REAL ESTATE ANSWERS: What’s changing in the real estate world?

What’s changing in the real estate world? There was a big lawsuit filed in Missouri in 2019, that focused on the way buyers’ agents are paid. A settlement agreement was reached last month, and it has been all over the news recently. What’s it all about? Sellers have long negotiated a total commission with their agents, and that commission has been shared between the listing (seller’s) agent and the agent representing the buyer of the property. This is all spelled out clearly in the listing agreement we use in California – it has a field for the total commission to [...]

REAL ESTATE ANSWERS: What counts as a bedroom in real estate, and do more bedrooms add value?

What counts as a bedroom in real estate, and do more bedrooms add value? A bedroom in general is just a room where people sleep. For a room to count as a bedroom for real estate purposes, there are several requirements: (1) FLOOR SIZE. According to the standards used by appraisers, a habitable room must have a floor of at least 70 square feet in area and be at least 7 feet in any direction. So a 7’x10’ room is okay, but a 6’x12’ space, even though it’s 72 square feet, wouldn’t be counted as a room (or a bedroom) [...]

REAL ESTATE ANSWERS: How do actions by “the Fed” affect interest rates on home loans?

How do actions by “the Fed” affect interest rates on home loans? The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high [...]

REAL ESTATE ANSWERS: What’s going on in the home insurance market, and how does it affect current homeowners?

What’s going on in the home insurance market, and how does it affect current homeowners? In late May, State Farm, which is the largest issuer of homeowners’ policies in California, announced that it would not sell any new home insurance policies in California. In addition, Farmer's Insurance just announced that they will limit the number of new policies they sell here. Allstate also stopped issuing new policies in California last fall, so this is a significant trend. Why are these big insurers pulling away from California at this time? Major wildfires in recent years have resulted in surges in claims, [...]

REAL ESTATE ANSWERS: What is (or was!) the California “Dream For All” program?

What is (or was!) the California “Dream For All” program? There have been many programs over the years aimed at helping first-time buyers get into the expensive California housing market, but they have mostly been so restrictive that few people were able to use them. The less-restrictive “Dream For All” program from the California Housing Finance Agency is targeted to low and moderate income first-time buyers. It provides funds for down payment and closing costs through a shared appreciation loan of up to 20% of the purchase price. Here’s an example of how it can work. A qualifying buyer uses [...]

REAL ESTATE ANSWERS: What design trends are you seeing now for kitchens?

What design trends are you seeing now for kitchens? Here are ten trends for kitchen design I have been seeing in publications and in our local market: Stark all-white kitchens are becoming less popular. People are looking for more warmth, which can come from materials or color. Unpainted wood cabinetry is increasingly popular; the grain and color of the wood add warmth and a natural element to the overall design. If cabinets are painted, we’re seeing less gray and less white, and more shades of blue, green, saffron, and ivory. The use of open shelving for storage is trending downward, [...]

REAL ESTATE ANSWERS: How has the negotiating environment changed as the market has shifted?

How has the negotiating environment changed as the market has shifted? When the real estate market is at its strongest, there is not a vast amount of negotiation between buyers and sellers. Buyers make strong offers in competition, often waiving the inspection contingency, and many sellers choose to accept the best offer, rather than negotiate and risk de-stabilizing the transaction. When the market is more balanced, there are fewer offers on properties, and buyers may not feel that they have to make their best offer at the start. An accepted offer might also have an inspection contingency, so there may [...]

REAL ESTATE ANSWERS: How much difference do higher interest rates make for home sales in our area?

How much difference do higher interest rates make for home sales in our area? Over the spring, the Federal Reserve announced a plan for multiple interest rate hikes this year to try to get inflation under control, and we’ve seen three rate increases already this year. As I write this, interest rates on home loans are approaching 6%, up from about 3% at the start of the year. Interest rates are at their highest level in 10 years, and there may be additional increases to come. Increasing rates make a lot of difference in the purchasing power of individual buyers. [...]

REAL ESTATE ANSWERS: Why are most sellers in our area no longer accepting “love letters” from buyers?

Why are most sellers in our area no longer accepting “love letters” from buyers? In our market, where buying a home is a super-competitive process, it used to be the case that buyers would include a “love letter” with their offer in hopes that it would influence the seller in their favor. The letter would tell the seller about the buyers, their qualifications, and why this property would be the perfect home for them. It also often included a photo of the buyers. The idea was that, because many (even most) sellers have some emotional attachment to the property they’re [...]

REAL ESTATE ANSWERS: Should I be careful not to over-disclose when I’m selling my home?

