REAL ESTATE ANSWERS: What counts as a bedroom in real estate, and do more bedrooms add value?

What counts as a bedroom in real estate, and do more bedrooms add value? A bedroom in general is just a room where people sleep. For a room to count as a bedroom for real estate purposes, there are several requirements: (1) FLOOR SIZE. According to the standards used by appraisers, a habitable room must have a floor of at least 70 square feet in area and be at least 7 feet in any direction. So a 7’x10’ room is okay, but a 6’x12’ space, even though it’s 72 square feet, wouldn’t be counted as a room (or a bedroom) [...]

THE OUTLOOK: North Berkeley & the Berkeley Hills, Q3 2023 results

THE OUTLOOK: North Berkeley & the Berkeley Hills, Q3 2023 results The main feature of the Berkeley real estate market in the third quarter of 2023 was the combination of rising interest rates and low inventory of homes for sale. Interest rates on home loans have climbed to the high 7% range, reaching almost 8% as I write this. This is more than double what rates were at the beginning of 2022, so it’s not surprising that we’ve seen a reduction in demand for properties compared to last year. At the same time though, there has been a decline in [...]

REAL ESTATE ANSWERS: How do actions by “the Fed” affect interest rates on home loans?

How do actions by “the Fed” affect interest rates on home loans? The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high [...]

Mobile Driver’s License

Mobile Driver’s License Did you know that the California DMV has a mobile Driver’s License (mDL) pilot program running now, open to up to 1.5 million users? If you’re interested in giving it a try, start by downloading the free app called “CA DMV Wallet” from the Apple App Store, or from Google Play if you have an Android device, and then follow the straightforward instructions there. You create (or log into) your DMV account, enter some basic information, scan your driver’s license, and then “scan” your face (like you’re taking a selfie). Next you submit your request, and wait [...]

COMPLETED SALES, North Berkeley, 3rd Quarter 2023

Click to see details and photos of properties SOLD in North Berkeley, 7/1/2023-9/30/2023. Note that, after you follow the link, you can click on each individual property to see photos and more details. Click "Close" near the top to return to the list. * For the purposes of this newsletter, “North Berkeley” is defined as the area bounded by University Avenue in the south, the line of Sacramento Street to the west, the Berkeley border to the north, and below Arlington Avenue, Los Angeles Avenue, and Spruce Street (south of Los Angeles) to the west.

COMPLETED SALES, Berkeley Hills, 3rd Quarter, 2023

Click to see details and photos of properties SOLD in the Berkeley Hills, 7/1/2023 - 9/30/2023. Note that, after you follow the link, you can click on each individual property to see photos and more details. Click "Close" near the top to return to the list. * For the purposes of this newsletter, “Berkeley Hills” refers to the area bounded as follows: north of campus, east of a line heading north on Spruce from campus, cutting over on Los Angeles to Arlington, and then north along Arlington to the Kensington border.

REAL ESTATE ANSWERS: What counts as a bedroom in real estate, and do more bedrooms add value?

What counts as a bedroom in real estate, and do more bedrooms add value?

A bedroom in general is just a room where people sleep. For a room to count as a bedroom for real estate purposes, there are several requirements:

(1) FLOOR SIZE. According to the standards used by appraisers, a habitable room must have a floor of at least 70 square feet in area and be at least 7 feet in any direction. So a 7’x10’ room is okay, but a 6’x12’ space, even though it’s 72 square feet, wouldn’t be counted as a room (or a bedroom) on an appraisal.

(2) CEILING HEIGHT. At least 50% of the ceiling must be at least 7 feet high.

(3) ENTRANCE. There should be a door to the bedroom from the interior of the house.

(4) EGRESS. There also needs to be an exit from the bedroom to the exterior. This can be a door to the outside, or it can be an exterior window. If it’s a window, it should be 24 to 44 inches from the floor, have an opening of at least 5.7 square feet, and it must be no less than 24 inches in vertical size and no less than 20 inches wide. (The point is to make it usable if someone needs to climb in or out in an emergency.)

Note that if you have an older home, built before these requirements were put in place and without the proper egress windows, the city is not going to knock on your door and require that you make the window openings larger. However, if you are doing a project that modifies the rough openings, you will be required to comply. And if you sell that home, it’s advisable to disclose that one or more “bedrooms” does not have an egress window.

Many people think that a bedroom has to have a closet. In California, that is not a requirement, although some local jurisdictions may have other requirements. Most buyers though do want to have a closet in or at least near each bedroom.

