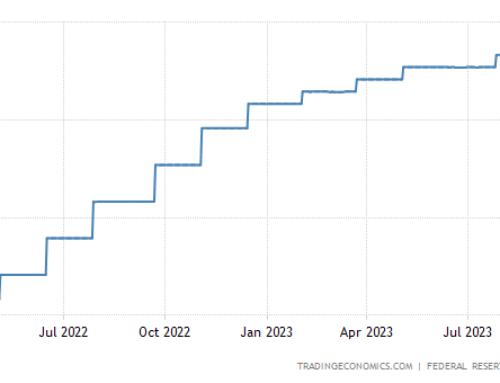

We’re very fortunate to live in an area that historically has weathered real estate downturns well, but there have been some real changes in the broader real estate market (in the Bay Area, statewide and nationally) since the beginning of 2018. With interest rates rising, and more limitations on the deductibility of property taxes and interest on home loans, homes are less affordable at any given price. Added to this, the tone of nationalist exclusion and the tariff wars coming to us from Washington have lessened the attractiveness of U.S. real estate to foreign investors. In light of these factors, it’s not surprising that the real estate market has cooled. There is one bit of good news: the borrowing limit on conforming loans (those that can be sold to Fannie Mae or Freddie Mac) for high-cost areas like ours is increasing to $726,525 for 2019.