Should I be careful not to over-disclose when I’m selling my home? Completing seller disclosure forms in California can be a daunting task. A seller is legally obligated to disclose all known material information about the property to the buyer, and can be sued for hiding defects or problems. A material fact is any piece of information that would affect the buyer’s decision to purchase the property. To meet this obligation, sellers complete a series of detailed questionnaires about the current condition of the property, ongoing maintenance, past repairs and upgrades, and a whole array of other topics. Some of [...]

REAL ESTATE ANSWERS: What kinds of projects can add lasting value to my home?

What kinds of projects can add lasting value to my home? Suppose you want to do some work on your home, and you want to choose a project that will add value, not just today, but into the future when you might sell your property. We all know that kitchens and baths sell houses, so remodeling either of those is an obvious possibility. However, if you have a long time horizon, there's a problem with that choice: remodeling is very style-dependent. If you remodel your kitchen now, but don’t sell your home for 15-20 years, you’re not going to get [...]

REAL ESTATE ANSWERS: What is the right pricing strategy for my home?

What is the right pricing strategy for my home? In Berkeley and in the surrounding areas, it has long been the case that many properties are listed below what they’ll likely sell for. I’ll call this “low pricing.” Low pricing is a strategy intended to attract the attention of a wide range of buyers and to generate multiple offers. Most properties around here follow this strategy, but it’s not the only possibility. “Transparent” pricing is a newer term for the classic pricing strategy followed in most other areas. It refers to choosing a list price that is at a value [...]

REAL ESTATE ANSWERS: What is home fire hardening, and do I need to do it?

What is home fire hardening, and do I need to do it? “We’ve learned from recent fires. Hardening your home and keeping the 5 feet closest to your house clear of flammable materials (including patio furniture and décor) greatly improves its chance of surviving a fire.” CALIFORNIA FIRE SAFE COUNCIL Fire hardening is making changes to an existing home to make it more resistant to wildfire. According to the Fire Safe Council, your home can catch fire in 3 main ways: from ember storms, where small pieces of burning material are blown in front of a fire (embers can apparently [...]

REAL ESTATE ANSWERS: How are property tax assessment transfer rules changing due to Prop. 19?

How are property tax assessment transfer rules changing due to Proposition 19? If you are one of the many people in California who at some point considered moving but decided not to because your property taxes would increase sharply, you could be in luck now. Proposition 19, which passed in the last election and goes into effect April 1, 2021, allows a homeowner who is 55 or older, severely disabled, or whose home was substantially damaged by wildfire or natural disaster to transfer their property tax assessment to a new replacement home with fewer restrictions than is currently the case. [...]

REAL ESTATE ANSWERS: Why (and how) do so many local sellers spend so much money getting their homes ready for sale?

Why (and how) do so many local sellers spend so much money getting their homes ready for sale? Sellers in our area routinely spend tens of thousands of dollars on work and staging in preparation for putting their home on the market. (The amount obviously depends on the size and condition of the home, but $50,000 is pretty common these days). Why spend so much, when there are so many buyers out there? The first part of the answer is that yes, there are lots of buyers, but there are also other homes for sale, so it’s important that your [...]

REAL ESTATE ANSWERS: Why should you pull a permit for work done on your home?

Why should you consider pulling a permit for work done on your home? The #1 reason you should get a permit if you’re having work done on your home that requires it is the obvious one: it’s required by law, and you can have problems with the City if they discover you don’t have a permit, either as the work is being done, or after the fact. That said, it’s definitely the case that many homes in our area have work that was done without permits. Homeowners choose to skip permits for a variety of reasons, including the cost of [...]

REAL ESTATE ANSWERS: I’m considering selling my home next year. What should I start doing now to get ready?

I’m considering selling my home next year. What should I start doing now to get ready? It’s a well-known fact that right now is not the optimal time to sell a home in our area. It is, however, the right time to start getting things in place if you’re thinking of selling next year, so that you’re ready for the very busy selling season. Here are the first things to do to get ready. (1) Think about where you’ll be when your home is on the market. Do you already have your next home set? Are you renting or buying [...]

REAL ESTATE ANSWERS: Why do list prices sometimes increase after a property has been on market for a while?

Why do list prices sometimes increase after a property has been on the market for a while? In most parts of the country, properties come on the market, and if they don’t sell after a period of time, motivated sellers will reduce the list price to attract buyers. Around here, if a property is not getting the interest the seller hoped for, sometimes the seller will reduce the list price, but other times the list price will increase. What’s going on? The answer lies in the strategy that was followed in choosing the original list price. In other areas, the [...]

REAL ESTATE ANSWERS: How have the massive fires in recent years affected homeowner’s insurance locally?

How have the massive fires in recent years affected homeowner’s insurance locally? I spoke with Ruth Stroup with Farmers Insurance, who is always a great source of information about the insurance world, and asked her what changes she’s seen as a result of the tragic fires we’ve had in California over the last few years. Ruth said that the huge claims in back-to-back years from the fires have affected insurance companies’ ability to get reinsurance. (Reinsurance pays a share of the claims in the case of massive losses like with the fires, and is a critical component of the insurance [...]