Do additional bedrooms always add value in a sale? Not necessarily. The first few bedrooms do add value to a typical Berkeley house, but only if the bedrooms are of reasonable size, and the remaining living space is of reasonable size for the number of bedrooms. Consider a 1000 square foot home with 5 bedrooms, for example. The bedrooms would have to be quite small, and there won’t be much living or storage space, which will make the property appealing to far fewer buyers. Even for a larger home, a 5-bedroom house doesn’t necessarily have more value (everything else being equal) than one with 4 bedrooms, as there are fewer buyers who need the 5th bedroom.

Bottom line: Bedroom count does matter for value, but only as part of the overall picture of a home and its function.

THE OUTLOOK: North Berkeley & the Berkeley Hills, Q3 2023 results

THE OUTLOOK: North Berkeley & the Berkeley Hills, Q3 2023 results

The main feature of the Berkeley real estate market in the third quarter of 2023 was the combination of rising interest rates and low inventory of homes for sale. Interest rates on home loans have climbed to the high 7% range, reaching almost 8% as I write this. This is more than double what rates were at the beginning of 2022, so it’s not surprising that we’ve seen a reduction in demand for properties compared to last year.

At the same time though, there has been a decline in the number of homes on the market. For Berkeley as a whole, the inventory of homes for sale in the third quarter of 2023 was the lowest we’ve seen since before 2000.

This reduction in inventory offsets the reduction in demand, so we’re still seeing multiple interested buyers for the few properties that are listed, and prices have been pretty solid. That said, when we look at the stats for the past quarter and compare them to the same period last year, we are comparing to prices that had just started falling off the crazy peak at the beginning of 2022.

- The median sold price in the hills was $1,810,000 for the third quarter this year, which is actually higher than for the same period last year. Average sold price per square foot ($850), was 3% lower though. There were 59 active listings in the hills, which is more than for the third quarter of 2022, but it’s way down from the 93 properties for sale in Q3 2021. 35 properties sold this past quarter, in an average of 21 days on the market. 83% of the sales were over list price, on average by 24% for those that went over. Of the 35 sales, 5 needed a price change before finding a buyer.

- In North Berkeley, both the median sold price and the average sold price were down from Q3 last year. The median sold price in North Berkeley was $1,537,500, which is down 5%, and average sold price per square foot was 6% lower at $997. Like in the hills, there were slightly more active listings (47) in North Berkeley compared to the third quarter of 2022, but the number was also down a lot from Q3 2021, when 60 properties were on the market. 30 properties sold in North Berkeley in the third quarter this year, in an average of 26 days on the market. 83% of the sales were over list price, on average by 32% for those that went over. 4 of the sold properties had price reductions before selling.

Who are the buyers who are still out there these days? They’re not move-up buyers — most people are not willing to give up a 3% mortgage to get more space. The types of buyers who are in the market now are first-time buyers (who are mostly shopping in a lower price range than they would have been last year), buyers who have all cash or high enough income that the higher rates don’t matter, investors looking for projects, or people who have to move for some reason, like a job change.

REAL ESTATE ANSWERS: How do actions by “the Fed” affect interest rates on home loans?

How do actions by “the Fed” affect interest rates on home loans?

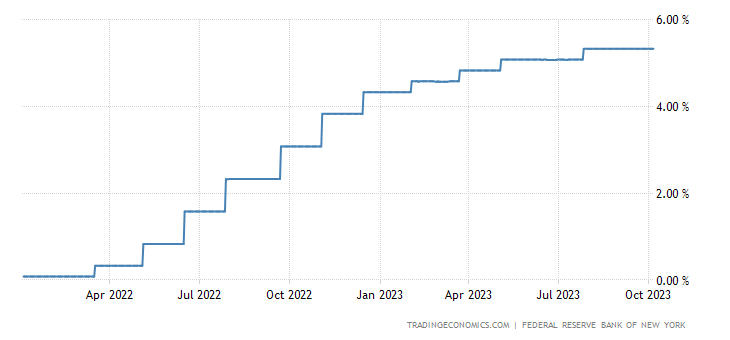

The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high unemployment. Since the start of 2022, they’ve been focused on eliminating the inflation that crept into the system during the main COVID years (2020-2021).

Interest rates on home loans are very long-term rates, since the typical home loan in the U.S. is a 30-year loan. They most closely track the rate on the 10-year Treasury note. Rates on home loans, like rates on 10-year Treasury notes, move up and down in response to economic conditions, changes in the return and relative riskiness of alternative assets, the availability of loanable funds, and current and expected future inflation rates. Rates on long term loans, like home loans, also depend on current and expected future short-term interest rates, so they are definitely affected by Fed policy.

