ARE YOU UNDER-INSURED?

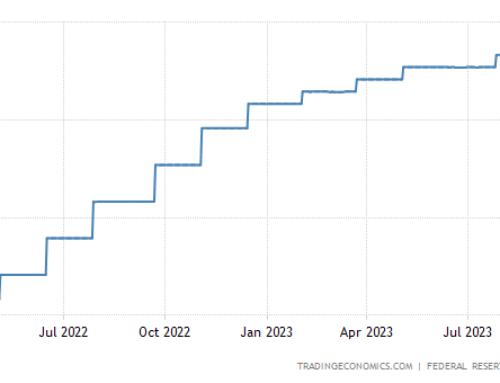

The huge wildfires this year are a reminder that we should all periodically evaluate our insurance coverage, and make sure that we could rebuild if we ever needed to. Most insurance policies auto-renew each year, and the coverage may not keep pace with rising building costs.

To get a very rough sense of the adequacy of your existing coverage, take your total coverage amount and divide it by the square footage of your home to calculate how much you would be able to spend per square foot if you had to rebuild. Experts say that $250-$300 per square foot is the minimum likely cost to rebuild in our area, so I would want to have at least that much coverage.

Also check to be sure that you’ve updated your policy to reflect improvements you’ve made to your home, and that you have coverage for any external structures.

Now, while we’re staying home, is also a good time to do a home inventory, which helps a great deal if you ever have to file a claim for a major loss. You can find forms online to fill out where you list the contents of your home, or you can take photos or video of your rooms, closets and other storage areas, showing the contents. Keep a copy of the information away from your home (ideally somewhere online), so you can get it if you ever need it. (Let’s hope we never need it!)

For more information on doing a home inventory, see

https://www.iii.org/article/how-create-home-inventory

Here’s also one example of a spreadsheet for doing a home inventory:

https://www.nycm.com/pdf/HomeContentsInventoryWorksheet.pdf