REAL ESTATE ANSWERS: How old is the housing stock in Berkeley?

Many times over the years, when counseling new buyer clients, I have pointed out that the majority of the homes in Berkeley are older, built in the early part of the 1900s. I know this anecdotally, and from looking at so many homes over the years, but I had not seen any actual figures. I thought it would be interesting to look at the data, so I went to my handy public records database and looked at records for the single family homes in Berkeley. A couple things to keep in mind: (1) I only looked at structures that are [...]

REAL ESTATE ANSWERS: What’s changing as a result of the Berkeley measures on the 2018 ballot?

There were 2 local measures on the November 2018 ballot that were approved by voters that will impact local real estate going forward. The first was Measure P, which passed with 72% of voters saying yes. Measure P increases the Berkeley city transfer tax on property sales at prices over $1.5M, from 1.5% of the sale price, to 2.5%. Property sales at prices of $1.5M or less will still be taxed at the old rate of 1.5%. The measure says that the funds raised are intended to be used for “general municipal purposes such as navigation centers, mental health support, [...]

REAL ESTATE ANSWERS: Why are there so many wild turkeys around these days?

This is not exactly a real estate question, but it is something I have been really wondering about myself! When I was growing up, I don’t remember ever encountering a wild turkey. Now it seems they’re everywhere, not just in the Bay Area, but in other parts of the country as well. A quick google search turns up articles about the abundance of wild turkeys in Massachusetts, Alabama, Chicago, Tennessee, Ohio, and lots of other places. Just a few days ago, I sat in my car at a stoplight and watched a gang of turkeys cross Marin Avenue at the [...]

REAL ESTATE ANSWERS: What can I do to make a dark room brighter?

Some people love a cozy, darker space, but for others (and for getting top dollar in a sale), bright, airy spaces are optimal. How can you get this look in an existing home? The obvious answer is with remodeling—adding windows or skylights to let in more natural light. There are many ways to brighten a room, though, that don’t involve calling a contractor and spending lots of money. Here are some suggestions: Start by making the most of the windows you have. If it’s been a while since the windows were washed (note to self…), having them cleaned can make [...]

REAL ESTATE ANSWERS: What’s changing in the real estate world?

What’s changing in the real estate world?

There was a big lawsuit filed in Missouri in 2019, that focused on the way buyers’ agents are paid. A settlement agreement was reached last month, and it has been all over the news recently. What’s it all about?

Sellers have long negotiated a total commission with their agents, and that commission has been shared between the listing (seller’s) agent and the agent representing the buyer of the property. This is all spelled out clearly in the listing agreement we use in California – it has a field for the total commission to be paid, and a separate specific entry that says how much of that total will be paid to the buyer’s agent. The commission offered to the buyer’s agent has been a required field for any property entered into the Multiple Listing Service (MLS). The lawsuit argued in part that this requirement of compensation to the buyer’s agent in the MLS is an antitrust violation.

The settlement agreement has not yet been approved by the courts, but, if approved, it will lead to two changes in the way we do business. The first is that an offer of compensation to a buyer’s agent will no longer be a requirement for a listing to be in the MLS. Sellers can still pay the buyer’s agent, but that compensation will not be part of the MLS info. The second change is that there will always be a separate written agreement between buyers and the realtor® representing them.

The commission paid to the buyer’s agent can be paid by the seller, or by the buyer. This of course begs the question, why would a seller pay for a buyer to have representation?

The sale of a home is a huge and complicated transaction, involving large sums of money, and real estate is one of the most litigious sectors of the economy. As a seller, you don’t want the buyer to end up with buyer’s remorse, so it is extremely important that the buyer understands the process, and the property involved. This is the critical role of the buyer’s agent: not only to bring your property to the attention of buyers for whom it is a good fit and show it to them, but also to provide them with essential information and context about the property, the area, legal requirements, and local market conditions and values.

A smart seller will always want their buyer to have not only an agent, but a good agent. When a seller offers to pay the buyer’s agent’s compensation, they are (1) increasing the pool of possible buyers (because not all buyers will have the cash to cover the downpayment and closing costs, and also pay their agent); (2) increasing the odds that their escrow will close (because the buyer will have someone knowledgeable helping them understand the property and what the process and costs are, and shepherding them through the offer and escrow); and (3) reducing future risk.

REAL ESTATE ANSWERS: What counts as a bedroom in real estate, and do more bedrooms add value?

What counts as a bedroom in real estate, and do more bedrooms add value?

