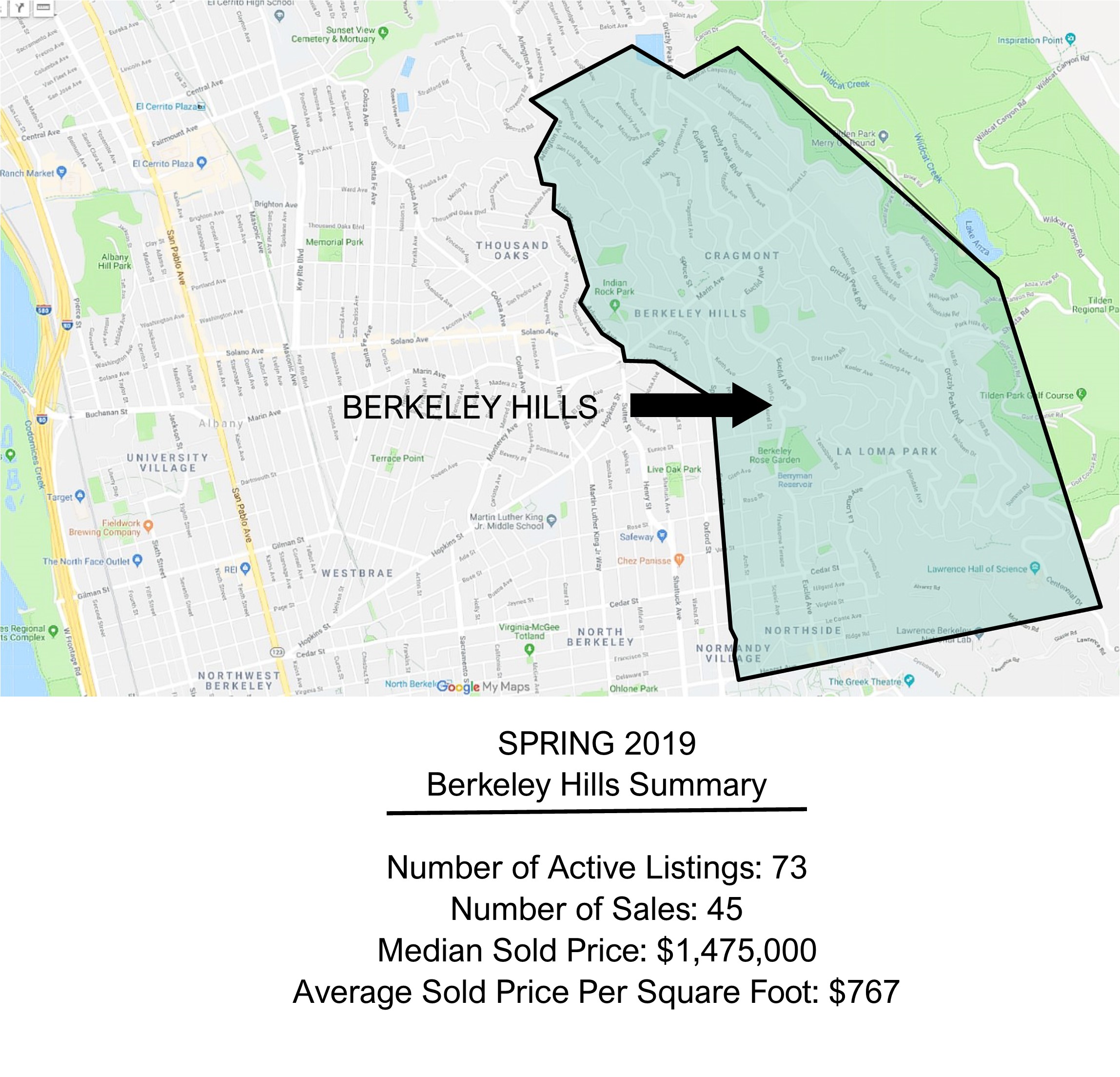

In the Berkeley hills this past quarter, there were 73 active listings, which is pretty typical for the spring season. Between March and the end of May, 45 properties sold, on average after 18 days on the market. The median sale price was $1,475,000, which is up 15% from the slow winter season, but down 3% from last spring.

