THE OUTLOOK: North Berkeley, Fall 2018 wrap-up

There have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, it’s not surprising that the real estate market has cooled. We’re very fortunate, though, to live in [...]

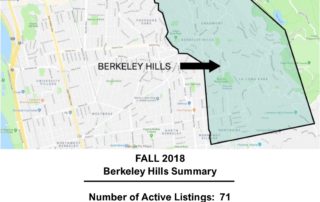

THE OUTLOOK: Berkeley Hills, Fall 2018 wrap-up

We’re very fortunate to live in an area that historically has weathered real estate downturns well, but there have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, [...]

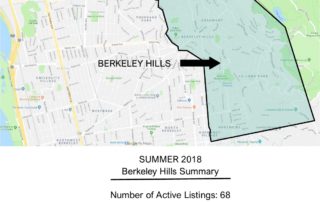

THE OUTLOOK: Berkeley Hills, Summer 2018 wrap-up

I mentioned in the last newsletter that there have been some rumblings of changes in the market, with higher inventory spreading out the buyer pool. This was true again over the summer in the hills. We had 68 active listings over the summer, compared to 66 last summer, 63 in summer 2016, and only 41 in summer 2015. Happily there were also lots of sales over the summer — 61 properties sold in the Berkeley hills. The higher number of properties competing for buyers did show in prices somewhat. The median sold price for the summer was $1,375,000, and the [...]