A bedroom in general is just a room where people sleep. For a room to count as a bedroom for real estate purposes, there are several requirements:

(1) FLOOR SIZE. According to the standards used by appraisers, a habitable room must have a floor of at least 70 square feet in area and be at least 7 feet in any direction. So a 7’x10’ room is okay, but a 6’x12’ space, even though it’s 72 square feet, wouldn’t be counted as a room (or a bedroom) on an appraisal.

(2) CEILING HEIGHT. At least 50% of the ceiling must be at least 7 feet high.

(3) ENTRANCE. There should be a door to the bedroom from the interior of the house.

(4) EGRESS. There also needs to be an exit from the bedroom to the exterior. This can be a door to the outside, or it can be an exterior window. If it’s a window, it should be 24 to 44 inches from the floor, have an opening of at least 5.7 square feet, and it must be no less than 24 inches in vertical size and no less than 20 inches wide. (The point is to make it usable if someone needs to climb in or out in an emergency.)

Note that if you have an older home, built before these requirements were put in place and without the proper egress windows, the city is not going to knock on your door and require that you make the window openings larger. However, if you are doing a project that modifies the rough openings, you will be required to comply. And if you sell that home, it’s advisable to disclose that one or more “bedrooms” does not have an egress window.

Many people think that a bedroom has to have a closet. In California, that is not a requirement, although some local jurisdictions may have other requirements. Most buyers though do want to have a closet in or at least near each bedroom.

Do additional bedrooms always add value in a sale? Not necessarily. The first few bedrooms do add value to a typical Berkeley house, but only if the bedrooms are of reasonable size, and the remaining living space is of reasonable size for the number of bedrooms. Consider a 1000 square foot home with 5 bedrooms, for example. The bedrooms would have to be quite small, and there won’t be much living or storage space, which will make the property appealing to far fewer buyers. Even for a larger home, a 5-bedroom house doesn’t necessarily have more value (everything else being equal) than one with 4 bedrooms, as there are fewer buyers who need the 5th bedroom.

Bottom line: Bedroom count does matter for value, but only as part of the overall picture of a home and its function.

REAL ESTATE ANSWERS: How do actions by “the Fed” affect interest rates on home loans?

How do actions by “the Fed” affect interest rates on home loans?

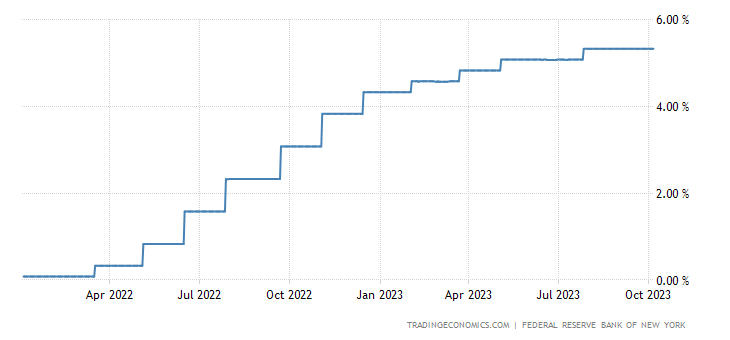

The Federal Reserve System (“the Fed”) uses monetary policy to keep the U.S. inflation rate low, and keep the economy operating at full employment. These are competing goals, so their work is a major balancing act. The Fed’s primary policy tool is changes in the federal funds rate, which is the rate at which commercial banks loan extra reserve funds overnight to each other (so it’s a very short-term interest rate). The Fed raises rates to combat inflation, and reduces them if they are trying to fight high unemployment. Since the start of 2022, they’ve been focused on eliminating the inflation that crept into the system during the main COVID years (2020-2021).

Interest rates on home loans are very long-term rates, since the typical home loan in the U.S. is a 30-year loan. They most closely track the rate on the 10-year Treasury note. Rates on home loans, like rates on 10-year Treasury notes, move up and down in response to economic conditions, changes in the return and relative riskiness of alternative assets, the availability of loanable funds, and current and expected future inflation rates. Rates on long term loans, like home loans, also depend on current and expected future short-term interest rates, so they are definitely affected by Fed policy.

In January of 2022, the Fed signaled that it was likely to start raising rates soon, setting off the real estate buying frenzy of early 2022, as buyers tried to get into the market before rates went up. The first rate increase by the Fed last year was in March of 2022, and by about this time last year, the target range for the federal funds rate was already up 3 percentage points, with more increases to come. By last fall, the Fed’s actions had resulted in a doubling of home loan rates, from the 3% range at the start of 2022, to about 6% in fall 2022. In the last year, the Fed has increased the target range for the federal funds rate 6 more times, for a total increase of 5.25% since the start of 2022. Today we’re looking at rates on homes loans that are approaching 8%.

