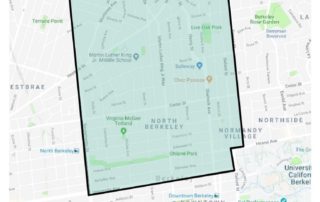

THE OUTLOOK: North Berkeley & Berkeley Hills, Winter 2020-21 wrap-up

As always in the March/April newsletter, I’m going to review both the data for the past year, and also look at the winter quarter results (for December through February). *** 2020 Results: 2020 was a surprisingly solid year in local real estate, despite a big lull in activity with the first shelter-in-place. After just a few weeks, though, real estate was deemed an essential service, and activity gradually picked back up. Berkeley Hills 150 properties sold in the Berkeley hills in 2020, which is a bit fewer than in 2019, but there were also fewer homes on the market. Properties [...]

THE OUTLOOK: North Berkeley & Berkeley Hills, Fall 2020 wrap-up

I find this sort of amazing given what’s been going on in the world this year, but our real estate market has continued to do remarkably well through the fall season. The combination of super low interest rates and the desire to have a better space to shelter in has kept demand from buyers strong. At the same time, fewer property owners have put their homes on the market — for Berkeley as whole, the number of homes for sale from January through November this year was down 14% compared to the same period last year. With low supply and [...]

THE OUTLOOK: Berkeley (North & Hills), Summer 2020 wrap-up

Between the pandemic, the wildfires, and the blanket of smoke we’ve had to live with lately, one would think that the local real estate market would have gone into hibernation, but this has not been the case. The pandemic has caused many people to re-evaluate where they want to live. We’ve been spending much more time in our homes— for work, for school, for meals, for entertainment, for exercise, for leisure— so having the right indoor and outdoor spaces for those activities is more important than ever. Many people working from home are moving to take advantage of lower real [...]

THE OUTLOOK: Berkeley (North & Hills), Spring 2020 wrap-up

I’m going to shift focus somewhat for this issue of The Outlook. We’re living in a time right now when many of our usual concerns seem trivial. Compared to the importance of the growing calls for an end to systematic racism and violence against black people and reforms in the way we police our communities, and compared to coping with a global pandemic and its effect on our lives and livelihoods, real estate market statistics seem like a side note. However, there are a variety of reasons why people still want to know what’s happening in the local real estate [...]

THE OUTLOOK: North Berkeley, Winter 2019-2020 wrap-up

Let’s start with a look back over the previous year in North Berkeley real estate, and then take a quick look forward. Over the course of 2019, there were 89 active listings in North Berkeley, and 81 properties sold. Both of these numbers are down from the previous year, when we had 101 active listings, and 92 sales. Low inventory meant that there were multiple buyers interested in most properties, and 81% of the sales were for more than list price. Sale price averaged 26% above list price for those properties that went over. The median sale price for 2019 [...]

THE OUTLOOK: Berkeley Hills, Winter 2019-20 wrap-up

In Berkeley hills, there were 195 active listings over the course of 2019, and 161 properties sold. 81% of the sales were for more than list price, with multiple buyers interested in most properties, and sale price averaged 20% above list price for those properties that went over. The median sale price for 2019 was $1,425,000, which is up 3% from the previous year. The average sold price per square foot was also up, by 3% from the previous year at $747. Most properties sold quickly, in an average of 20 days on the market. Fourteen properties (8% of the [...]

THE OUTLOOK: North Berkeley & Berkeley Hills, Winter 2020-21 wrap-up

As always in the March/April newsletter, I’m going to review both the data for the past year, and also look at the winter quarter results (for December through February).

***

2020 Results:

2020 was a surprisingly solid year in local real estate, despite a big lull in activity with the first shelter-in-place. After just a few weeks, though, real estate was deemed an essential service, and activity gradually picked back up.

Berkeley Hills

150 properties sold in the Berkeley hills in 2020, which is a bit fewer than in 2019, but there were also fewer homes on the market. Properties sold in an average of 22 days (excluding the Spring Mansion at 1960 San Antonio, which was on the market for 1340 days). The median sold price in the hills was $1,500,000 for 2020, which is up 5.3% from the previous year. 70% of the sales were for more than list price, and those averaged 14% over list. The average sold price per square foot was $770, which is up 3% from 2019.

