HOME LOANS AND INTEREST RATES

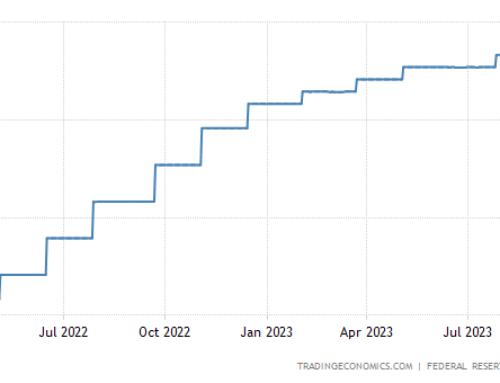

x Interest rates on home loans have been very low lately! If your interest rate is close to, or above, 4%, it could be worth your while to contact your favorite loan person and see if you could benefit from refinancing your loan. x (See the update below.)

Also, the limit on conforming loans (which can be sold to Fannie Mae and Freddie Mac) in our area was increased for 2020 to $765,600, up from $726,525 last year. Loans below that limit often have lower interest rates than those above.

UPDATE, March 20, 2020

While the Fed has cut interest rates multiple times, and the interest rate on 10-year Treasury notes (which is typically the rate most tied to rates on home loans) has fallen substantially since the beginning of the year, home loan rates have actually risen. Lenders reportedly were already struggling to keep up with refinance requests, and these difficulties cannot have been helped by the Shelter-in-Place. I suspect rates will come down later in the year, but for now, they’re on the high side compared to both recent history, and underlying factors.

In the news: (This is a big one for everyone who has been worried about making ends meet during these challenging times! Fingers crossed that this actually is a readily accessible option…) If you have a conforming loan, guaranteed by Fannie Mae or Freddie Mac, the government, in response to the pandemic, has said that you should be eligible to have your mortgage payments reduced or suspended for up to 12 months. For more information, see https://www.npr.org/2020/03/19/818343720/homeowners-hurt-financially-by-the-coronavirus-may-get-a-mortgage-break

ON A SEPARATE NOTE…

There are a lot of real estate newsletters (electronic and printed) out there, but did you know that most of them are produced by an outside party, with a more regional focus so that they can be more broadly used?

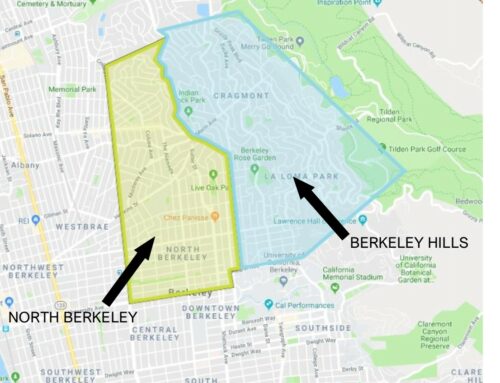

I’ve been writing the Berkeley Hills Report (myself) now for 13 years. I create and review the data so that I can focus on our immediate area and get a deep sense of what’s happening in the market. (My PhD is in economics, so this sort of analysis is right up my alley.) I write this newsletter so I can share this information with you, and at the same time give you a good sense of who I am and what I bring to the table. I hope you find it useful!