When will interest rates go down again? Market rates are always bouncing around in response to new information, but we are unlikely to see a sustained reduction in interest rates until the Fed sees a need to stimulate the economy again, because inflation is low, and unemployment is increasing, or if they see a need to increase bank liquidity to keep the system functioning well.

REAL ESTATE ANSWERS: What’s going on in the home insurance market, and how does it affect current homeowners?

What’s going on in the home insurance market, and how does it affect current homeowners?

In late May, State Farm, which is the largest issuer of homeowners’ policies in California, announced that it would not sell any new home insurance policies in California. In addition, Farmer’s Insurance just announced that they will limit the number of new policies they sell here. Allstate also stopped issuing new policies in California last fall, so this is a significant trend.

Why are these big insurers pulling away from California at this time? Major wildfires in recent years have resulted in surges in claims, and climate change has made this much more likely to be the norm in coming years. Pandemic supply-chain issues and lingering inflation have meant that the cost of settling claims has gone up significantly. The cost of reinsurance, which is insurance that the companies get to protect themselves against excessive losses, has also gotten more expensive. The California Department of Insurance, though, limits companies’ ability to raise rates to cover higher costs and elevated risks, leading State Farm and Allstate to decide that it’s not worth selling new policies here.

Happily, this does not mean that existing State Farm and Allstate customers are losing their coverage. It does mean, though, that anyone looking for a new policy right now is going to find it more challenging, and more expensive. There are still lots of insurers selling policies in California, but there are fewer choices now. The remaining insurers are seeing increased demand for their products, which in theory would lead to higher prices. With pricing controlled by the California Department of Insurance, though, what we get are insurance companies that are much more selective in which properties they choose to insure.

This is not a good time to shop for a new or replacement homeowner’s insurance policy, so it’s also not a good time to do anything to give your existing insurer a reason to cancel. Be extra sure right now that the insurance bill is paid on time. If your insurance is paid by an outside party (such as a lender who collects money for taxes and insurance through an impound account, and makes those payments for you), it’s worth the effort to confirm that the payments are made on time, especially if your loan has been recently transferred to a new bank or servicer. If you are shopping for a new home, when you see one you like, you should plan to check insurability and get coverage quotes very early in the process.

Insurance companies are paying much more attention to the condition of the homes they insure, including their roofs as well as their plumbing and electrical systems. Many companies will not issue a new policy for a home that has older electrical (such as knob and tube wiring, or fuses instead of circuit breakers). If you are planning to sell your home, it’s worth seriously considering work that will make the home more insurable, such as replacing a wood shake roof or knob and tube wiring. Your current insurance policy will (sadly) not be transferrable to the new owners, and buyers need to be able to get insurance to get a loan.

REAL ESTATE ANSWERS: What is (or was!) the California “Dream For All” program?

What is (or was!) the California “Dream For All” program?

There have been many programs over the years aimed at helping first-time buyers get into the expensive California housing market, but they have mostly been so restrictive that few people were able to use them. The less-restrictive “Dream For All” program from the California Housing Finance Agency is targeted to low and moderate income first-time buyers.

It provides funds for down payment and closing costs through a shared appreciation loan of up to 20% of the purchase price.

Here’s an example of how it can work. A qualifying buyer uses an approved lender, and gets a “regular” loan for 80% of the purchase price, combined with a 20% Dream For All shared appreciation loan. The buyer, in this example, only needs to have funds to cover closing costs (which might be, very roughly, 5% of the purchase price).

The buyer makes regular payments (principal plus interest) on the 80% loan, but there are no ongoing payments on the shared appreciation loan. Instead of paying interest on the Dream For All assistance funds, when the property is sold, the assistance funds are repaid, along with a share of the appreciation on the property. If the Dream For All assistance was 20% of the purchase price, the program gets 20% of the appreciation.

There are other programs out there for buyers without a lot of down payment money, where the borrower only needs to put around 3% of the purchase price down. In the Dream For All scenario, though, the monthly payment (on 80%, rather than 97% of the purchase price) is lower, and there is no mortgage insurance as long as the “regular” loan component is 80% or less of the value.

Here are some of the requirements of the Dream For All program:

- The property must be a 1-unit/single family home or a condo, purchased as the primary residence of the new owner.

- Non-occupant co-signers are not allowed.

- The maximum income to qualify in Alameda County is $282,000.

- You must be a first-time buyer, BUT they define a first-time buyer as someone who has not owned a home in California in the last three years.

- The maximum “regular” loan amount is $1,089,300, which means that, with 20% Dream For All assistance, the maximum purchase price would be $1,361,625.

- The buyer has to take a Homebuyer Education and Counseling course.

For more details, see www.calhfa.ca.gov/dream/.

Here’s the bad news — the program was so popular, that its funding, which was expected to last until early fall, ran out in not even 10 days! It’s unclear whether the state will provide additional funding, but if you know someone who might qualify and be interested, they should watch and be ready to act quickly if more funds are added.

