REAL ESTATE ANSWERS: How has the negotiating environment changed as the market has shifted?

How has the negotiating environment changed as the market has shifted? When the real estate market is at its strongest, there is not a vast amount of negotiation between buyers and sellers. Buyers make strong offers in competition, often waiving the inspection contingency, and many sellers choose to accept the best offer, rather than negotiate and risk de-stabilizing the transaction. When the market is more balanced, there are fewer offers on properties, and buyers may not feel that they have to make their best offer at the start. An accepted offer might also have an inspection contingency, so there may [...]

REAL ESTATE ANSWERS: How much difference do higher interest rates make for home sales in our area?

How much difference do higher interest rates make for home sales in our area? Over the spring, the Federal Reserve announced a plan for multiple interest rate hikes this year to try to get inflation under control, and we’ve seen three rate increases already this year. As I write this, interest rates on home loans are approaching 6%, up from about 3% at the start of the year. Interest rates are at their highest level in 10 years, and there may be additional increases to come. Increasing rates make a lot of difference in the purchasing power of individual buyers. [...]

LOW RATES & HIGHER CONFORMING LOAN LIMITS

LOW RATES AND HIGHER CONFORMING LOAN LIMITS Interest rates are low, low, low right now! As I write this, the 30-year fixed rate is lower than it’s been since Freddie Mac began tracking mortgage rates in 1971. While it’s not surprising that rates are low given the economic impacts of the pandemic, it is still an opportunity for both buyers getting new loans and homeowners who can refinance their existing loans. Fixed rate 30-year conforming loans (up to the loan limits discussed below) can in many cases be had for under 3%. Even larger-amount jumbo loans, which were challenging to [...]

REAL ESTATE ANSWERS: How has the negotiating environment changed as the market has shifted?

How has the negotiating environment changed as the market has shifted?

When the real estate market is at its strongest, there is not a vast amount of negotiation between buyers and sellers. Buyers make strong offers in competition, often waiving the inspection contingency, and many sellers choose to accept the best offer, rather than negotiate and risk de-stabilizing the transaction. When the market is more balanced, there are fewer offers on properties, and buyers may not feel that they have to make their best offer at the start. An accepted offer might also have an inspection contingency, so there may be further negotiations during the inspection period.

Most real estate negotiations are over dollar amounts (although timing and other terms can also be negotiated), but the same dollars can be factored into a contract in different ways: as a change in price, as a change in who is paying various closing costs, as a credit towards closing costs for the buyer, or as a buy-down of the buyer’s interest rate by the seller. Each of these possibilities affects the buyer’s and seller’s bottom lines differently, so a strong, creative negotiation strategy weighs the effects of each to find the right one or the right mix.

From a financial perspective, the seller’s goals are relatively simple. Sellers want to maximize their net proceeds, so they want the price as high as possible, and their costs as low as possible. The buyer side is much more complicated. Buyers want to minimize their cost for the purchase, so to keep the sale price and their closing costs as low as possible. Buyers also want to minimize their ongoing costs of ownership: their loan payments (if any) and their annual property taxes. In addition, buyers will consider the available cash they will have after the purchase to make needed repairs or improvements.

When I am negotiating for a seller client, my first step is aways to gather as much information as possible about the buyers and their circumstances. Are they getting a loan? Will they have plenty of cash on hand after the purchase for needed repairs? Is the monthly cost of ownership their primary constraint, or do they ultimately care the most about the overall purchase price? Will their lender allow credits toward closing costs? How much will a point paid on their loan reduce their monthly payment? Using that information, I can then consider all the various ways to structure potential contract changes, to find an option that will be the most attractive to the seller, while making the deal work for the buyer.

It is all quite complex, but it’s an important part of the process. One of the benefits of longevity in this business is having experience navigating markets of all different strengths. I guess that makes up for the extra wrinkles the years have also brought me!

REAL ESTATE ANSWERS: How much difference do higher interest rates make for home sales in our area?

How much difference do higher interest rates make for home sales in our area?

Over the spring, the Federal Reserve announced a plan for multiple interest rate hikes this year to try to get inflation under control, and we’ve seen three rate increases already this year. As I write this, interest rates on home loans are approaching 6%, up from about 3% at the start of the year. Interest rates are at their highest level in 10 years, and there may be additional increases to come.

Increasing rates make a lot of difference in the purchasing power of individual buyers. For sellers and property values in our market, where we have excess demand, the impact is not as extreme, but it does definitely affect the market.

Consider individual buyers who are qualified for at most a $1 million dollar home loan (to choose a round number) when interest rates are 3%. This means that they are qualified, given their income and other debts, for a maximum monthly loan payment of $4216. When rates go up to 6%, assuming the buyers can afford that same payment, they now only qualify for a loan of $703K (so they can spend $297K less on a home, compared to when rates were at 3%). As a very rough rule of thumb, the maximum loan amount people can qualify for goes down about 10% each time the interest rate goes up by one percentage point.

Another way to think about this – a particular buyer might need something like $230K of household income to qualify for a $1M home loan when the interest rate is 3%. (The actual income requirement will depend on things like credit rating, other debt, etc.) When the interest rate rises to 6%, that same buyer would now need over $300K in income to qualify.

How do buyers respond to increasing interest rates? With less purchasing power, buyers need to adjust their expectations. They could look for a smaller home, a less expensive location, or a home that needs more repairs or improvements. Other buyers, who were not already planning to spend their max, might decide to go closer to their limit, and still buy the same thing.