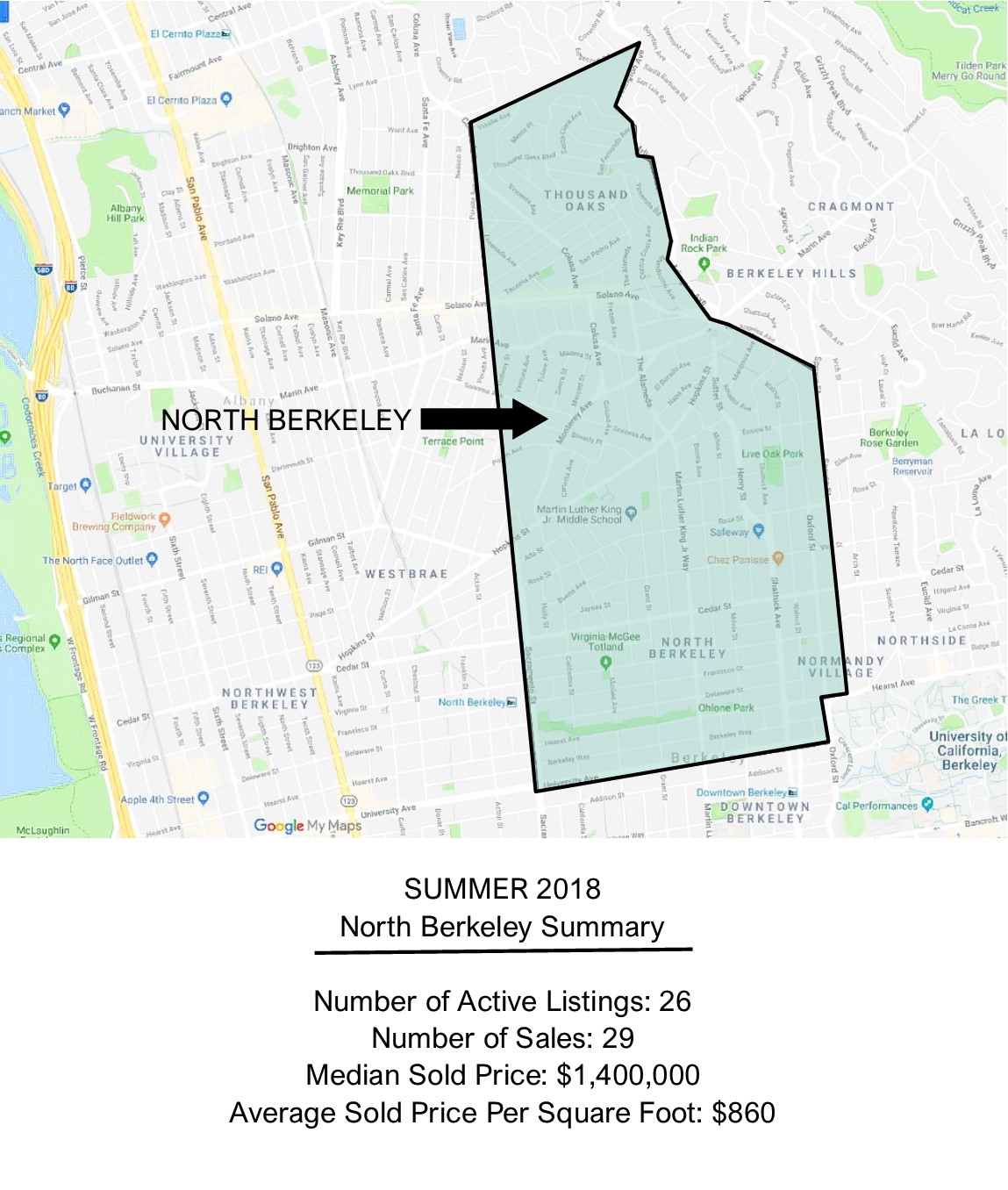

THE OUTLOOK: North Berkeley, Summer 2018 wrap-up

There has been a lot of talk lately about changes in the market triggered by higher levels of inventory. Higher inventory was a factor again over the summer in other areas of Berkeley (see the post with data for the Hills area this summer, for example), but not in North Berkeley. There were only 26 active listings in North Berkeley over the summer, compared to 40 last summer, 33 in summer 2016, and 31 in summer 2015. 29 North Berkeley properties sold over the summer, at a median price of $1,400,000. This is up 8% compared to the spring, but [...]

THE OUTLOOK: North Berkeley, Spring 2018 wrap-up

I was excited to crunch the numbers for this spring season, with two questions in mind. First, there has been a lot of talk lately about the relatively high level of inventory on the market, so I wanted to see how the number of active listings compared to past springs. It turns out that there were in fact more active listings this spring (47) than in the past several years (36 in spring 2017, 35 in 2016, and 33 in 2015). This pattern — more homes for sale as the market has been rising — is not surprising, as more [...]

THE OUTLOOK: Berkeley Hills, Spring 2018 wrap-up

I was excited to crunch the numbers for this spring season, with two questions in mind. First, there has been a lot of talk lately about the relatively high level of inventory on the market, so I wanted to see how the number of active listings compared to past springs. It turns out that there were in fact more active listings this spring (74) than in the past several years (69 in spring 2017, 59 in 2016, and 55 in 2015). This pattern — more homes for sale as the market has been rising — is not surprising, as more [...]

Home Project Website

https://www.homewyse.com/ I saw a mention of the website above in a Money magazine article about home improvement projects, so I checked it out and thought it was worth passing along. It's a price calculator for home renovation and maintenance projects. You select a project, make some choices about the scope of the work, the quality of the materials and the type of contractor, enter your zip code, and they give you a rough estimated range for the cost. I found this really interesting. I cannot vouch for the accuracy of their numbers, but there is information about their methodology and sources on [...]

THE OUTLOOK: North Berkeley, Fall 2018 wrap-up

There have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, it’s not surprising that the real estate market has cooled. We’re very fortunate, though, to live in an area that historically has weathered real estate downturns well. There is one bit of good news: the borrowing limit on conforming loans (those that can be sold to Fannie Mae or Freddie Mac) for high-cost areas like ours will be increasing to $726,525 for 2019.

How has the local market fared? Let’s look at the numbers for fall 2018. In North Berkeley, there were 35 active listings (which is just a bit on the high side), and 26 properties that sold between September and the end of November.

The average time to sell was 20 days on the market. This is a bit longer than we’ve been seeing, but there were only 3 properties that took 30 days or more to sell.

73% of the sales over the fall quarter were for more than list price, and 23% of the sales were for all cash. There were no short sales in the fall data, and no sales of bank-owned properties.

The results for prices were mixed. The median sold price for the fall was $1,272,500, which is down 9% from this summer, but up 2% from last fall. The results for sold price per square foot were similar: the average sold price per square foot was $814, down 5% compared to this summer, but up 4% compared to last fall.

2 of the 26 properties that sold had price reductions before selling, but there were still many cases of multiple offers (on average 4 offers for the properties where this was reported).

Clearly there are still buyers out there, although they are more cautious and price-sensitive. We never really know when the peak or trough of a market cycle has come until we look back in retrospect. I suspect though that we’re at or near (or even past) the turning point. If that’s true, hopefully the Berkeley market will be as resilient as ever.

THE OUTLOOK: Berkeley Hills, Fall 2018 wrap-up

We’re very fortunate to live in an area that historically has weathered real estate downturns well, but there have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, it’s not surprising that the real estate market has cooled. There is one bit of good news: the borrowing limit on conforming loans (those that can be sold to Fannie Mae or Freddie Mac) for high-cost areas like ours is increasing to $726,525 for 2019.

