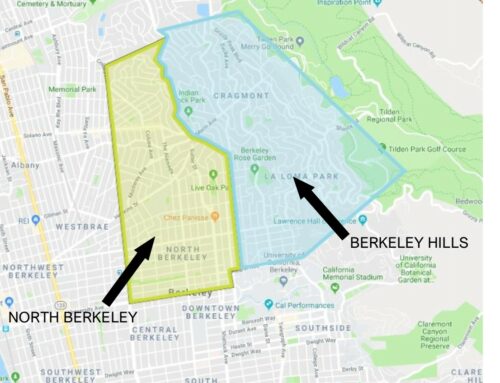

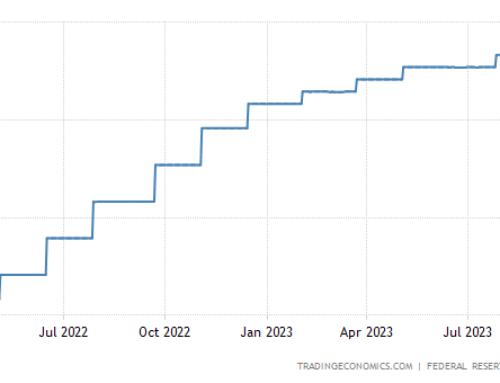

The real estate market is constantly in transition — seasonally, through market cycles, in response to changes in changes in employment and interest rates, and in response to changes in preferences. Over the last handful of years, the North Berkeley market has benefited a lot from increasing demand for properties near BART, shops and restaurants. The market as a whole was somewhat slower than expected in the fall, but overall 2018 was pretty good in North Berkeley real estate. Going into 2019, there is a lot of talk about big upcoming tech IPOs, and the influx of cash and purchasing power they could bring to the market. I have seen articles saying that the number of people who are likely to be affected by the IPOs is not large enough to have a big impact on the market. That might be true, but one of the biggest movers of the market is sentiment — if people think the IPOs will push up prices, buyers will offer more to compete, and it will end up increasing prices.

Looking back at the annual data for 2018 in North Berkeley, the median sold price was $1,327,500, which is up less than 1% from 2017. The average sold price per square foot was up a good bit more, by 9% from the previous year, at $840. There were a few more active listings: 101 in 2018, compared to 97 in 2017. The number of sales was almost identical, with 92 sales in 2018, compared to 91 in 2017. Properties spent less time on the market in 2018 — things sold in only 17 days on average. Overall, not bad.

The real question is, what’s going to happen this year, in 2019? Looking at winter quarter sales (December 2018 – February 2019) is not a perfect market indicator, because winter season is the slowest time of the year, but there is some information there.

Over the winter, the median sold price in North Berkeley was $1,115,000. This is a good bit lower than the median for 2018 as a whole, and it’s down by 18% from the previous winter. The average sold price per square foot ($789) was down 3% from the fall season (this is not unusual for the slow winter season), but (here’s the good news) is up 14% from the previous winter.

This winter we had more sales of smaller homes compared to last winter, and smaller homes tend to sell for lower prices, but for more per square foot. The average size of the sold properties this winter was only 1598 square feet, compared to 2174 last winter. This winter, 2/3 of the sales went over list price.

Overall, the winter results weren’t bad, and so far this spring, the local market is looking quite solid. We’ll have to wait to see how much of that IPO money ends up in Berkeley (and how much other buyers factor in that possibility) as the year progresses.