I was excited to crunch the numbers for this spring season, with two questions in mind.

First, there has been a lot of talk lately about the relatively high level of inventory on the market, so I wanted to see how the number of active listings compared to past springs. It turns out that there were in fact more active listings this spring (47) than in the past several years (36 in spring 2017, 35 in 2016, and 33 in 2015). This pattern — more homes for sale as the market has been rising — is not surprising, as more sellers are inspired to take advantage of higher prices. A lot of the spring listings came on the market in May, so many will close escrow in June, and the outcome for those will be in the summer statistics.

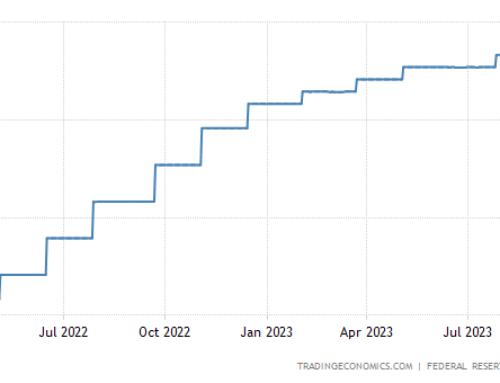

The other thing I wondered about was how much the increase in interest rates has affected prices so far. Interest rates on home loans now are about a full percentage point higher than they were last year. We’re looking at rates in the high 4% range (4.75%+) now for a typical home loan, compared to the high 3% range last year. A buyer who last year was approved for a maximum purchase of $1.3M (the current median price) at a 3.75% interest rate with a 20% down payment is now not going to be able to borrow as much (if everything else is the same). At an interest rate of 4.75%, the maximum loan amount that corresponds to the monthly payment that same buyer qualified for is now $117,000 less. On the positive side, jumbo loans (above $679,650) have come down in cost relative to conventional loans, and in some cases, actually have lower interest rates than smaller loans.

