REAL ESTATE ANSWERS: What is (or was!) the California “Dream For All” program?

What is (or was!) the California “Dream For All” program? There have been many programs over the years aimed at helping first-time buyers get into the expensive California housing market, but they have mostly been so restrictive that few people were able to use them. The less-restrictive “Dream For All” program from the California Housing Finance Agency is targeted to low and moderate income first-time buyers. It provides funds for down payment and closing costs through a shared appreciation loan of up to 20% of the purchase price. Here’s an example of how it can work. A qualifying buyer uses [...]

LOW RATES & HIGHER CONFORMING LOAN LIMITS

LOW RATES AND HIGHER CONFORMING LOAN LIMITS Interest rates are low, low, low right now! As I write this, the 30-year fixed rate is lower than it’s been since Freddie Mac began tracking mortgage rates in 1971. While it’s not surprising that rates are low given the economic impacts of the pandemic, it is still an opportunity for both buyers getting new loans and homeowners who can refinance their existing loans. Fixed rate 30-year conforming loans (up to the loan limits discussed below) can in many cases be had for under 3%. Even larger-amount jumbo loans, which were challenging to [...]

REAL ESTATE ANSWERS: What is (or was!) the California “Dream For All” program?

What is (or was!) the California “Dream For All” program?

There have been many programs over the years aimed at helping first-time buyers get into the expensive California housing market, but they have mostly been so restrictive that few people were able to use them. The less-restrictive “Dream For All” program from the California Housing Finance Agency is targeted to low and moderate income first-time buyers.

It provides funds for down payment and closing costs through a shared appreciation loan of up to 20% of the purchase price.

Here’s an example of how it can work. A qualifying buyer uses an approved lender, and gets a “regular” loan for 80% of the purchase price, combined with a 20% Dream For All shared appreciation loan. The buyer, in this example, only needs to have funds to cover closing costs (which might be, very roughly, 5% of the purchase price).

The buyer makes regular payments (principal plus interest) on the 80% loan, but there are no ongoing payments on the shared appreciation loan. Instead of paying interest on the Dream For All assistance funds, when the property is sold, the assistance funds are repaid, along with a share of the appreciation on the property. If the Dream For All assistance was 20% of the purchase price, the program gets 20% of the appreciation.

There are other programs out there for buyers without a lot of down payment money, where the borrower only needs to put around 3% of the purchase price down. In the Dream For All scenario, though, the monthly payment (on 80%, rather than 97% of the purchase price) is lower, and there is no mortgage insurance as long as the “regular” loan component is 80% or less of the value.

Here are some of the requirements of the Dream For All program:

- The property must be a 1-unit/single family home or a condo, purchased as the primary residence of the new owner.

- Non-occupant co-signers are not allowed.

- The maximum income to qualify in Alameda County is $282,000.

- You must be a first-time buyer, BUT they define a first-time buyer as someone who has not owned a home in California in the last three years.

- The maximum “regular” loan amount is $1,089,300, which means that, with 20% Dream For All assistance, the maximum purchase price would be $1,361,625.

- The buyer has to take a Homebuyer Education and Counseling course.

For more details, see www.calhfa.ca.gov/dream/.

Here’s the bad news — the program was so popular, that its funding, which was expected to last until early fall, ran out in not even 10 days! It’s unclear whether the state will provide additional funding, but if you know someone who might qualify and be interested, they should watch and be ready to act quickly if more funds are added.