Let’s look at the numbers for fall 2018 to see how has the local market fared. In the Berkeley hills, there were 71 active listings (which is on the high side), and 43 properties that sold between September and the end of November.

Most properties sold quickly, in an average of 18 days on the market. There were 8 properties that took 30 days or more to sell.

84% of the sales over the fall quarter were at prices above list price, and 33 of the sales were for all cash. There were no short sales in the fall data, and no sales of bank-owned properties.

The results for prices were mixed. The median sold price for the fall was $1,360,000, which is down a bit both from this summer (down 1%), and from last fall (down 2%). On the positive side, sold price per square foot was $723, up 1% from this summer, and up 5% compared to last fall.

4 of the 43 properties that sold had price reductions before selling, but we also had one property with 23 offers. (The latter was a 5 bedroom, 3 bath mid-century home with Bay views that was listed low at less than $1 million, so it’s not surprising it got tons of interest!)

Clearly there are still buyers out there, although they are more cautious and price-sensitive. We never really know when the peak or trough of a market cycle has come until we look back in retrospect. I suspect though that we’re at or near (or even past) the turning point. If that’s true, hopefully the Berkeley market will be as resilient as ever.

THE OUTLOOK: Berkeley Hills, Summer 2018 wrap-up

I mentioned in the last newsletter that there have been some rumblings of changes in the market, with higher inventory spreading out the buyer pool. This was true again over the summer in the hills. We had 68 active listings over the summer, compared to 66 last summer, 63 in summer 2016, and only 41 in summer 2015.

Happily there were also lots of sales over the summer — 61 properties sold in the Berkeley hills. The higher number of properties competing for buyers did show in prices somewhat. The median sold price for the summer was $1,375,000, and the average sold price per square foot was $713. Both of these numbers are down from the spring, but the good news is, they are both a good bit higher than last summer. Median sold price is up 15% from a year ago, and average sold price per square foot is up 9%.

The average number of days on the market crept up slightly relative to the spring and to last summer, but was still only 19 days, which is nothing to complain about. 7 of the 61 sold properties had price reductions before selling, but on the flip side, 80% of the sold properties went for more than list price. For those properties that went over, the average was 19% above list price.

The average number of offers, where reported (remember, our MLS does not require agents to share information on the number of offers; it’s optional) was 4. Most properties had 1, 2 or 3 offers, 4 properties had between 4 and 8 offers, and 3 properties had 10 or more offers. Not surprisingly, the properties with the double-digit number of offers were the ones that were priced very low relative to value, so they attracted lots of attention. It’s an interesting market lately, and an especially tough one for buyers to navigate. We have some homes listed at or near market value, and others at the same time that are using the low-list-price strategy. Each of these can make sense in the right situation.

Overall, the market was a bit less crazy over the summer than it has been for the last few years. Buyers are a little more cautious, and they have had more properties to choose from. In this environment, smart pricing and smart preparation are more important than ever when selling, to ensure that your property compares favorably to other homes on the market.

THE OUTLOOK: North Berkeley, Summer 2018 wrap-up

There has been a lot of talk lately about changes in the market triggered by higher levels of inventory. Higher inventory was a factor again over the summer in other areas of Berkeley (see the post with data for the Hills area this summer, for example), but not in North Berkeley. There were only 26 active listings in North Berkeley over the summer, compared to 40 last summer, 33 in summer 2016, and 31 in summer 2015.

29 North Berkeley properties sold over the summer, at a median price of $1,400,000. This is up 8% compared to the spring, but down very slightly (less than 1%) compared to last summer. The average sold price per square foot was a whopping $860, up 1% from the spring, and up 15% from last summer.

With so little inventory, it’s not surprising that properties sold quickly — the average number of days on the market was 16. 2 of the 29 sold properties did have price reductions before selling, but 83% of the sold properties went for more than list price. For those properties that went over list price, the average sold price was 23% higher.

The average number of offers, where reported (remember, our MLS does not require agents to share information on the number of offers; it’s optional) was 4. Most properties had 1, 2 or 3 offers, 4 properties had between 4 and 9 offers, and 1 property had 12 offers. Not surprisingly, the properties with the higher numbers of offers were the ones that were priced very low relative to value, so they attracted lots of attention. It’s an interesting market lately, and an especially tough one for buyers to navigate. We have some homes listed at or near market value, and others at the same time that are using the low-list-price strategy. Each of these can make sense in the right situation.

