REAL ESTATE ANSWERS: What counts as a bedroom in real estate, and do more bedrooms add value?

What counts as a bedroom in real estate, and do more bedrooms add value? A bedroom in general is just a room where people sleep. For a room to count as a bedroom for real estate purposes, there are several requirements: (1) FLOOR SIZE. According to the standards used by appraisers, a habitable room must have a floor of at least 70 square feet in area and be at least 7 feet in any direction. So a 7’x10’ room is okay, but a 6’x12’ space, even though it’s 72 square feet, wouldn’t be counted as a room (or a bedroom) [...]

REAL ESTATE ANSWERS: How do actions by “the Fed” affect interest rates on home loans?

How do actions by “the Fed” affect interest rates on home loans? The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high [...]

LOW RATES & HIGHER CONFORMING LOAN LIMITS

LOW RATES AND HIGHER CONFORMING LOAN LIMITS Interest rates are low, low, low right now! As I write this, the 30-year fixed rate is lower than it’s been since Freddie Mac began tracking mortgage rates in 1971. While it’s not surprising that rates are low given the economic impacts of the pandemic, it is still an opportunity for both buyers getting new loans and homeowners who can refinance their existing loans. Fixed rate 30-year conforming loans (up to the loan limits discussed below) can in many cases be had for under 3%. Even larger-amount jumbo loans, which were challenging to [...]

Home Loans, Interest rates, and Real Estate Newsletters

HOME LOANS AND INTEREST RATES x Interest rates on home loans have been very low lately! If your interest rate is close to, or above, 4%, it could be worth your while to contact your favorite loan person and see if you could benefit from refinancing your loan. x (See the update below.) Also, the limit on conforming loans (which can be sold to Fannie Mae and Freddie Mac) in our area was increased for 2020 to $765,600, up from $726,525 last year. Loans below that limit often have lower interest rates than those above. UPDATE, March 20, 2020 While [...]

REAL ESTATE ANSWERS: What counts as a bedroom in real estate, and do more bedrooms add value?

What counts as a bedroom in real estate, and do more bedrooms add value?

A bedroom in general is just a room where people sleep. For a room to count as a bedroom for real estate purposes, there are several requirements:

(1) FLOOR SIZE. According to the standards used by appraisers, a habitable room must have a floor of at least 70 square feet in area and be at least 7 feet in any direction. So a 7’x10’ room is okay, but a 6’x12’ space, even though it’s 72 square feet, wouldn’t be counted as a room (or a bedroom) on an appraisal.

(2) CEILING HEIGHT. At least 50% of the ceiling must be at least 7 feet high.

(3) ENTRANCE. There should be a door to the bedroom from the interior of the house.

(4) EGRESS. There also needs to be an exit from the bedroom to the exterior. This can be a door to the outside, or it can be an exterior window. If it’s a window, it should be 24 to 44 inches from the floor, have an opening of at least 5.7 square feet, and it must be no less than 24 inches in vertical size and no less than 20 inches wide. (The point is to make it usable if someone needs to climb in or out in an emergency.)

Note that if you have an older home, built before these requirements were put in place and without the proper egress windows, the city is not going to knock on your door and require that you make the window openings larger. However, if you are doing a project that modifies the rough openings, you will be required to comply. And if you sell that home, it’s advisable to disclose that one or more “bedrooms” does not have an egress window.

Many people think that a bedroom has to have a closet. In California, that is not a requirement, although some local jurisdictions may have other requirements. Most buyers though do want to have a closet in or at least near each bedroom.

Do additional bedrooms always add value in a sale? Not necessarily. The first few bedrooms do add value to a typical Berkeley house, but only if the bedrooms are of reasonable size, and the remaining living space is of reasonable size for the number of bedrooms. Consider a 1000 square foot home with 5 bedrooms, for example. The bedrooms would have to be quite small, and there won’t be much living or storage space, which will make the property appealing to far fewer buyers. Even for a larger home, a 5-bedroom house doesn’t necessarily have more value (everything else being equal) than one with 4 bedrooms, as there are fewer buyers who need the 5th bedroom.

Bottom line: Bedroom count does matter for value, but only as part of the overall picture of a home and its function.

REAL ESTATE ANSWERS: How do actions by “the Fed” affect interest rates on home loans?

How do actions by “the Fed” affect interest rates on home loans?