North Berkeley

A total of 88 properties sold in North Berkeley in 2020, in an average of 18 days on the market. This is more sales, with less time on the market, compared to the previous year. The median sold price in North Berkeley was $1,350,000, which is unchanged from 2019. More than 3/4 of the sales in 2020 were for more than list price, and those averaged 22% over list. The average sold price per square foot was $890, which is up 1.8% from 2019.

***

Winter Results (December 1, 2020 – February 28, 2021):

Berkeley Hills

The median sold price in the hills over the winter quarter was $1,547,500, which is up slightly (0.8%) from the fall and more significantly (by 9.8%) from last winter.

North Berkeley

There were very few sales in North Berkeley over the winter (only 8), so the data is heavily influenced by the characteristics of the properties that sold. 3 of the 8 sales over the winter were small (relatively inexpensive) condos. One of those condos was also a below-market-rate unit (BMR), which means that it must be sold for a restricted, pre-set price ($201,815 in this case). Because these small properties made up a big proportion of the sales, the median sold price over the winter was lower, at $1,195,000, which is lower than in either the fall of 2020, or the previous winter. Despite this data point, single family homes have been selling incredibly well so far in 2021, with loads of offers (we got 26 offers on my listing at 1726 Grant) at very high prices.

***

Interest rates have started creeping up a bit recently (to a little over 3% in many cases), but buyer interest remains intense right now, and the results for the spring season should reflect that!

THE OUTLOOK: North Berkeley & Berkeley Hills, Fall 2020 wrap-up

I find this sort of amazing given what’s been going on in the world this year, but our real estate market has continued to do remarkably well through the fall season. The combination of super low interest rates and the desire to have a better space to shelter in has kept demand from buyers strong. At the same time, fewer property owners have put their homes on the market — for Berkeley as whole, the number of homes for sale from January through November this year was down 14% compared to the same period last year.

With low supply and high demand, it’s not surprising that we’re seeing high prices and a strong seller’s market. Note, though, that condos (where you may share outdoor spaces or an elevator with other people) and multi-unit properties (which are challenging in this environment where tenants may not be able to pay rent) are not faring as well.

***

Berkeley Hills, Fall results:

There were 81 active listings in the hills from September through the end of November, which is actually on the high side of normal despite the year-to-date figures for Berkeley as a whole. 53 properties sold, in an average of 40 days on the market. 40 days on the market is a long time for our area, but looking at the data, the reason is quite clear. 1960 San Antonio (commonly referred to as “The Spring Mansion”) sold this fall after literally years on the market. The fact that that property finally sold says something about the strength of the market, but it’s also an extremely unusual property (if you’re not familiar with it, it’s a 12,000 square foot historic fixer), so its time on the market is an outlier. Leaving that data point out, the average days on the market was only 15. Three quarters of the fall sales were for more than list price, and those that went over averaged 14% over list. 5 of the 53 properties that sold had price changes (4 reductions and 1 increase) before finding a buyer.

The median sold price in the hills was $1,535,000, which is up 6.6% from the summer, and up 8.6% from Fall 2019. The average sold price per square foot was also higher at $786, up 1.1% from the summer, and 7.8% higher than last fall.

***

North Berkeley, Fall results:

There were 40 active listings in North Berkeley from September through the end of November, which, like in the hills, is slightly on the high side of normal (making up a bit for earlier in the year). 32 properties sold, in an average of 18 days on the market. 81 percent of the fall sales were for more than list price, and those that went over averaged 24% over list. 2 of the 32 sold properties had price reductions before finding a buyer.

There were 3 condos in the sales this fall, and these three all sold quickly and above list price. There are others, though, that have been sitting on the market well beyond the typical two weeks.

The median sold price in North Berkeley over the fall was $1,388,750, which is up 5.2% from the summer, and up 3.8% from Fall 2019. The average sold price per square foot was also higher at $920, up 3.6% from the summer, and 9.2% higher than last fall.