REAL ESTATE ANSWERS: What design trends are you seeing now for kitchens?

What design trends are you seeing now for kitchens?

Here are ten trends for kitchen design I have been seeing in publications and in our local market:

- Stark all-white kitchens are becoming less popular. People are looking for more warmth, which can come from materials or color.

- Unpainted wood cabinetry is increasingly popular; the grain and color of the wood add warmth and a natural element to the overall design.

- If cabinets are painted, we’re seeing less gray and less white, and more shades of blue, green, saffron, and ivory.

- The use of open shelving for storage is trending downward, as people factor in the impracticality and required upkeep. Some open shelving for display space rather than everyday use is still popular.

- Fancy statement-making range hoods are less popular, with more people opting for something simpler to fit in with a clean aesthetic.

- Countertop materials can go in two directions: we’ve been seeing more natural stone with color and patterns of flowing wavy movement, but a clean, simple quartz is also popular. Which of these makes sense in a design depends on the surrounding elements. Is the stone the statement piece in an environment that is otherwise clean and simple, or are there surrounding elements (wood grain on cabinets, or pattern on the backsplash or flooring) with which you don’t want to compete?

- Solid slab backsplashes, generally in the same material as the counters, are becoming more popular.

- Microwaves over the range are feeling dated.

- The trend from last year toward more natural materials like rattan or rope is continuing. In the kitchen, we see it on pendant lights and seating.

- For hardware, last year we saw a lot of matte black for faucets, cabinet handles and lights. Brass or gold finishes have also been popular for these items. These finishes have not gone away, but designers say that polished chrome is coming back, which is always a good classic choice.

Kitchens are an important component of property value, so it’s a good idea to consider how long you are expecting to be in the house if you are planning a remodel.

If you are going to sell the property fairly soon, you’ll get the best return if you factor in current trends. As the time until you’ll want to sell gets longer, the more it makes sense to choose more classic and neutral finishes for the big-ticket and harder-to-change components. Beyond a certain point though (20 or 30 years?) anything you choose today is likely to feel dated by the time you sell, so you can feel free to go for whatever you like the most!

REAL ESTATE ANSWERS: How has the negotiating environment changed as the market has shifted?

How has the negotiating environment changed as the market has shifted?

When the real estate market is at its strongest, there is not a vast amount of negotiation between buyers and sellers. Buyers make strong offers in competition, often waiving the inspection contingency, and many sellers choose to accept the best offer, rather than negotiate and risk de-stabilizing the transaction. When the market is more balanced, there are fewer offers on properties, and buyers may not feel that they have to make their best offer at the start. An accepted offer might also have an inspection contingency, so there may be further negotiations during the inspection period.

Most real estate negotiations are over dollar amounts (although timing and other terms can also be negotiated), but the same dollars can be factored into a contract in different ways: as a change in price, as a change in who is paying various closing costs, as a credit towards closing costs for the buyer, or as a buy-down of the buyer’s interest rate by the seller. Each of these possibilities affects the buyer’s and seller’s bottom lines differently, so a strong, creative negotiation strategy weighs the effects of each to find the right one or the right mix.

From a financial perspective, the seller’s goals are relatively simple. Sellers want to maximize their net proceeds, so they want the price as high as possible, and their costs as low as possible. The buyer side is much more complicated. Buyers want to minimize their cost for the purchase, so to keep the sale price and their closing costs as low as possible. Buyers also want to minimize their ongoing costs of ownership: their loan payments (if any) and their annual property taxes. In addition, buyers will consider the available cash they will have after the purchase to make needed repairs or improvements.

When I am negotiating for a seller client, my first step is aways to gather as much information as possible about the buyers and their circumstances. Are they getting a loan? Will they have plenty of cash on hand after the purchase for needed repairs? Is the monthly cost of ownership their primary constraint, or do they ultimately care the most about the overall purchase price? Will their lender allow credits toward closing costs? How much will a point paid on their loan reduce their monthly payment? Using that information, I can then consider all the various ways to structure potential contract changes, to find an option that will be the most attractive to the seller, while making the deal work for the buyer.

It is all quite complex, but it’s an important part of the process. One of the benefits of longevity in this business is having experience navigating markets of all different strengths. I guess that makes up for the extra wrinkles the years have also brought me!

REAL ESTATE ANSWERS: How much difference do higher interest rates make for home sales in our area?

How much difference do higher interest rates make for home sales in our area?

Over the spring, the Federal Reserve announced a plan for multiple interest rate hikes this year to try to get inflation under control, and we’ve seen three rate increases already this year. As I write this, interest rates on home loans are approaching 6%, up from about 3% at the start of the year. Interest rates are at their highest level in 10 years, and there may be additional increases to come.