In January of 2022, the Fed signaled that it was likely to start raising rates soon, setting off the real estate buying frenzy of early 2022, as buyers tried to get into the market before rates went up. The first rate increase by the Fed last year was in March of 2022, and by about this time last year, the target range for the federal funds rate was already up 3 percentage points, with more increases to come. By last fall, the Fed’s actions had resulted in a doubling of home loan rates, from the 3% range at the start of 2022, to about 6% in fall 2022. In the last year, the Fed has increased the target range for the federal funds rate 6 more times, for a total increase of 5.25% since the start of 2022. Today we’re looking at rates on homes loans that are approaching 8%.

When will interest rates go down again? Market rates are always bouncing around in response to new information, but we are unlikely to see a sustained reduction in interest rates until the Fed sees a need to stimulate the economy again, because inflation is low, and unemployment is increasing, or if they see a need to increase bank liquidity to keep the system functioning well.

Mobile Driver’s License

Mobile Driver’s License

Did you know that the California DMV has a mobile Driver’s License (mDL) pilot program running now, open to up to 1.5 million users? If you’re interested in giving it a try, start by downloading the free app called “CA DMV Wallet” from the Apple App Store, or from Google Play if you have an Android device, and then follow the straightforward instructions there. You create (or log into) your DMV account, enter some basic information, scan your driver’s license, and then “scan” your face (like you’re taking a selfie). Next you submit your request, and wait a few business days while it’s processed.

This idea of a digital ID card sounds cool to me, but it is not very useful at this point. You are still required to carry your physical driver’s license and present it if asked. For now, you can use the mDL at some (but not all) TSA Pre-Check lines, including SFO’s Terminal 3. (See https://www.tsa.gov/digital-id for a list of participating airports.) You can also activate “TruAge” within the DMV Wallet, and in theory use it to buy age-restricted items (alcohol, tobacco products, etc.) without sharing personal information such as your address. TruAge, though, is so far only accepted at a few Circle K convenience stores in the Sacramento area.

I suspect this sort of ID is the wave of the future, like the European Union’s Digital Identity Wallet, but for now it’s just a novelty here. I did sign up, just to check it out!