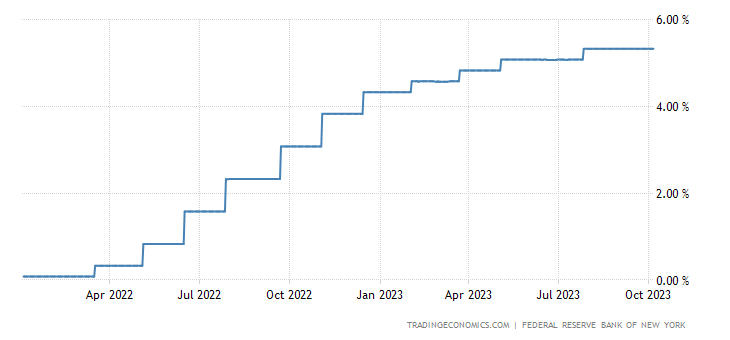

The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high unemployment. Since the start of 2022, they’ve been focused on eliminating the inflation that crept into the system during the main COVID years (2020-2021).

Interest rates on home loans are very long-term rates, since the typical home loan in the U.S. is a 30-year loan. They most closely track the rate on the 10-year Treasury note. Rates on home loans, like rates on 10-year Treasury notes, move up and down in response to economic conditions, changes in the return and relative riskiness of alternative assets, the availability of loanable funds, and current and expected future inflation rates. Rates on long term loans, like home loans, also depend on current and expected future short-term interest rates, so they are definitely affected by Fed policy.

In January of 2022, the Fed signaled that it was likely to start raising rates soon, setting off the real estate buying frenzy of early 2022, as buyers tried to get into the market before rates went up. The first rate increase by the Fed last year was in March of 2022, and by about this time last year, the target range for the federal funds rate was already up 3 percentage points, with more increases to come. By last fall, the Fed’s actions had resulted in a doubling of home loan rates, from the 3% range at the start of 2022, to about 6% in fall 2022. In the last year, the Fed has increased the target range for the federal funds rate 6 more times, for a total increase of 5.25% since the start of 2022. Today we’re looking at rates on homes loans that are approaching 8%.

When will interest rates go down again? Market rates are always bouncing around in response to new information, but we are unlikely to see a sustained reduction in interest rates until the Fed sees a need to stimulate the economy again, because inflation is low, and unemployment is increasing, or if they see a need to increase bank liquidity to keep the system functioning well.