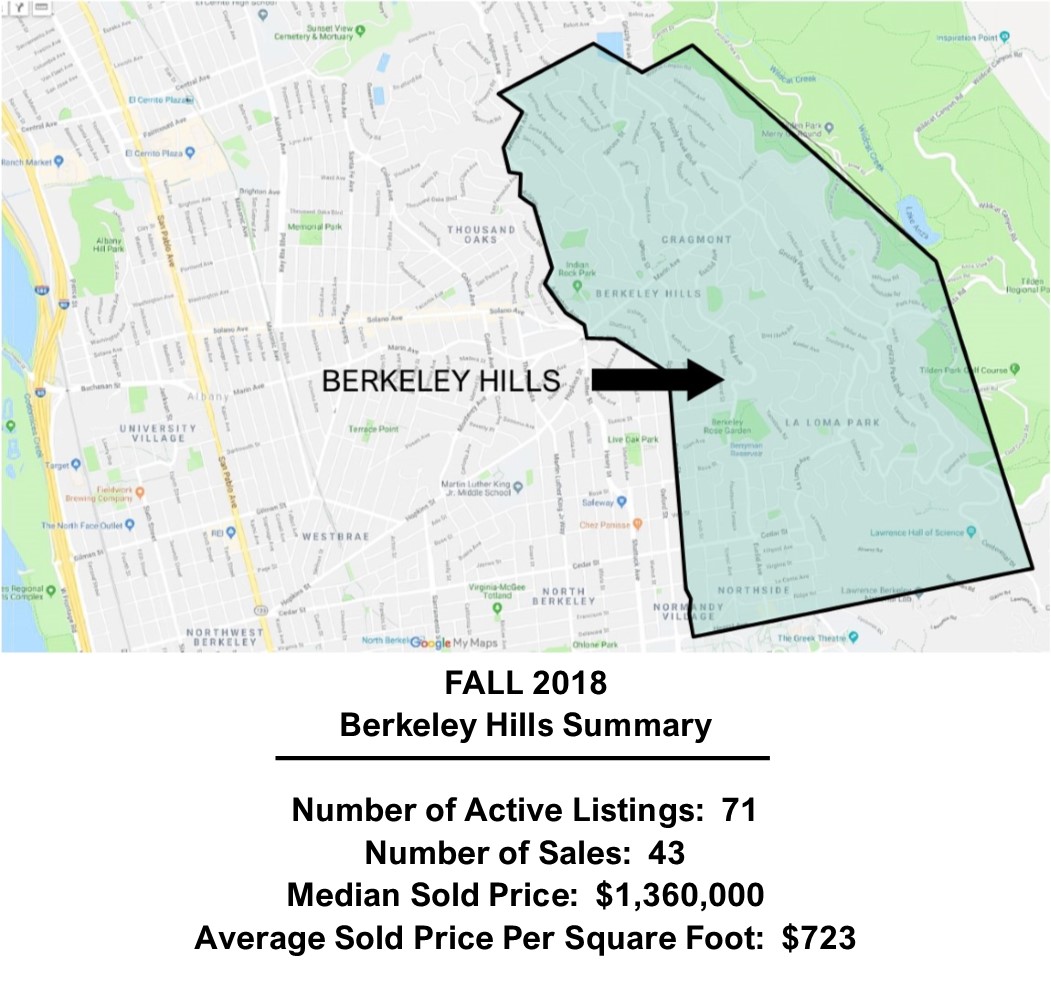

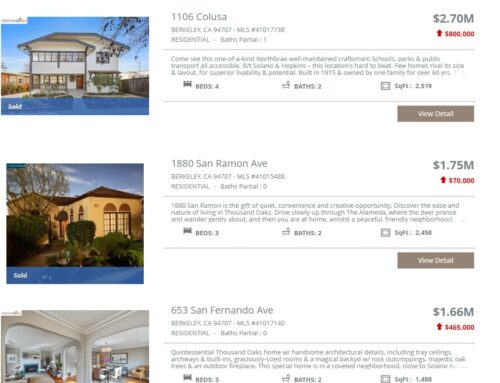

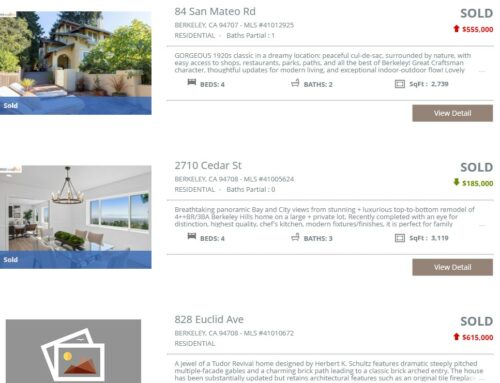

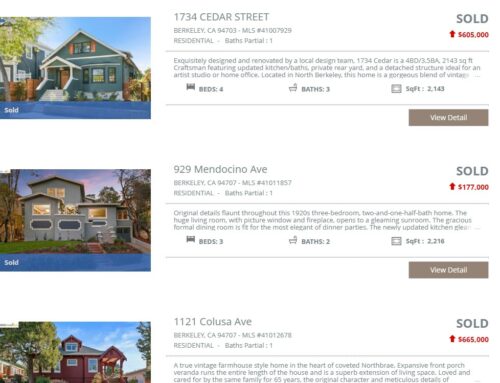

Let’s look at the numbers for fall 2018 to see how has the local market fared. In the Berkeley hills, there were 71 active listings (which is on the high side), and 43 properties that sold between September and the end of November.

Most properties sold quickly, in an average of 18 days on the market. There were 8 properties that took 30 days or more to sell.

84% of the sales over the fall quarter were at prices above list price, and 33 of the sales were for all cash. There were no short sales in the fall data, and no sales of bank-owned properties.

The results for prices were mixed. The median sold price for the fall was $1,360,000, which is down a bit both from this summer (down 1%), and from last fall (down 2%). On the positive side, sold price per square foot was $723, up 1% from this summer, and up 5% compared to last fall.

4 of the 43 properties that sold had price reductions before selling, but we also had one property with 23 offers. (The latter was a 5 bedroom, 3 bath mid-century home with Bay views that was listed low at less than $1 million, so it’s not surprising it got tons of interest!)

Clearly there are still buyers out there, although they are more cautious and price-sensitive. We never really know when the peak or trough of a market cycle has come until we look back in retrospect. I suspect though that we’re at or near (or even past) the turning point. If that’s true, hopefully the Berkeley market will be as resilient as ever.