THE OUTLOOK: North Berkeley, Fall 2018 wrap-up

There have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, it’s not surprising that the real estate market has cooled. We’re very fortunate, though, to live in [...]

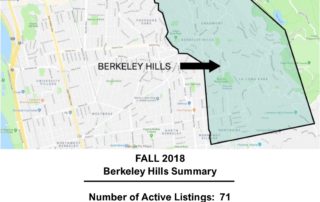

THE OUTLOOK: Berkeley Hills, Fall 2018 wrap-up

We’re very fortunate to live in an area that historically has weathered real estate downturns well, but there have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, [...]

REAL ESTATE ANSWERS: What’s changing as a result of the Berkeley measures on the 2018 ballot?

There were 2 local measures on the November 2018 ballot that were approved by voters that will impact local real estate going forward. The first was Measure P, which passed with 72% of voters saying yes. Measure P increases the Berkeley city transfer tax on property sales at prices over $1.5M, from 1.5% of the sale price, to 2.5%. Property sales at prices of $1.5M or less will still be taxed at the old rate of 1.5%. The measure says that the funds raised are intended to be used for “general municipal purposes such as navigation centers, mental health support, [...]

THE OUTLOOK: North Berkeley, Fall 2018 wrap-up

There have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, it’s not surprising that the real estate market has cooled. We’re very fortunate, though, to live in an area that historically has weathered real estate downturns well. There is one bit of good news: the borrowing limit on conforming loans (those that can be sold to Fannie Mae or Freddie Mac) for high-cost areas like ours will be increasing to $726,525 for 2019.

How has the local market fared? Let’s look at the numbers for fall 2018. In North Berkeley, there were 35 active listings (which is just a bit on the high side), and 26 properties that sold between September and the end of November.

The average time to sell was 20 days on the market. This is a bit longer than we’ve been seeing, but there were only 3 properties that took 30 days or more to sell.

73% of the sales over the fall quarter were for more than list price, and 23% of the sales were for all cash. There were no short sales in the fall data, and no sales of bank-owned properties.

The results for prices were mixed. The median sold price for the fall was $1,272,500, which is down 9% from this summer, but up 2% from last fall. The results for sold price per square foot were similar: the average sold price per square foot was $814, down 5% compared to this summer, but up 4% compared to last fall.

2 of the 26 properties that sold had price reductions before selling, but there were still many cases of multiple offers (on average 4 offers for the properties where this was reported).

Clearly there are still buyers out there, although they are more cautious and price-sensitive. We never really know when the peak or trough of a market cycle has come until we look back in retrospect. I suspect though that we’re at or near (or even past) the turning point. If that’s true, hopefully the Berkeley market will be as resilient as ever.

THE OUTLOOK: Berkeley Hills, Fall 2018 wrap-up

We’re very fortunate to live in an area that historically has weathered real estate downturns well, but there have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, it’s not surprising that the real estate market has cooled. There is one bit of good news: the borrowing limit on conforming loans (those that can be sold to Fannie Mae or Freddie Mac) for high-cost areas like ours is increasing to $726,525 for 2019.

Let’s look at the numbers for fall 2018 to see how has the local market fared. In the Berkeley hills, there were 71 active listings (which is on the high side), and 43 properties that sold between September and the end of November.

Most properties sold quickly, in an average of 18 days on the market. There were 8 properties that took 30 days or more to sell.

84% of the sales over the fall quarter were at prices above list price, and 33 of the sales were for all cash. There were no short sales in the fall data, and no sales of bank-owned properties.

The results for prices were mixed. The median sold price for the fall was $1,360,000, which is down a bit both from this summer (down 1%), and from last fall (down 2%). On the positive side, sold price per square foot was $723, up 1% from this summer, and up 5% compared to last fall.

4 of the 43 properties that sold had price reductions before selling, but we also had one property with 23 offers. (The latter was a 5 bedroom, 3 bath mid-century home with Bay views that was listed low at less than $1 million, so it’s not surprising it got tons of interest!)

Clearly there are still buyers out there, although they are more cautious and price-sensitive. We never really know when the peak or trough of a market cycle has come until we look back in retrospect. I suspect though that we’re at or near (or even past) the turning point. If that’s true, hopefully the Berkeley market will be as resilient as ever.

REAL ESTATE ANSWERS: What’s changing as a result of the Berkeley measures on the 2018 ballot?

There were 2 local measures on the November 2018 ballot that were approved by voters that will impact local real estate going forward.

The first was Measure P, which passed with 72% of voters saying yes. Measure P increases the Berkeley city transfer tax on property sales at prices over $1.5M, from 1.5% of the sale price, to 2.5%. Property sales at prices of $1.5M or less will still be taxed at the old rate of 1.5%. The measure says that the funds raised are intended to be used for “general municipal purposes such as navigation centers, mental health support, rehousing and other services for the homeless, including homeless seniors and youth.” It also establishes a Homeless Services Panel of Experts to recommend services.

Berkeley now has the highest transfer taxes in the state except for properties that sell for more than $10M in San Francisco or Richmond. San Francisco properties that sell for less than $10M have a lower transfer tax than in Berkeley. In Richmond, properties selling for less than $3M have a lower transfer tax, and properties in the $3M-$10M range match Berkeley’s 2.5% tax.

As a result of Measure P, I think we’ll be seeing a real discontinuity in the market at $1.5M. The difference between a sale at $1,500,000 and a sale at $1,500,001 is an extra $15,000 in transfer taxes! I expect that a lot of buyers who might have made an offer in the low $1.5M range will decide instead to not go over $1.5M. Since the city transfer tax is typically split 50/50 between the buyer and seller, both parties have an incentive to keep a sale price under that figure. Buyers will be trying to find creative ways to sweeten their offer in a multiple-offer situation without crossing that threshold. For properties valued well above $1.5M, the buyers will just have to factor in the higher costs (and the sellers the lower proceeds).

The other local real estate measure that passed was Measure Q. Measure Q was written to address how Berkeley rent control would proceed if the statewide proposition to repeal the 1995 Costa Hawkins Rental Housing Act passed. The statewide proposition did not pass, so Costa Hawkins is still in effect and most of Measure Q ended up being not relevant. (You likely saw this when you voted in November, but if you’d like a refresher, Costa Hawkins most notably prevents rent control from being imposed on single family homes and condominiums, allows rents to be reset to market rates when a unit is rented to new tenants, and prevents rent control from being imposed on units constructed after February 1995.)

However, one part of measure Q, intended to encourage construction of new accessory dwelling units (ADUs), will go into effect. For properties with one legal and permitted ADU, if the owner resides on the property, the rental unit will be exempt from rent and eviction controls. The exemption will apply to tenancies that started November 7, 2018 or later.