In the broader Berkeley market, and especially in some areas outside of Berkeley, the market was less crazy over the summer than it has been lately. Buyers are a little more cautious, and they have had more properties to choose from. Under these conditions, smart pricing and smart preparation are more important than ever when selling, to ensure that your property compares favorably to other homes on the market. The North Berkeley market though continues to hold strong!

THE OUTLOOK: North Berkeley, Spring 2018 wrap-up

I was excited to crunch the numbers for this spring season, with two questions in mind.

First, there has been a lot of talk lately about the relatively high level of inventory on the market, so I wanted to see how the number of active listings compared to past springs. It turns out that there were in fact more active listings this spring (47) than in the past several years (36 in spring 2017, 35 in 2016, and 33 in 2015). This pattern — more homes for sale as the market has been rising — is not surprising, as more sellers are inspired to take advantage of higher prices. A lot of the spring listings came on the market in May, so many will close escrow in June, and the outcome for those will be in the summer statistics.

The other thing I wondered about was how much the increase in interest rates has affected prices so far. Interest rates on home loans now are about a full percentage point higher than they were last year. We’re looking at rates in the high 4% range (4.75%+) now for a typical home loan, compared to the high 3% range last year. A buyer who last year was approved for a maximum purchase of $1.3M (the current median price) at a 3.75% interest rate with a 20% down payment is now not going to be able to borrow as much (if everything else is the same). At an interest rate of 4.75%, the maximum loan amount that corresponds to the monthly payment that same buyer qualified for is now $117,000 less. On the positive side, jumbo loans (above $679,650) have come down in cost relative to conventional loans, and in some cases, actually have lower interest rates than smaller loans.

The increase in interest rates hasn’t had a negative effect on prices, which have been steady. During Spring 2018, 24 properties sold, in an average of only 16 days on the market. The median sold price in North Berkeley was $1,300,000, which is up 1% from last spring, and the average sold price per square foot was $849, about the same as a year ago.

88% of the North Berkeley sales this spring went over list price, and on average, those that went over sold for 22% above list price.

We’re starting the summer with more inventory and higher interest rates, so I’m expecting the market to be more balanced between buyers and sellers. This is good news for buyers, and not bad for sellers either, as it will help keep buyers in the market over time.

THE OUTLOOK: Berkeley Hills, Spring 2018 wrap-up

I was excited to crunch the numbers for this spring season, with two questions in mind.

First, there has been a lot of talk lately about the relatively high level of inventory on the market, so I wanted to see how the number of active listings compared to past springs. It turns out that there were in fact more active listings this spring (74) than in the past several years (69 in spring 2017, 59 in 2016, and 55 in 2015). This pattern — more homes for sale as the market has been rising — is not surprising, as more sellers are inspired to take advantage of higher prices. A lot of the spring listings came on the market in May, so many will close escrow in June, and the outcome for those will be in the summer statistics.

The other thing I wondered about was how much the increase in interest rates has affected prices so far. Interest rates on home loans now are about a full percentage point higher than they were last year. We’re looking at rates in the high 4% range (4.75%+) now for a typical home loan, compared to the high 3% range last year. A buyer who last year was approved for a maximum purchase of $1.5M (about the median price) at a 3.75% interest rate with a 20% down payment is now not going to be able to borrow as much (if everything else is the same). At an interest rate of 4.75%, the maximum loan amount that corresponds to the monthly payment that same buyer qualified for is now $130,000 less. On the positive side, jumbo loans (above $679,650) have come down in cost relative to conventional loans, and in some cases, actually have lower interest rates than smaller loans.

Despite the increase in interest rates, prices were still strong over the spring. During Spring 2018, 41 properties sold, in an average of only 17 days on the market. The median sold price in the hills was $1,520,000, which is up 16% from last spring. The average sold price per square foot was $722, which is up 3% from a year ago.

88% of the sales in the hills this spring went over list price, and on average, those that went over sold for 23% above list price.

We’re starting the summer with more inventory and higher interest rates, so I’m expecting the market to be more balanced between buyers and sellers. This is good news for buyers, and not bad for sellers either, as it will help keep buyers in the market over time.

Home Project Website

https://www.homewyse.com/

I saw a mention of the website above in a Money magazine article about home improvement projects, so I checked it out and thought it was worth passing along. It’s a price calculator for home renovation and maintenance projects. You select a project, make some choices about the scope of the work, the quality of the materials and the type of contractor, enter your zip code, and they give you a rough estimated range for the cost. I found this really interesting. I cannot vouch for the accuracy of their numbers, but there is information about their methodology and sources on the site (under the Reference menu at the top). Whether or not their numbers are very accurate, it could be useful in getting a sense of the factors that determine the cost of a particular project that you’re contemplating.