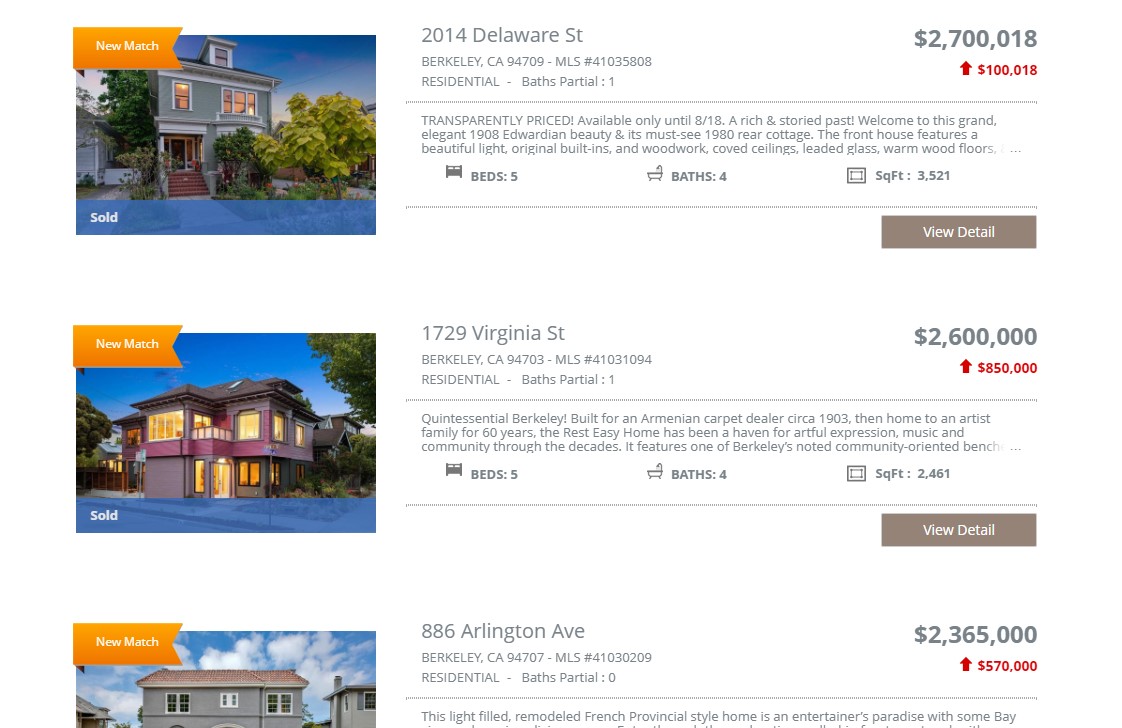

COMPLETED SALES, North Berkeley, 3rd Quarter 2023

Click to see details and photos of properties SOLD in North Berkeley, 7/1/2023-9/30/2023.

Note that, after you follow the link, you can click on each individual property to see photos and more details. Click “Close” near the top to return to the list.

* For the purposes of this newsletter, “North Berkeley” is defined as the area bounded by University Avenue in the south, the line of Sacramento Street to the west, the Berkeley border to the north, and below Arlington Avenue, Los Angeles Avenue, and Spruce Street (south of Los Angeles) to the west.

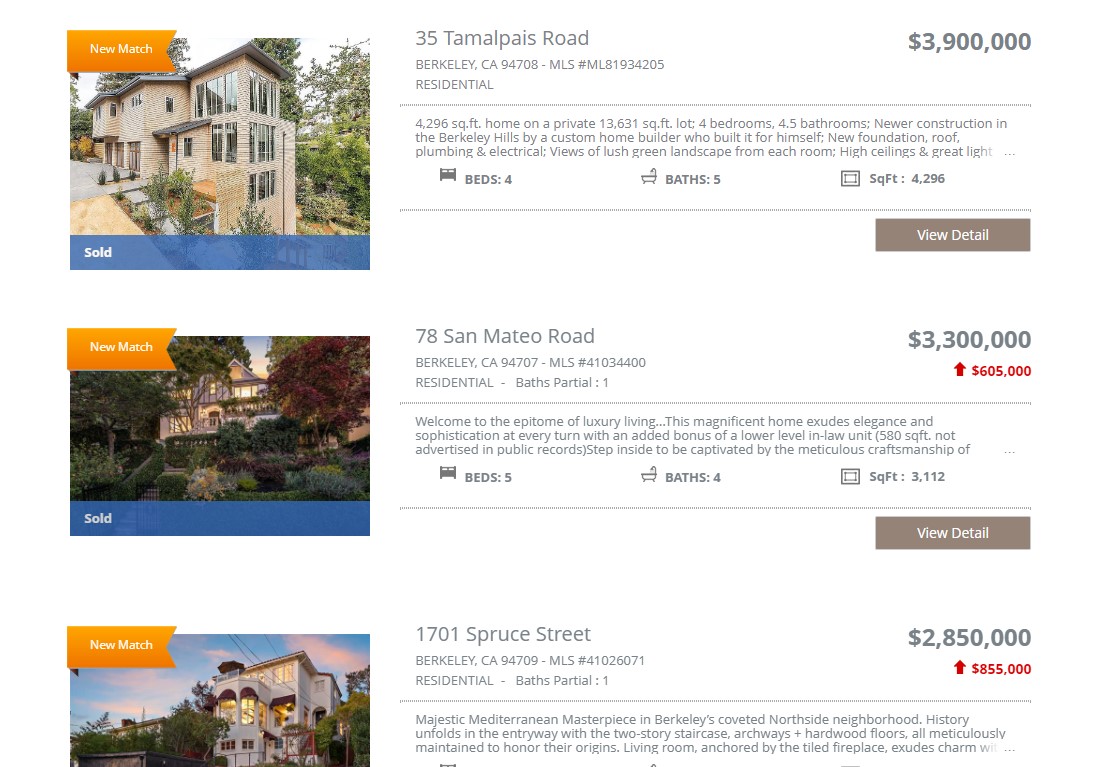

COMPLETED SALES, Berkeley Hills, 3rd Quarter, 2023

Click to see details and photos of properties SOLD in the Berkeley Hills, 7/1/2023 – 9/30/2023.

Note that, after you follow the link, you can click on each individual property to see photos and more details. Click “Close” near the top to return to the list.

* For the purposes of this newsletter, “Berkeley Hills” refers to the area bounded as follows: north of campus, east of a line heading north on Spruce from campus, cutting over on Los Angeles to Arlington, and then north along Arlington to the Kensington border.