Increasing rates make a lot of difference in the purchasing power of individual buyers. For sellers and property values in our market, where we have excess demand, the impact is not as extreme, but it does definitely affect the market.

Consider individual buyers who are qualified for at most a $1 million dollar home loan (to choose a round number) when interest rates are 3%. This means that they are qualified, given their income and other debts, for a maximum monthly loan payment of $4216. When rates go up to 6%, assuming the buyers can afford that same payment, they now only qualify for a loan of $703K (so they can spend $297K less on a home, compared to when rates were at 3%). As a very rough rule of thumb, the maximum loan amount people can qualify for goes down about 10% each time the interest rate goes up by one percentage point.

Another way to think about this – a particular buyer might need something like $230K of household income to qualify for a $1M home loan when the interest rate is 3%. (The actual income requirement will depend on things like credit rating, other debt, etc.) When the interest rate rises to 6%, that same buyer would now need over $300K in income to qualify.

How do buyers respond to increasing interest rates? With less purchasing power, buyers need to adjust their expectations. They could look for a smaller home, a less expensive location, or a home that needs more repairs or improvements. Other buyers, who were not already planning to spend their max, might decide to go closer to their limit, and still buy the same thing.

In thinking about how higher interest rates affect our market as a whole, the crucial question is, will there be fewer buyers at particular price points after all this happens? In our market, we have had an excess of buyers at various price points, and a good number of cash buyers as well. Some buyers will need to move down a price category, but there should be other buyers (moving down from higher price points) to take their place. And yes, some buyers will be unwilling to compromise on their purchase and may choose not to buy now at all.

Overall, I would expect there to be somewhat fewer buyers in each price point. There was so much excess demand before, though, that there should still be enough buyers out there to keep the market stable.

REAL ESTATE ANSWERS: Why are most sellers in our area no longer accepting “love letters” from buyers?

Why are most sellers in our area no longer accepting “love letters” from buyers?

In our market, where buying a home is a super-competitive process, it used to be the case that buyers would include a “love letter” with their offer in hopes that it would influence the seller in their favor. The letter would tell the seller about the buyers, their qualifications, and why this property would be the perfect home for them. It also often included a photo of the buyers.

The idea was that, because many (even most) sellers have some emotional attachment to the property they’re selling, providing more information about the buyers and how much they appreciate the property could highlight commonalities and make it easy for the sellers to picture a particular set of buyers as the new owners. Maybe the seller would think “Oh, these buyers are a cute young couple who want to raise their family here like we did!” Or, “Look, we both work for X Company!” Or “These people love to garden, so will maintain the yard I put so much effort into!” Buyers hoped that these commonalities might lead the seller to choose their offer over others (maybe even if their price wasn’t quite as high).

The problem with these letters is that they can reveal information about the buyers that the seller cannot legally consider in choosing between offers.

Sellers are prohibited by law from choosing a buyer based on any of these criteria: race, color, ancestry, national origin, religion, sex, sexual orientation, gender, gender identity, gender expression, marital status, familial status, source of income, disability, medical condition, citizenship, primary language, immigration status, military/veteran status, age, criminal history, and any arbitrary determination.

Notice that my “cute family” example above is on the list of prohibited criteria (familial status), and “We both work for the same company” is related to source of income.

Even the best-intentioned seller, who would never knowingly violate Fair Housing laws, could be subconsciously influenced, and even if this is not the case, it is still safer as a seller to not have information related to the prohibited criteria at all. In our super-competitive market, there are routinely multiple unsuccessful buyers, and there is always the risk that an unhappy buyer whose offer was not accepted could claim that a decision was influenced by something that is in a protected category.

The safest choice is to “just say no” to buyer letters. If you as the seller do not have information the about buyers’ characteristics, it’s hard for someone to say that you made a decision for the wrong reasons. I think skipping the buyer letters is not just the safest choice, but it’s also the right choice, because it levels the playing field for everyone.

REAL ESTATE ANSWERS: Should I be careful not to over-disclose when I’m selling my home?

Should I be careful not to over-disclose when I’m selling my home?

Completing seller disclosure forms in California can be a daunting task. A seller is legally obligated to disclose all known material information about the property to the buyer, and can be sued for hiding defects or problems. A material fact is any piece of information that would affect the buyer’s decision to purchase the property. To meet this obligation, sellers complete a series of detailed questionnaires about the current condition of the property, ongoing maintenance, past repairs and upgrades, and a whole array of other topics. Some of the questionnaire forms are specifically required by the state or federal government, and the others are like a guided walk down memory lane, making sure sellers think about and pass along information within many different relevant categories.