LOW RATES & HIGHER CONFORMING LOAN LIMITS

LOW RATES AND HIGHER CONFORMING LOAN LIMITS

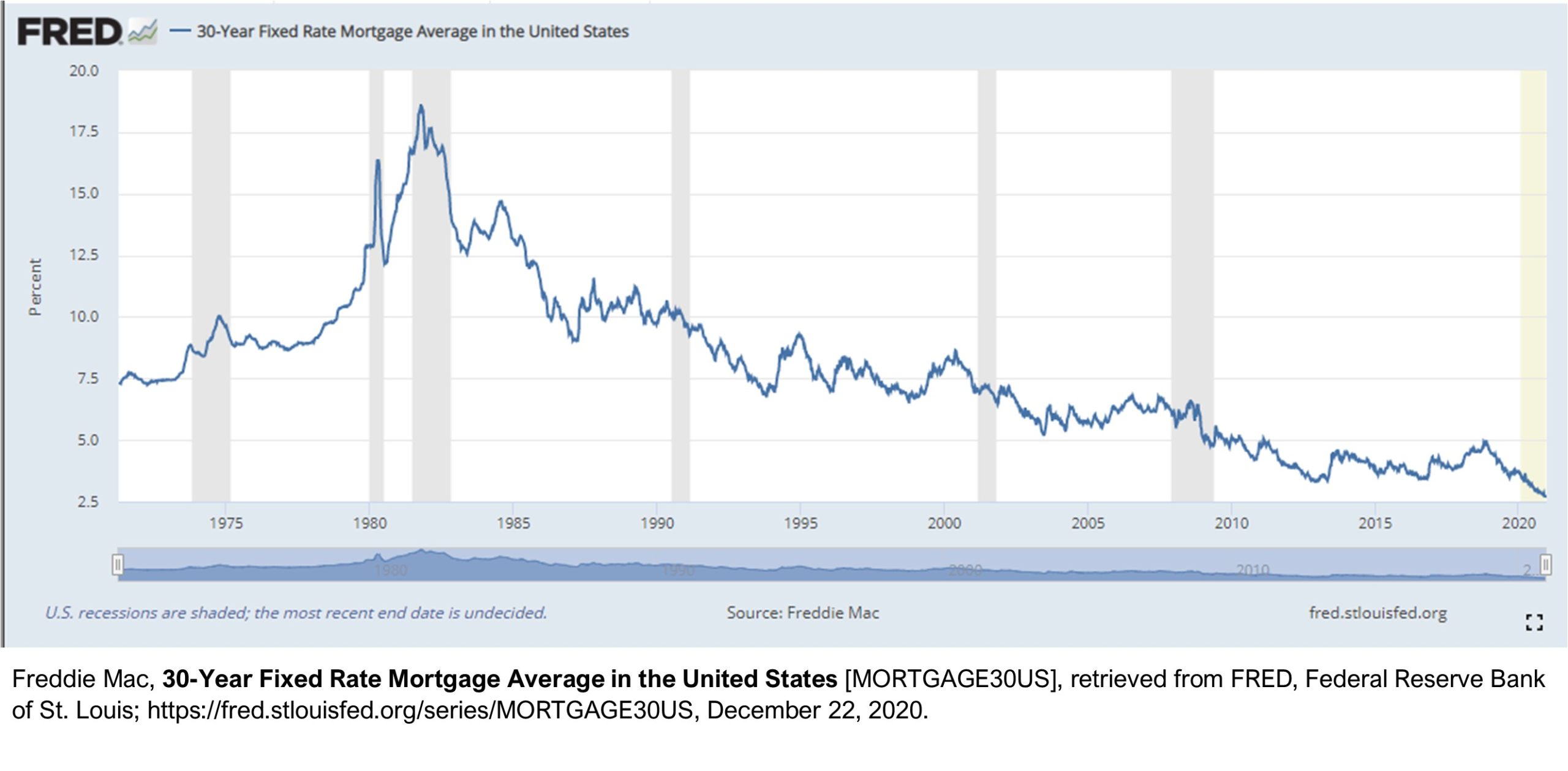

Interest rates are low, low, low right now! As I write this, the 30-year fixed rate is lower than it’s been since Freddie Mac began tracking mortgage rates in 1971.

While it’s not surprising that rates are low given the economic impacts of the pandemic, it is still an opportunity for both buyers getting new loans and homeowners who can refinance their existing loans. Fixed rate 30-year conforming loans (up to the loan limits discussed below) can in many cases be had for under 3%. Even larger-amount jumbo loans, which were challenging to get and much more expensive earlier in the year, are available around 3%.

The loan limits for conforming loans (those that meet the funding criteria of Freddie Mac & Fannie Mae) are set to go up again in 2021. The Federal Housing Finance Agency determined that home prices nationwide rose an average of 7.42% from the third quarter of 2019 to the third quarter of 2020, so loan limits will be increased that same amount (7.42%) for the coming year. In high-cost areas like ours, that means the limit for single-family homes will increase from the current $765,600 to $822,375 in 2021.