How has the negotiating environment changed as the market has shifted?

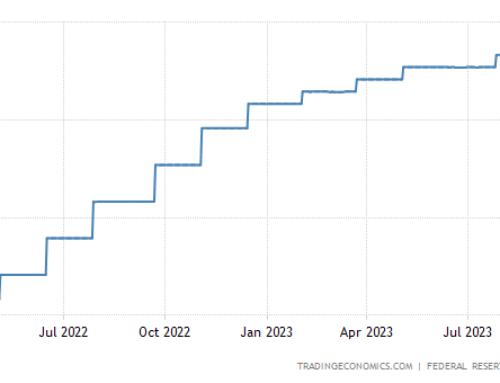

When the real estate market is at its strongest, there is not a vast amount of negotiation between buyers and sellers. Buyers make strong offers in competition, often waiving the inspection contingency, and many sellers choose to accept the best offer, rather than negotiate and risk de-stabilizing the transaction. When the market is more balanced, there are fewer offers on properties, and buyers may not feel that they have to make their best offer at the start. An accepted offer might also have an inspection contingency, so there may be further negotiations during the inspection period.

Most real estate negotiations are over dollar amounts (although timing and other terms can also be negotiated), but the same dollars can be factored into a contract in different ways: as a change in price, as a change in who is paying various closing costs, as a credit towards closing costs for the buyer, or as a buy-down of the buyer’s interest rate by the seller. Each of these possibilities affects the buyer’s and seller’s bottom lines differently, so a strong, creative negotiation strategy weighs the effects of each to find the right one or the right mix.

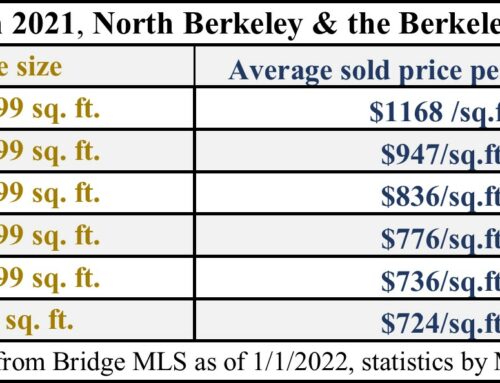

From a financial perspective, the seller’s goals are relatively simple. Sellers want to maximize their net proceeds, so they want the price as high as possible, and their costs as low as possible. The buyer side is much more complicated. Buyers want to minimize their cost for the purchase, so to keep the sale price and their closing costs as low as possible. Buyers also want to minimize their ongoing costs of ownership: their loan payments (if any) and their annual property taxes. In addition, buyers will consider the available cash they will have after the purchase to make needed repairs or improvements.

When I am negotiating for a seller client, my first step is aways to gather as much information as possible about the buyers and their circumstances. Are they getting a loan? Will they have plenty of cash on hand after the purchase for needed repairs? Is the monthly cost of ownership their primary constraint, or do they ultimately care the most about the overall purchase price? Will their lender allow credits toward closing costs? How much will a point paid on their loan reduce their monthly payment? Using that information, I can then consider all the various ways to structure potential contract changes, to find an option that will be the most attractive to the seller, while making the deal work for the buyer.

It is all quite complex, but it’s an important part of the process. One of the benefits of longevity in this business is having experience navigating markets of all different strengths. I guess that makes up for the extra wrinkles the years have also brought me!