How have the massive fires in recent years affected homeowner’s insurance locally?

I spoke with Ruth Stroup with Farmers Insurance, who is always a great source of information about the insurance world, and asked her what changes she’s seen as a result of the tragic fires we’ve had in California over the last few years.

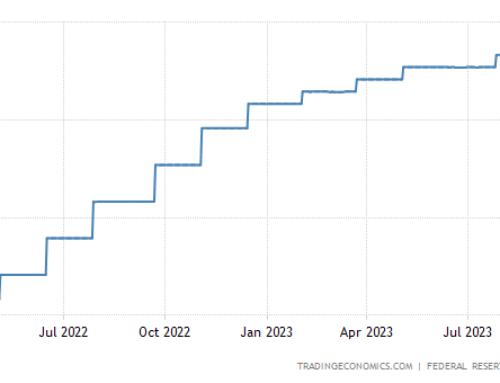

Ruth said that the huge claims in back-to-back years from the fires have affected insurance companies’ ability to get reinsurance. (Reinsurance pays a share of the claims in the case of massive losses like with the fires, and is a critical component of the insurance business.) As a result, many of the big-name insurance companies are not selling new policies in high-risk locations.

Insurers use a scoring system that evaluates how much risk of loss there is in a particular location. A property is given a risk score based on characteristics like accessibility (how easily fire-fighting equipment can get to a property—Ruth said this is the biggest factor), slope, and the amount of fuel nearby.

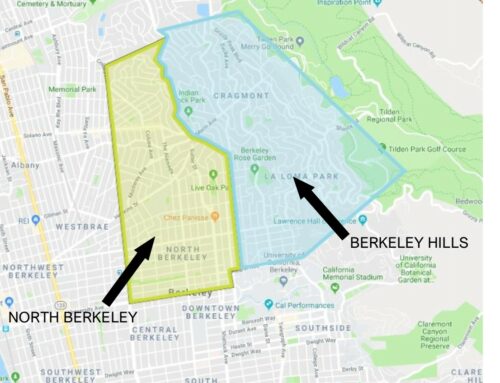

New insurance policies are available for properties with high risk scores, but one has to go to a specialty insurer, at a much higher cost. Ruth has not seen any issues of this type for properties in the Berkeley “flats,” where the lack of slope, easier road access and fewer areas of dense vegetation lead to more favorable risk scores. This can, though, be an issue right now for homes in the Berkeley hills. (If you live in the hills, this is probably not the time to shop for a new insurance carrier!).

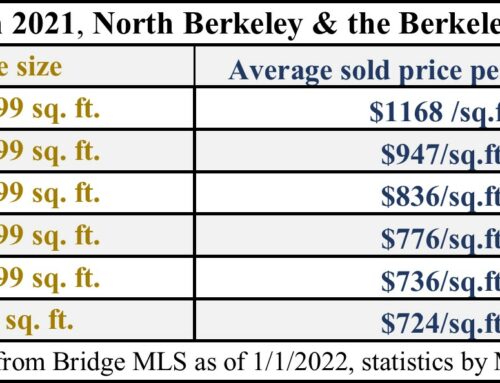

Ruth recommends that everyone periodically review their insurance policy, to make sure you have enough coverage. Building costs have increased substantially in recent years, so it’s important to make sure your replacement value reflects that. Ruth also suggests that everyone check the endorsements on their current insurance, to see if you have enough coverage for building code upgrades. She recommends getting building code upgrade coverage of at least 25%, due to newer ordinances that would require expensive improvements if you had to rebuild, such as interior sprinklers, greater seismic resistance and higher energy efficiency.

I live in the hills, so I asked Ruth how much it would cost to insure my house, if I were buying a new insurance policy today. My home’s risk score turned out to be on the low side for the hills (there are some wide and fairly straight roads between me and the nearest fire stations), but she still estimated that a new policy would cost me double what I am now paying. I think some of that additional cost is the current situation, and some is probably that I am underinsured in light of higher construction costs. Time to call my insurance agent!