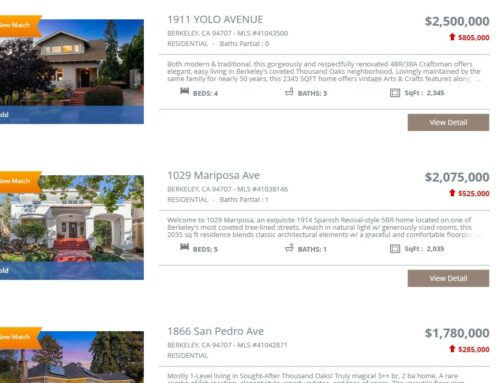

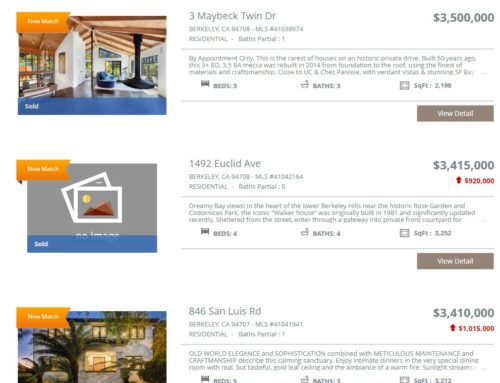

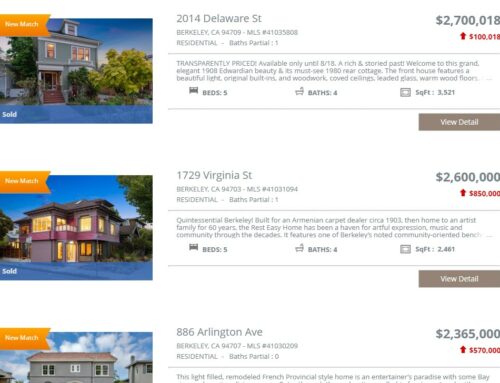

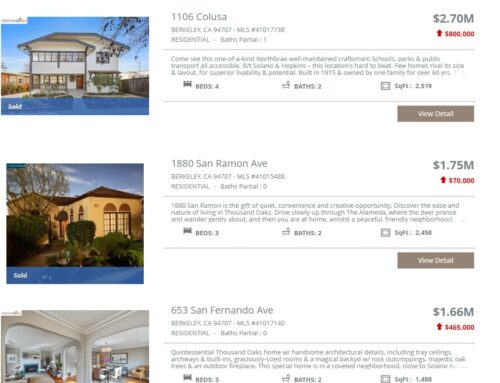

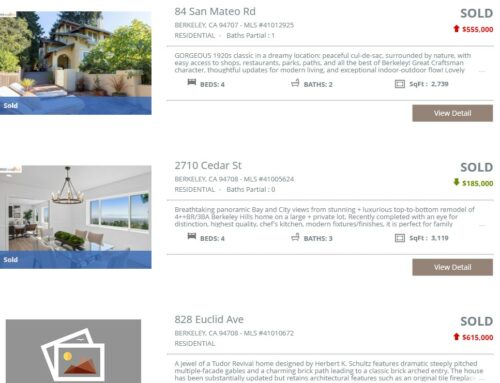

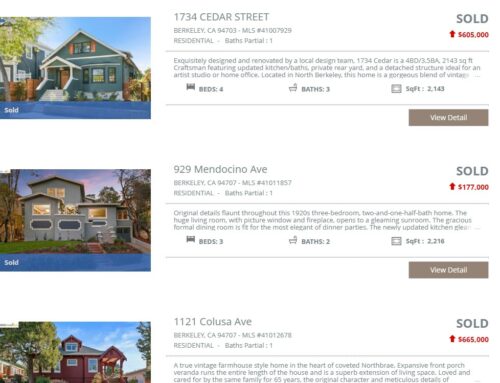

Only one of the sold properties had a price reduction, and 84% of the sales were for more than list price. Among the properties that went over, the sold price was on average 25% above list price.

Where reported in the MLS, the average number of offers was 5. One property, a fixer on Poppy Lane, got 18 offers, but this property was on the market for some time. It was first listed in November, and it fell out of contract twice before it finally sold in March.

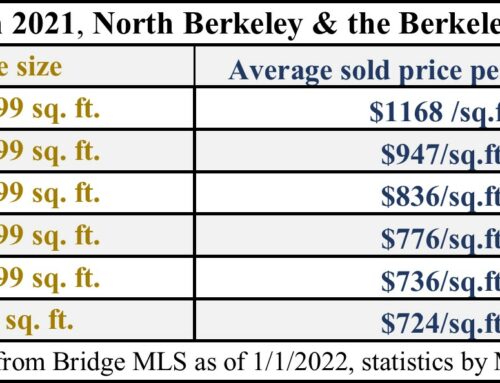

The average sold price per square foot in the spring was $767, which is down 2% from the winter, but up 6% from last spring. There was a big range in outcomes for price per square foot though. Of the 45 sold properties, 5 sold for less than $600 per square foot. These were fixers and larger homes. At the other end of the range, 6 properties sold for more than $1000 per square foot. These were all smaller homes, which is the usual pattern (smaller homes typically sell for more per square foot). The other 34 sold properties were scattered pretty evenly throughout the range in between.

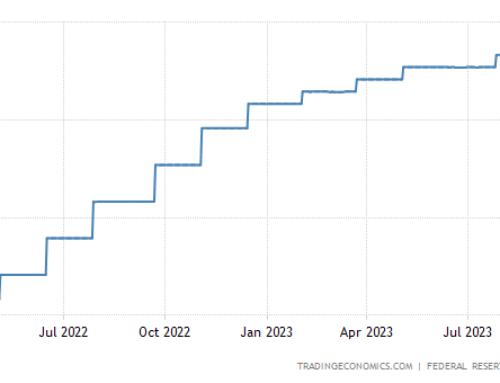

Overall, even though there continue to be signs that the real estate market is slowing elsewhere, but so far locally, we’re still doing well. The local market looked like it was slowing towards the end of last year, but was not the case this spring. The common perception that big IPOs were going to create wealth and boost our real estate market seems to have had some effect. The other significant factor has been interest rates. Rates on home loans have lately been among the lowest we’ve seen since election time in 2016, after peaking at close to 5% in November of last year. Low rates give buyers more incentive to buy now, and more purchasing power. Likewise, if you are currently a homeowner, and you’ve been thinking about refinancing your home loan, now could be a good time!