***

Usually, the market slows down substantially in December and January, but that doesn’t seem to be the case so far this winter. With fewer people traveling, we’re not seeing the usual dip in activity, and winter seems to be shaping up to be another very strong quarter.

Sending you all my best wishes for the holiday season and the new year — stay safe, stay healthy, stay sane, and here’s hoping we’re all able to get back to the people, places and activities we love in 2021!

THE OUTLOOK: Berkeley (North & Hills), Summer 2020 wrap-up

Between the pandemic, the wildfires, and the blanket of smoke we’ve had to live with lately, one would think that the local real estate market would have gone into hibernation, but this has not been the case. The pandemic has caused many people to re-evaluate where they want to live. We’ve been spending much more time in our homes— for work, for school, for meals, for entertainment, for exercise, for leisure— so having the right indoor and outdoor spaces for those activities is more important than ever.

Many people working from home are moving to take advantage of lower real estate prices and bigger yards in more remote locations. While that has meant that some people have left Berkeley for more rural spots, we’ve also seen more people than ever leaving San Francisco for Berkeley. Overall, there have been more than enough new Berkeley buyers in the market to balance flows out of our area, and we’re still seeing quick sales, solid prices, and multiple offers on many properties.

***

Berkeley Hills, Summer results:

There were 61 active listings in the hills this summer, which is actually on the high side, but this is because some of what would have been spring sellers delayed coming on the market. There were 101 active listings in the hills for spring and summer together, compared to 115 listings for spring and summer of 2019. This summer, 29 properties sold, in an average of 25 days on the market. Two-thirds of those sales were for more than list price, and those averaged 8% over list.

The median sold price in the hills was $1,440,000, which is down from both this spring (by 4%) and last summer (by 8.2%). However, sold price per square foot was $778, which is 6.8% higher than the spring, and 1.1% higher than for summer 2019. When these two measures (median price and price per square foot) move in opposite directions, it means that the mix of properties sold was different between the time periods (in this case, there were more small homes in the data this summer).

***

North Berkeley, Summer results:

In North Berkeley, there were 36 active listings over the summer, which is high for this area (last summer there were only 23 active listings), but again, this is because some homes that would have been listed during the spring didn’t actually come on the market until the summer. There were 30 properties that sold over the summer in North Berkeley, in an average of 19 days on the market. Four out of five of those sales (80%) were for more than list price, and those averaged 18% over list.

The median sold price for the summer was $1,320,000, which is down 1.3% from the spring, but up 2.3% from last summer. Sold price per square foot averaged $888, which is down from both the spring (by 2.8%) and from last summer (by 5.1%). There were 6 properties that sold for more than $1000 per square foot, and 4 that sold for less than $700 per square foot. The lowest was $512 per square foot for a tenant-occupied fixer on Marin.

***

Because of the pandemic, we’re seeing less demand for condominiums and tenant-occupied properties right now, but in both North Berkeley and in the hills, values for other types of properties are stable, or even up very slightly from last year. Interest rates continue to be historically low, which should keep the market strong through the end of 2020.

THE OUTLOOK: Berkeley (North & Hills), Spring 2020 wrap-up

I’m going to shift focus somewhat for this issue of The Outlook. We’re living in a time right now when many of our usual concerns seem trivial. Compared to the importance of the growing calls for an end to systematic racism and violence against black people and reforms in the way we police our communities, and compared to coping with a global pandemic and its effect on our lives and livelihoods, real estate market statistics seem like a side note.

However, there are a variety of reasons why people still want to know what’s happening in the local real estate market. Some people need to make a move, and others, given all the economic uncertainty we’re living with today, would like to know the status of what may be their biggest investment. For those people, and for anyone who might be curious, I’m going to give a rundown on how the market is doing in these uncertain times.

I will get into the actual data for both North Berkeley and the Berkeley Hills shortly, but overall, the market is doing surprisingly well, with a lot of adjustments for current circumstances. Some buyers have dropped out of the market, but there are also fewer listings, so these things have balanced each other out and we haven’t seen significant changes in values. We always have a good number of buyers from San Francisco, and this is even more true now. With so many people working and spending more time at home, the desire for more space and a private yard is greater than ever.

