in North Berkeley for the first quarter (Q1) of 2024, which is up 3% from Q1 last year. Average sold price per square foot, at $1,014, is also up, by 9%.

There were only 16 active listings in North Berkeley, which is the lowest Q1 figure in my database, which goes back to the year 2000. With few properties on the market, only 12 properties sold, in an average of 19 days, and none of the sold properties needed price changes. 92% of the sales were above list price, and those that went over sold, on average, 19% above list.

***

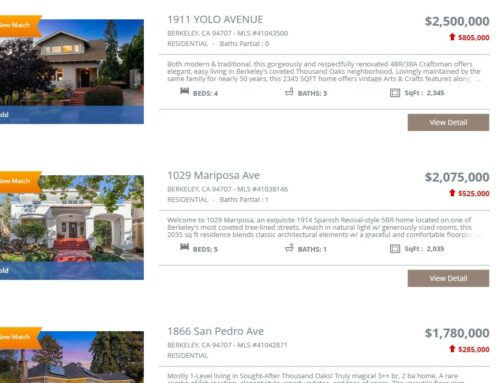

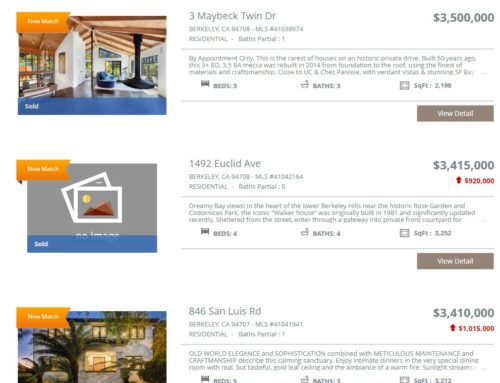

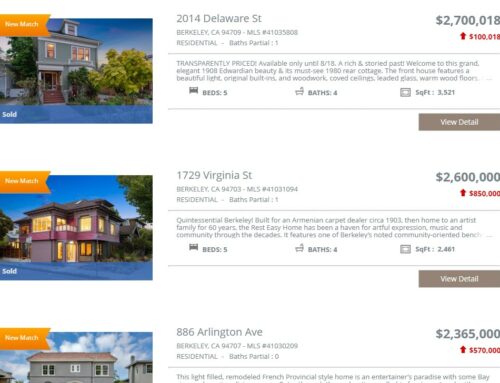

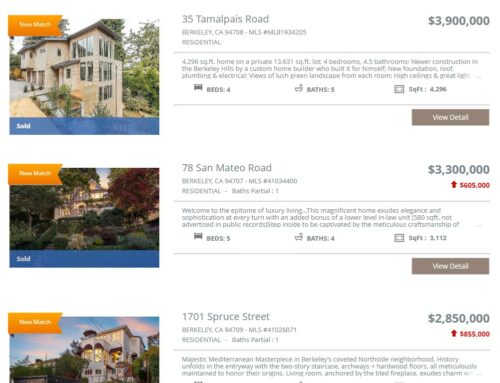

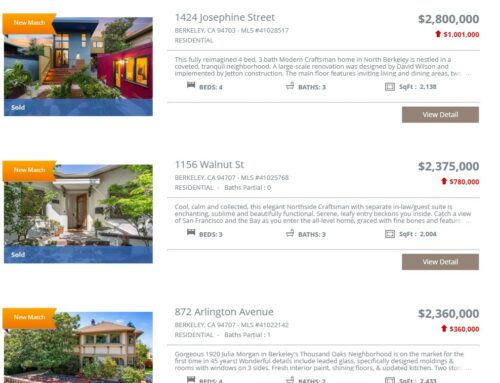

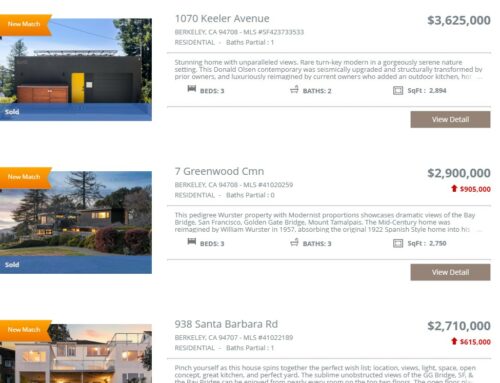

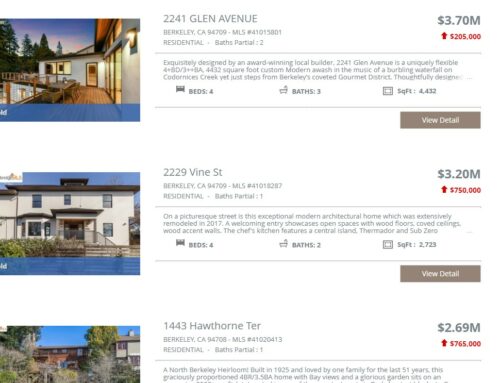

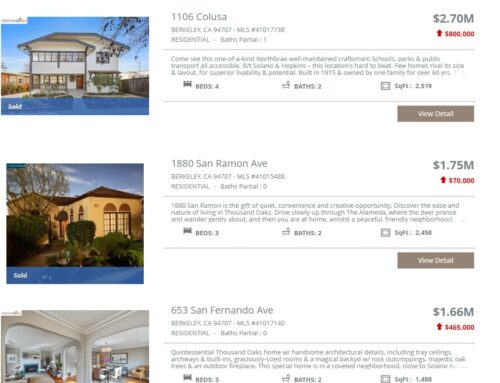

There are still multiple offers out there, especially for starter homes. At the same time, some good properties in the $2M-$3M range, especially those in the hills, are sitting longer on the market.

We’re all watching interest rates and the economic conditions that affect them closely. As long as the economy is performing pretty well, and inflation is still on the higher side, we’re unlikely to see significant rate cuts.