In thinking about how higher interest rates affect our market as a whole, the crucial question is, will there be fewer buyers at particular price points after all this happens? In our market, we have had an excess of buyers at various price points, and a good number of cash buyers as well. Some buyers will need to move down a price category, but there should be other buyers (moving down from higher price points) to take their place. And yes, some buyers will be unwilling to compromise on their purchase and may choose not to buy now at all.

Overall, I would expect there to be somewhat fewer buyers in each price point. There was so much excess demand before, though, that there should still be enough buyers out there to keep the market stable.

LOW RATES & HIGHER CONFORMING LOAN LIMITS

LOW RATES AND HIGHER CONFORMING LOAN LIMITS

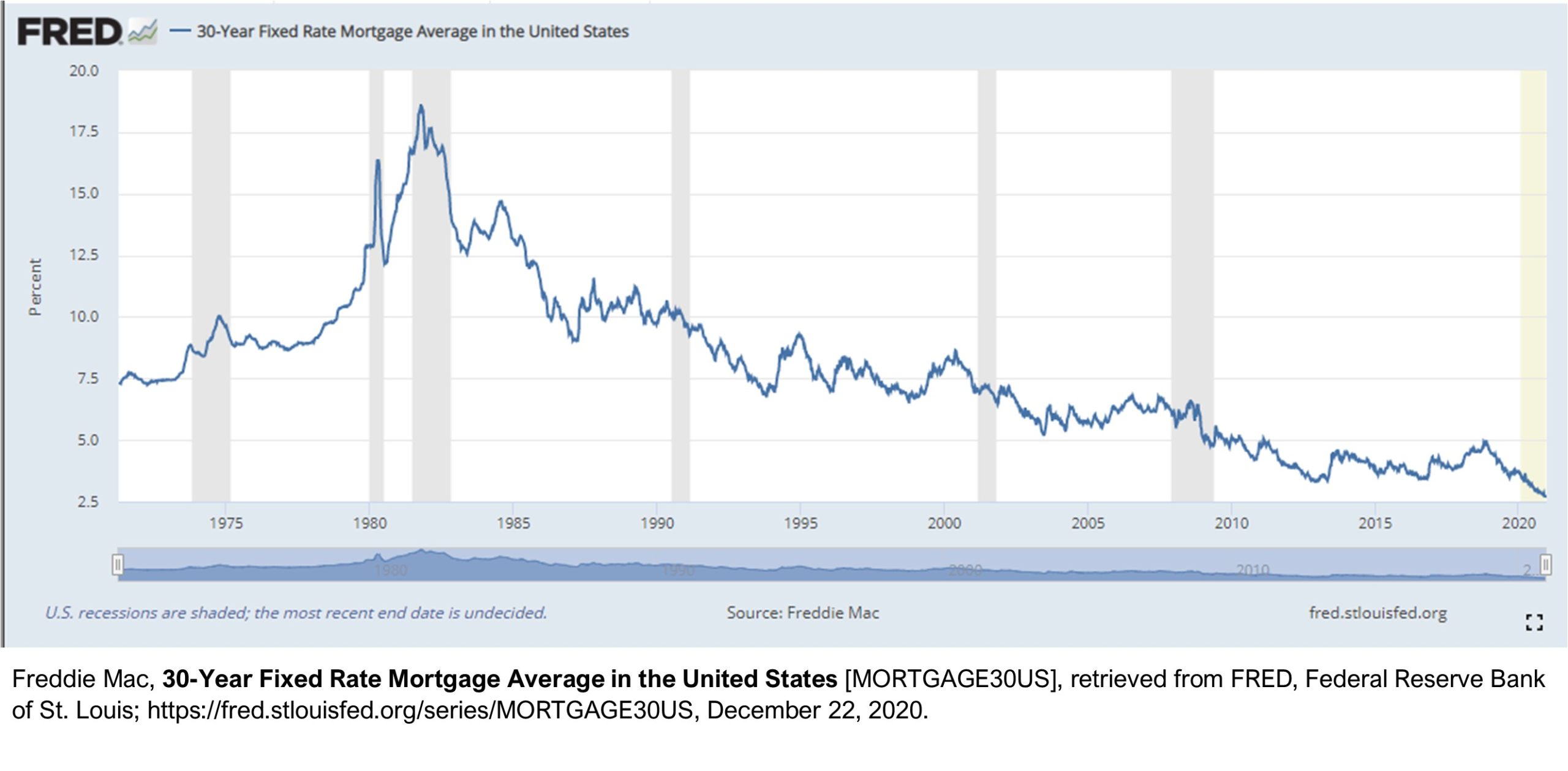

Interest rates are low, low, low right now! As I write this, the 30-year fixed rate is lower than it’s been since Freddie Mac began tracking mortgage rates in 1971.

While it’s not surprising that rates are low given the economic impacts of the pandemic, it is still an opportunity for both buyers getting new loans and homeowners who can refinance their existing loans. Fixed rate 30-year conforming loans (up to the loan limits discussed below) can in many cases be had for under 3%. Even larger-amount jumbo loans, which were challenging to get and much more expensive earlier in the year, are available around 3%.

The loan limits for conforming loans (those that meet the funding criteria of Freddie Mac & Fannie Mae) are set to go up again in 2021. The Federal Housing Finance Agency determined that home prices nationwide rose an average of 7.42% from the third quarter of 2019 to the third quarter of 2020, so loan limits will be increased that same amount (7.42%) for the coming year. In high-cost areas like ours, that means the limit for single-family homes will increase from the current $765,600 to $822,375 in 2021.