Safety and Marketing in the time of COVID-19

The real estate community as a whole has been very focused on keeping everyone safe. The biggest change in how we do business is that there are, of course, no gatherings: no in-person open houses, no in-person brokers tours, no in-person office meetings. Our office meetings and brokers tours are now online Zoom meetings, which allow agents to network and share information while everyone stays safely at home. Listing agents are making more information available online, so that buyers can evaluate properties and decide what they’re seriously interested in without leaving home. There are far fewer people walking through homes that are for sale, which I think is a good thing from a public health perspective. From a marketing perspective, this has not hurt the process, because it’s the people who are not actually thinking of buying a property who are not seeing it in person.

Serious buyers can and are still touring homes, but there are specific protocols that are followed for everyone’s safety. All showings are by pre-arranged appointment with an agent, so that only one party is at the property at a time. Only two people from the same household can visit a property at one time, and all visitors sign a disclosure about safety, risk, and protocols up front. Masks are worn, 6-foot distancing is maintained, everyone uses hand sanitizer, and properties are cleaned before and after showings.

Spring market data, North Berkeley

During the spring season (March through the end of May), there were 30 active listings in North Berkeley, and 20 closed sales. Both of these numbers are lower than the previous spring, when there were 36 active listings and 25 sales, but not by as much as one might think given the circumstances. On average, properties sold in only 10 days on the MLS.

The median sale price in North Berkeley for the spring was $1,337,500, which is down 3.6% from Spring 2019. However, the average sold price per square foot was up 10% from last spring, at $914 per square foot. One property had a price reduction before it sold, one property increased its price, and 3 out of 4 properties sold above list price. For the properties that sold above list price, the average was 25% over asking.

Spring market data, the Berkeley Hills

For Spring 2020, there were 40 active listings in the Berkeley hills, and 28 closed sales. These numbers are significantly lower than usual; a year ago in the spring there were 73 active listings and 46 sales. Properties in the hills sold on average in 21 days on the MLS.

The median sale price in the hills for the spring was up 3.6% from Spring 2019 at$1,500,000. The average sold price per square foot was $729, which is up slightly (1%) from the winter season, but down 5.6% from last spring. Five of the sold properties had price reductions, but 7 out of 10 properties sold above list price. For the properties that sold above list price, the average was 13% over asking.

The summer season looks like it could be more active than usual in both the hills and in North Berkeley. Market activity usually slows a bit over the summer, as many buyers are out of town traveling, and for that reason, not as many listings come on the market. This year, however, people are not doing much traveling, so the buyers are around, and there are a good number of sellers who delayed coming on the market in the spring.

Fair housing

I want to end by acknowledging the continuing demonstrations against violence and bias against blacks in policing, and more broadly against systematic bias and racism in general. The housing industry has a horrible history of systematic racism. I would like to think that it has been vastly better since the implementation of fair housing legislation, in California with the 1959 Fair Housing and Employment Act and the 1963 Rumford Fair Housing Act (thank you, William Bryon Rumford, whose statue sits on the median of Sacramento Street at Ashby), and nationally with the Fair Housing Act of 1968. In the realm of California home sales (which is the part of the housing market I see directly), I think the fair housing laws have been pretty effective, both because of ongoing training throughout the real estate community, and because of ongoing vigilance and enforcement. There is however still work to be done, and the legacy of past discrimination lives on in many ways, including in the wealth gap between black and white Americans. [See for example https://www.epi.org/blog/housing-discrimination-underpins-the-staggering-wealth-gap-between-blacks-and-whites/ .] I hope that, in time, we can look back at the current protests and see that they led to not only widespread and honest self-examination, but also lasting and meaningful change at a societal level.

THE OUTLOOK: North Berkeley, Winter 2019-2020 wrap-up

Let’s start with a look back over the previous year in North Berkeley real estate, and then take a quick look forward.

Over the course of 2019, there were 89 active listings in North Berkeley, and 81 properties sold. Both of these numbers are down from the previous year, when we had 101 active listings, and 92 sales. Low inventory meant that there were multiple buyers interested in most properties, and 81% of the sales were for more than list price. Sale price averaged 26% above list price for those properties that went over.