LOW RATES & HIGHER CONFORMING LOAN LIMITS

LOW RATES AND HIGHER CONFORMING LOAN LIMITS

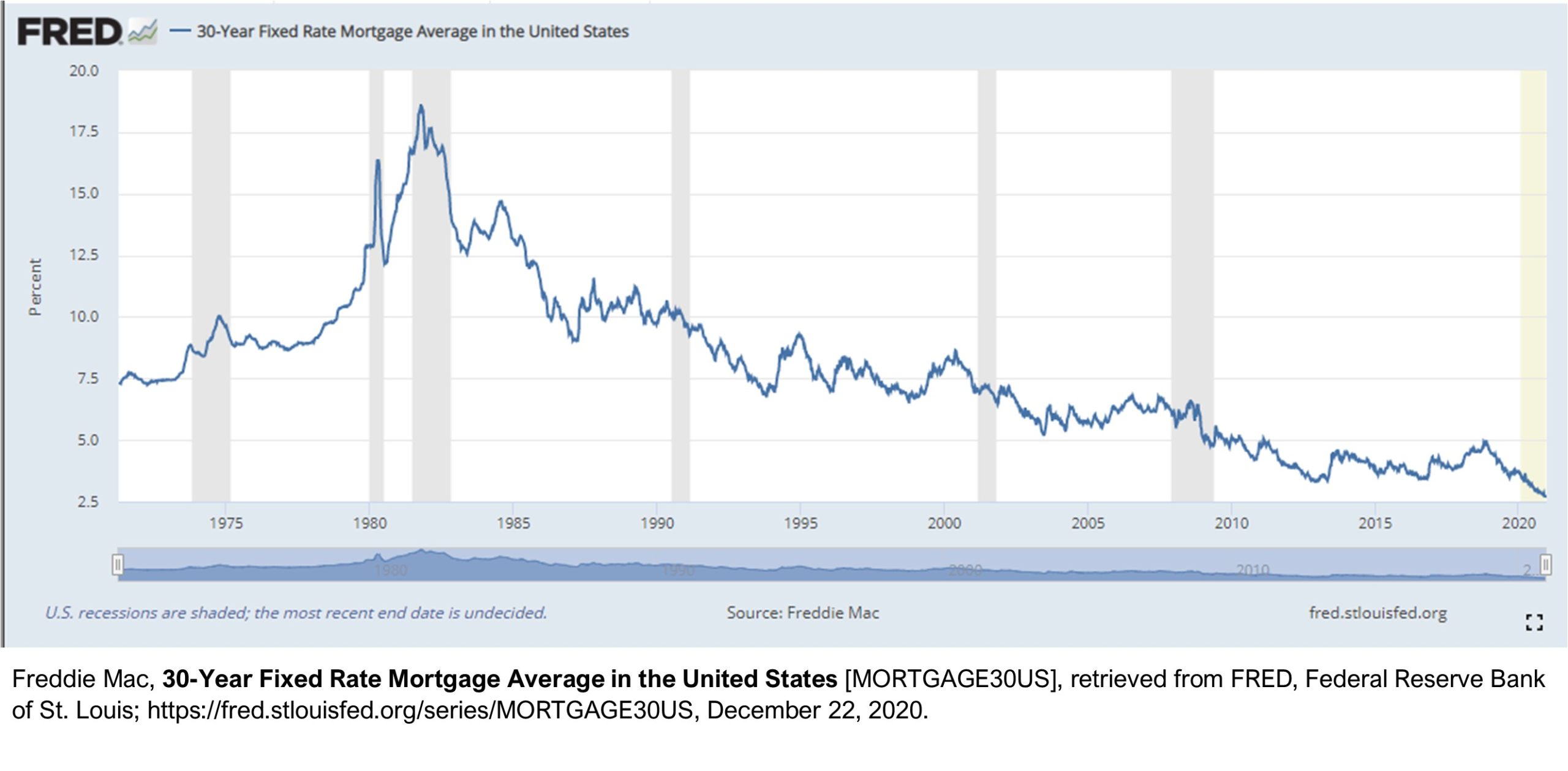

Interest rates are low, low, low right now! As I write this, the 30-year fixed rate is lower than it’s been since Freddie Mac began tracking mortgage rates in 1971.

While it’s not surprising that rates are low given the economic impacts of the pandemic, it is still an opportunity for both buyers getting new loans and homeowners who can refinance their existing loans. Fixed rate 30-year conforming loans (up to the loan limits discussed below) can in many cases be had for under 3%. Even larger-amount jumbo loans, which were challenging to get and much more expensive earlier in the year, are available around 3%.

The loan limits for conforming loans (those that meet the funding criteria of Freddie Mac & Fannie Mae) are set to go up again in 2021. The Federal Housing Finance Agency determined that home prices nationwide rose an average of 7.42% from the third quarter of 2019 to the third quarter of 2020, so loan limits will be increased that same amount (7.42%) for the coming year. In high-cost areas like ours, that means the limit for single-family homes will increase from the current $765,600 to $822,375 in 2021.

Home Loans, Interest rates, and Real Estate Newsletters

HOME LOANS AND INTEREST RATES

x Interest rates on home loans have been very low lately! If your interest rate is close to, or above, 4%, it could be worth your while to contact your favorite loan person and see if you could benefit from refinancing your loan. x (See the update below.)

Also, the limit on conforming loans (which can be sold to Fannie Mae and Freddie Mac) in our area was increased for 2020 to $765,600, up from $726,525 last year. Loans below that limit often have lower interest rates than those above.

UPDATE, March 20, 2020

While the Fed has cut interest rates multiple times, and the interest rate on 10-year Treasury notes (which is typically the rate most tied to rates on home loans) has fallen substantially since the beginning of the year, home loan rates have actually risen. Lenders reportedly were already struggling to keep up with refinance requests, and these difficulties cannot have been helped by the Shelter-in-Place. I suspect rates will come down later in the year, but for now, they’re on the high side compared to both recent history, and underlying factors.

In the news: (This is a big one for everyone who has been worried about making ends meet during these challenging times! Fingers crossed that this actually is a readily accessible option…) If you have a conforming loan, guaranteed by Fannie Mae or Freddie Mac, the government, in response to the pandemic, has said that you should be eligible to have your mortgage payments reduced or suspended for up to 12 months. For more information, see https://www.npr.org/2020/03/19/818343720/homeowners-hurt-financially-by-the-coronavirus-may-get-a-mortgage-break

ON A SEPARATE NOTE…

There are a lot of real estate newsletters (electronic and printed) out there, but did you know that most of them are produced by an outside party, with a more regional focus so that they can be more broadly used?

I’ve been writing the Berkeley Hills Report (myself) now for 13 years. I create and review the data so that I can focus on our immediate area and get a deep sense of what’s happening in the market. (My PhD is in economics, so this sort of analysis is right up my alley.) I write this newsletter so I can share this information with you, and at the same time give you a good sense of who I am and what I bring to the table. I hope you find it useful!