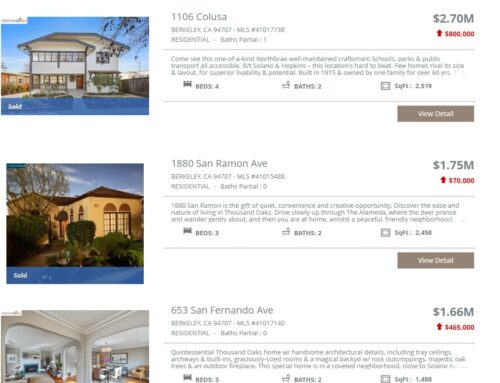

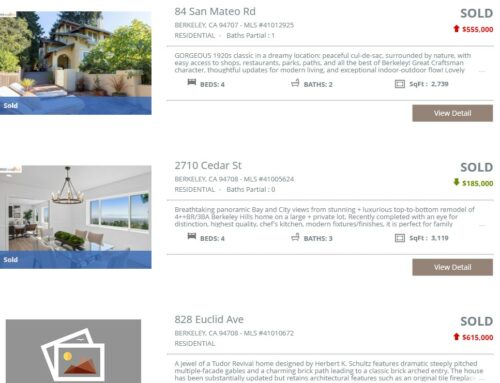

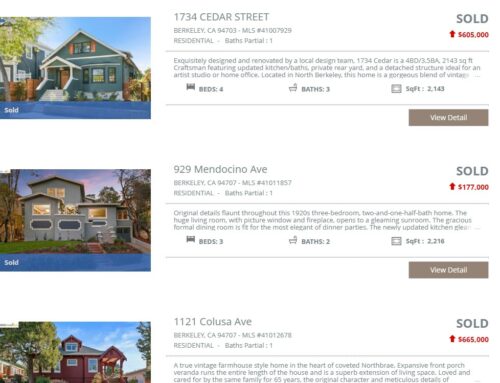

In Berkeley hills, there were 195 active listings over the course of 2019, and 161 properties sold. 81% of the sales were for more than list price, with multiple buyers interested in most properties, and sale price averaged 20% above list price for those properties that went over.

The median sale price for 2019 was $1,425,000, which is up 3% from the previous year. The average sold price per square foot was also up, by 3% from the previous year at $747.

Most properties sold quickly, in an average of 20 days on the market. Fourteen properties (8% of the total) did need to adjust their prices before selling—9 properties had price reductions, and 5 properties had price increases. (Remember that in our market, a price change in either direction is generally a signal that a property did not get the initial interest that was expected.)

All of these numbers feel very consistent with where we seem to be in the real estate market cycle. I think we’re right around the peak, so we’re seeing relatively modest price increases and a few properties not doing as well as expected.

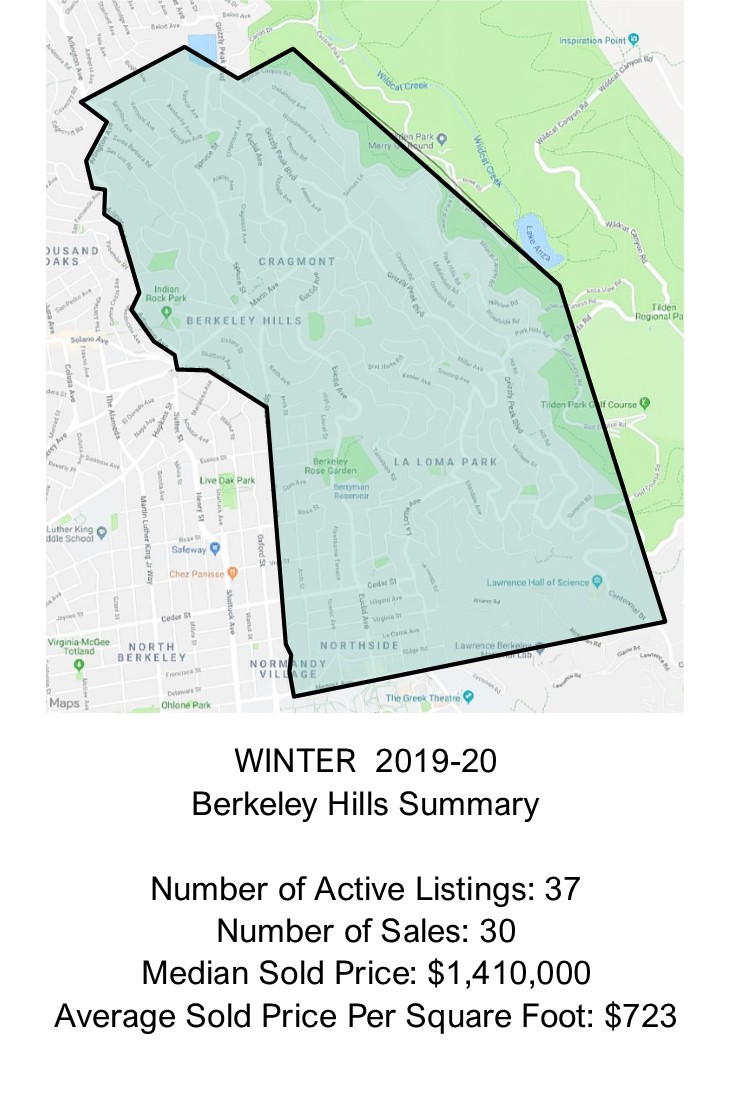

For the winter quarter just past (December through February), there were 37 active listings, and 30 sales. 5 properties had price changes, and the median sold price was $1,410,000, which is about the same as in the fall, but 10% higher than the previous winter. The average sold price per square foot was $723 over the winter, down 1% from the fall, and also down 8% from winter 2018.

So far in 2020, the dry sunny weather has the buyers out in droves, looking at the very few houses on the market. Will the coronavirus slow things down going forward? Low interest rates will help, but uncertainty about the economy, and a focus on staying home rather than going to public gatherings (like open houses) could affect buyers’ plans. We’ll have to wait and see how it all develops.

UPDATE, March 20, 2020

Since I wrote the post above, things have definitely changed. We now have a statewide Shelter-In-Place order, which has slowed (but surprisingly, not stopped) activity in the real estate market. Open houses are canceled, but there are still properties on the market, being shown, and sold, with photos and virtual tours. I’ve been surprised at how many offers properties have been getting under these extraordinary and difficult circumstances.

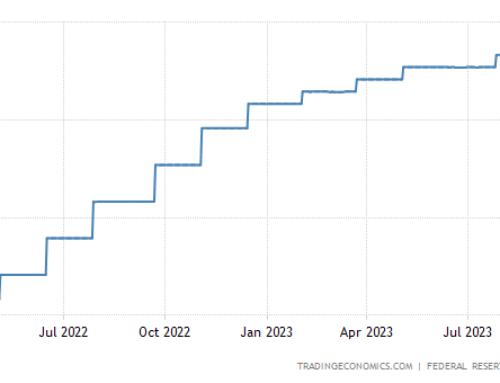

Also of note: while the Fed has cut interest rates multiple times, and the interest rate on 10-year Treasury notes (which is typically the rate most tied to rates on home loans) has fallen substantially since the beginning of the year, home loan rates have actually risen. Lenders reportedly were already struggling to keep up with refinance requests, and these difficulties cannot have been helped by the Shelter-in-Place.