The median sale price for 2019 was $1,350,000 in North Berkeley, which is up 2% from the previous year. The average sold price per square foot was up 4% from the previous year at $874.

Most properties sold quickly, in an average of 21 days on the market. Twelve properties (15% of the total) did need to adjust their prices before selling—8 properties had price reductions, and 4 properties had price increases. Remember that in our market, a price change in either direction is generally a signal that a property did not get the initial interest that was expected. In 2018, 9 properties had price changes, or 10% of the total sales.

All of these numbers feel consistent with where we seem to be in the real estate market cycle. I think we’re right around the peak, so we’re seeing relatively modest price increases and a few more properties not doing as well as expected.

For the winter quarter just past (December through February), there were only 15 active listings, and 10 sales. 2 properties had price changes, and the median sold price was $1,387,500, up 4% from the fall quarter. The average sold price per square foot was $830 for the winter, which is down 2% from the fall, but up 5% from the previous winter.

So far in 2020, the buyers have been out in droves, looking at the very few houses on the market. Will the coronavirus slow things down going forward? Low interest rates will help, but uncertainty about the economy, and a focus on staying home rather than going to public gatherings (like open houses) could affect buyers’ plans. We’ll have to wait and see how it all develops.

UPDATE, March 20, 2020

Well, since I wrote the post above, things have definitely changed. We now have a statewide Shelter-In-Place order, which has slowed (but surprisingly, not stopped) activity in the real estate market. Open houses are canceled, but there are still properties on the market, being shown, and sold, with photos and virtual tours. I’ve been surprised at how many offers properties have been getting under these extraordinary and difficult circumstances.

Also of note: while the Fed has cut interest rates multiple times, and the interest rate on 10-year Treasury notes (which is typically the rate most tied to rates on home loans) has fallen substantially since the beginning of the year, home loan rates have actually risen. Lenders reportedly were already struggling to keep up with refinance requests, and these difficulties cannot have been helped by the Shelter-in-Place.

THE OUTLOOK: Berkeley Hills, Winter 2019-20 wrap-up

In Berkeley hills, there were 195 active listings over the course of 2019, and 161 properties sold. 81% of the sales were for more than list price, with multiple buyers interested in most properties, and sale price averaged 20% above list price for those properties that went over.

The median sale price for 2019 was $1,425,000, which is up 3% from the previous year. The average sold price per square foot was also up, by 3% from the previous year at $747.

Most properties sold quickly, in an average of 20 days on the market. Fourteen properties (8% of the total) did need to adjust their prices before selling—9 properties had price reductions, and 5 properties had price increases. (Remember that in our market, a price change in either direction is generally a signal that a property did not get the initial interest that was expected.)

All of these numbers feel very consistent with where we seem to be in the real estate market cycle. I think we’re right around the peak, so we’re seeing relatively modest price increases and a few properties not doing as well as expected.

For the winter quarter just past (December through February), there were 37 active listings, and 30 sales. 5 properties had price changes, and the median sold price was $1,410,000, which is about the same as in the fall, but 10% higher than the previous winter. The average sold price per square foot was $723 over the winter, down 1% from the fall, and also down 8% from winter 2018.

So far in 2020, the dry sunny weather has the buyers out in droves, looking at the very few houses on the market. Will the coronavirus slow things down going forward? Low interest rates will help, but uncertainty about the economy, and a focus on staying home rather than going to public gatherings (like open houses) could affect buyers’ plans. We’ll have to wait and see how it all develops.

UPDATE, March 20, 2020

Since I wrote the post above, things have definitely changed. We now have a statewide Shelter-In-Place order, which has slowed (but surprisingly, not stopped) activity in the real estate market. Open houses are canceled, but there are still properties on the market, being shown, and sold, with photos and virtual tours. I’ve been surprised at how many offers properties have been getting under these extraordinary and difficult circumstances.

Also of note: while the Fed has cut interest rates multiple times, and the interest rate on 10-year Treasury notes (which is typically the rate most tied to rates on home loans) has fallen substantially since the beginning of the year, home loan rates have actually risen. Lenders reportedly were already struggling to keep up with refinance requests, and these difficulties cannot have been helped by the Shelter-in-Place.