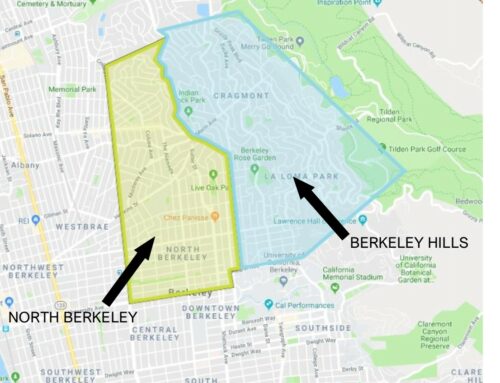

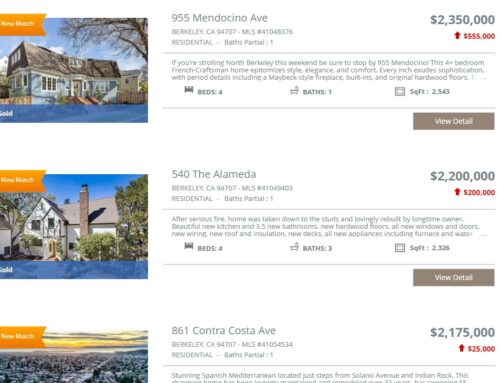

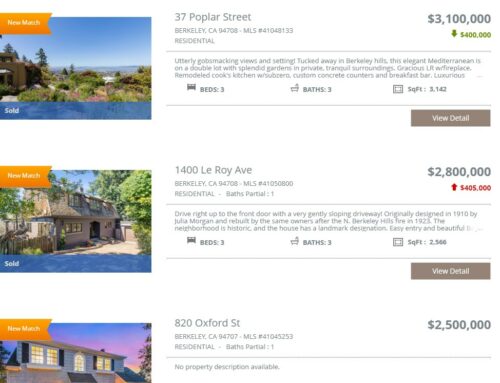

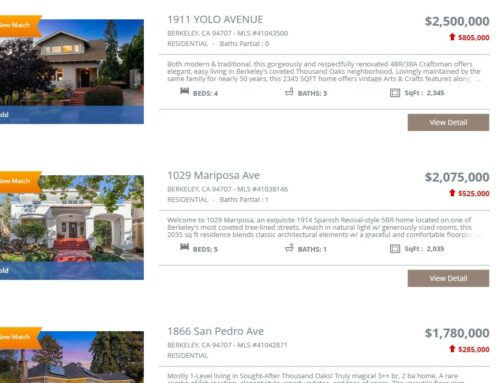

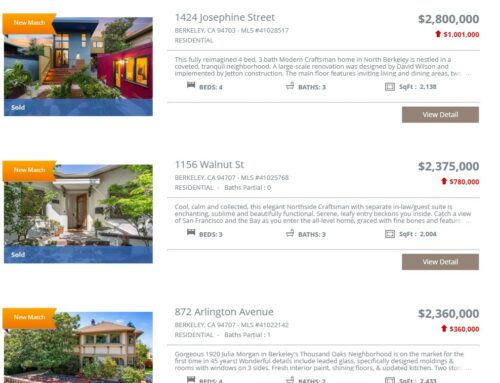

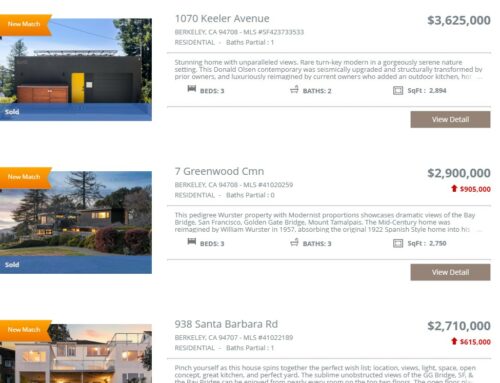

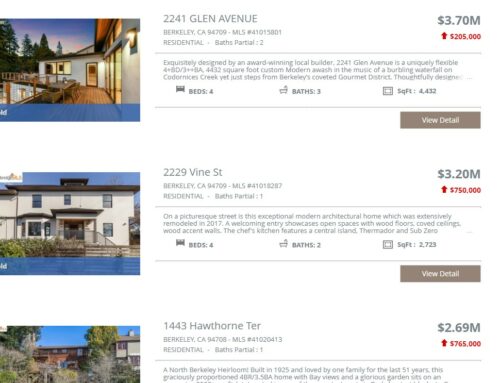

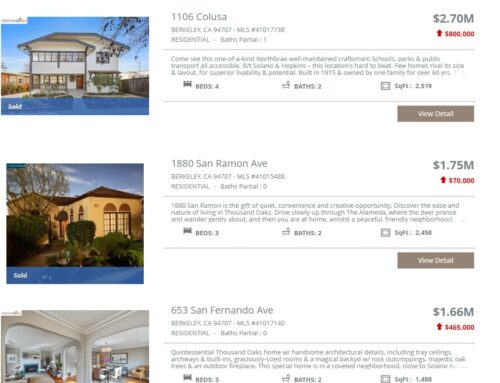

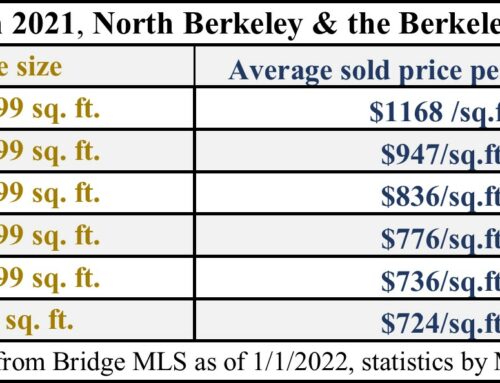

The increase in interest rates hasn’t had a negative effect on prices, which have been steady. During Spring 2018, 24 properties sold, in an average of only 16 days on the market. The median sold price in North Berkeley was $1,300,000, which is up 1% from last spring, and the average sold price per square foot was $849, about the same as a year ago.

88% of the North Berkeley sales this spring went over list price, and on average, those that went over sold for 22% above list price.

We’re starting the summer with more inventory and higher interest rates, so I’m expecting the market to be more balanced between buyers and sellers. This is good news for buyers, and not bad for sellers either, as it will help keep buyers in the market over time.