LOW RATES & HIGHER CONFORMING LOAN LIMITS

LOW RATES AND HIGHER CONFORMING LOAN LIMITS Interest rates are low, low, low right now! As I write this, the 30-year fixed rate is lower than it’s been since Freddie Mac began tracking mortgage rates in 1971. While it’s not surprising that rates are low given the economic impacts of the pandemic, it is still an opportunity for both buyers getting new loans and homeowners who can refinance their existing loans. Fixed rate 30-year conforming loans (up to the loan limits discussed below) can in many cases be had for under 3%. Even larger-amount jumbo loans, which were challenging to [...]

LOW RATES & HIGHER CONFORMING LOAN LIMITS

LOW RATES AND HIGHER CONFORMING LOAN LIMITS

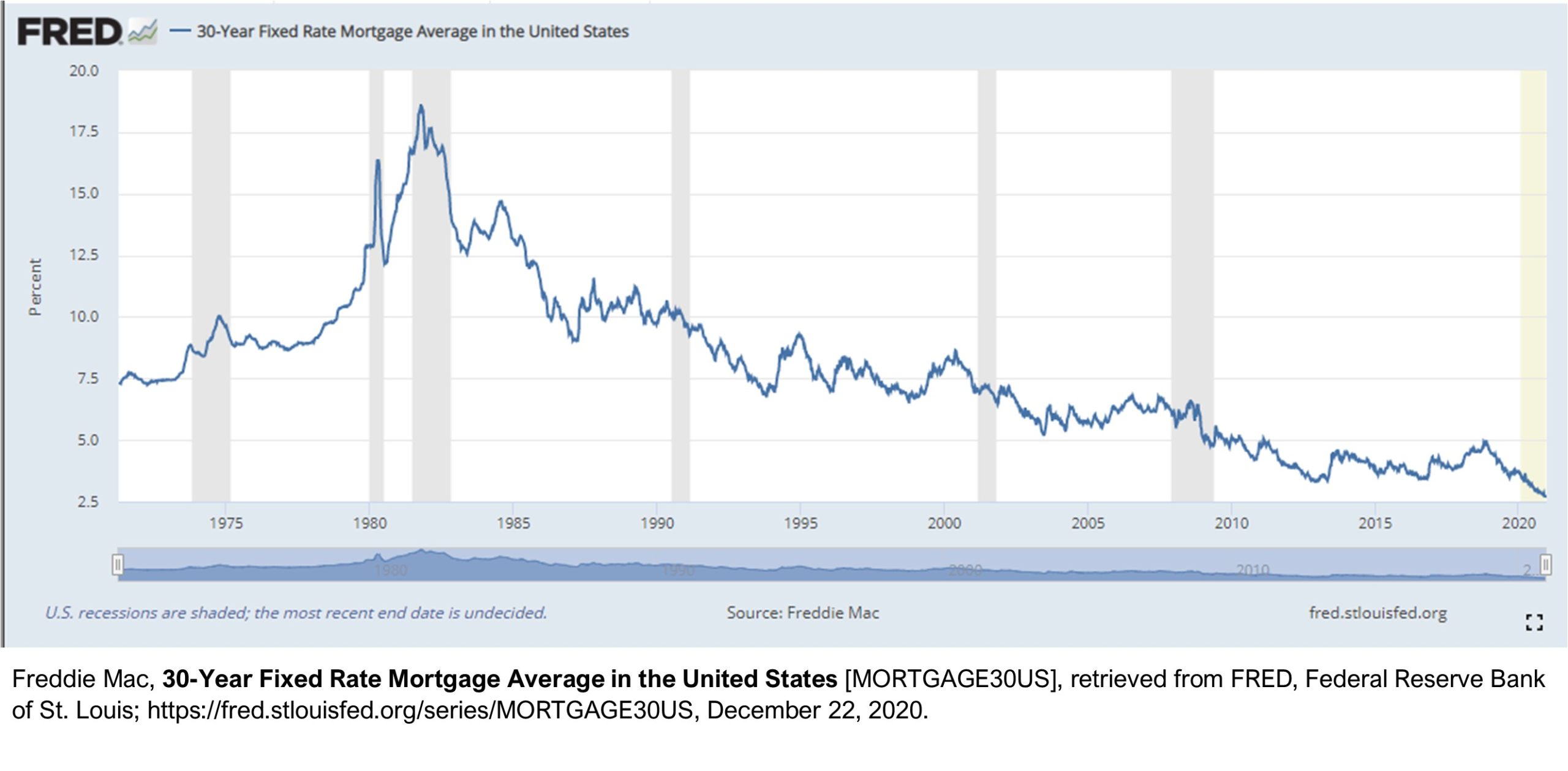

Interest rates are low, low, low right now! As I write this, the 30-year fixed rate is lower than it’s been since Freddie Mac began tracking mortgage rates in 1971.

While it’s not surprising that rates are low given the economic impacts of the pandemic, it is still an opportunity for both buyers getting new loans and homeowners who can refinance their existing loans. Fixed rate 30-year conforming loans (up to the loan limits discussed below) can in many cases be had for under 3%. Even larger-amount jumbo loans, which were challenging to get and much more expensive earlier in the year, are available around 3%.

The loan limits for conforming loans (those that meet the funding criteria of Freddie Mac & Fannie Mae) are set to go up again in 2021. The Federal Housing Finance Agency determined that home prices nationwide rose an average of 7.42% from the third quarter of 2019 to the third quarter of 2020, so loan limits will be increased that same amount (7.42%) for the coming year. In high-cost areas like ours, that means the limit for single-family homes will increase from the current $765,600 to $822,375 in 2021.