In completing these forms, it’s not uncommon for a seller to worry that they’re over-disclosing – telling the buyer too much – and that they’re going to hurt their sale. My general rule of thumb for disclosures is this: If you wonder if you should include something in the disclosures, the answer is always yes. Why? Because if it’s an item that the buyer cares about, then it’s a material fact, and you are required to disclose it. If the buyer doesn’t care, then it’s not hurting anything to have it there.

Carefully completed disclosures are important not just because of the legal requirement, but also because they set the tone for the transaction, and establish a baseline level of trust between the parties. If the seller has lived in the property for many years, but discloses next to nothing, buyers don’t feel confident that they’re getting an accurate picture of the property, which makes them worry about unknown problems. They may also think the seller is not playing fair, which affects their impression of the whole property, and their behavior in the transaction, including their willingness to be flexible when procedural things come up during escrow (and procedural and other issues often do come up!).

Disclosure forms include questions that ask you to describe all work and improvements you’ve done on the house, plus repairs needed now and those done in the past, plus ongoing maintenance. Putting together all of this information can be challenging, especially if you’ve owned the home for many years. Including a lot of detail, though, especially about more recent improvements and repairs, gives the buyer the sense that the property has been well-maintained and improved over time.

Even if you’re not thinking of selling anytime soon, it will make your life much easier when the time comes if you start a list (or a spreadsheet, or a file) now, and update it when you have a new improvement or repair. For each item, record three things: what was done, who did it, and when. For recurring maintenance items, there’s no need to keep track of every time the tree trimmer or gutter cleaner came; just keep a list of what those maintenance items are. If you start doing this now, you’ll be way ahead of the game when you do decide it’s time to sell!

REAL ESTATE ANSWERS: What kinds of projects can add lasting value to my home?

What kinds of projects can add lasting value to my home?

Suppose you want to do some work on your home, and you want to choose a project that will add value, not just today, but into the future when you might sell your property. We all know that kitchens and baths sell houses, so remodeling either of those is an obvious possibility. However, if you have a long time horizon, there’s a problem with that choice: remodeling is very style-dependent.

If you remodel your kitchen now, but don’t sell your home for 15-20 years, you’re not going to get much return on the project, because your “new” kitchen will be pretty outdated by then. (Of course, there is value in the enjoyment you’ll get from having a great kitchen or a luxurious bath in the intervening years, so you might still want to do the project!)

Here are three things, though, that are unlikely to go out of style: (1) an additional bathroom, (2) more usable space, and (3) a great yard. The first of these is straightforward: another bathroom (especially if there is no bathroom on one level, or no bathroom attached to the primary bedroom, or only one bathroom overall) adds value.

Adding usable space can mean an expensive addition to your home, but it can also mean improving a basement, garage or attic, adding an ADU, or even adding a detached shed. Did you know that you don’t need a permit to add a single-story shed of up to 120 square feet (although you are supposed to have a permit if you add plumbing or electricity). Adding a nice shed is a relatively cost-effective way of gaining a little

more space to spread out, or adding a workspace, something many people are looking for these days. If you go with a nicer shed, incorporate it well into the yard, and maintain it over time, the next owner will appreciate it too (and pay more for the property).

A great yard, with nice plantings and spaces to play and hang out, also adds a lot of value. If you are (or you have) a great gardener, then well-chosen plantings that mature over time can make a garden feel special. If you’re not a great gardener, and you don’t think new plantings will last and look great in the long term, you can still improve your yard (and the value of your property) with space planning and some hardscape design. The goal is to fully utilize the yard space you have. Can you use the side yard to create a play area, or add storage or a place to tuck away trash and recycling cans to make more space elsewhere? Can you create a flat area on a sloped space, with nice stairs to it, to add a pleasant hang-out space? Can you add planting beds in a sunny spot, for herbs or tomatoes or something else?

I recently helped some lovely but extremely busy clients, who were not big gardeners, sell a property where the previous owners had done substantial landscaping on the property. Some of the plantings in the yard were not in great shape, but the layout and a few big plants were still there. We brought in a gardener, who cleaned everything up and added new plants, and the yard was magical again. These sellers had also added a shed/office in back, and the combination of the gorgeous yard and the little bit of additional space led to a fantastic sale price for the property.

If there’s a good chance you might sell in the next 10 years, then remodeling a kitchen or bath will have a higher return. Keep in mind this general rule though: the longer the time until you’ll want to sell, the more important it is to choose more classic finishes, rather than what’s bold and trendy right now.

REAL ESTATE ANSWERS: What is the right pricing strategy for my home?

What is the right pricing strategy for my home?

In Berkeley and in the surrounding areas, it has long been the case that many properties are listed below what they’ll likely sell for. I’ll call this “low pricing.” Low pricing is a strategy intended to attract the attention of a wide range of buyers and to generate multiple offers. Most properties around here follow this strategy, but it’s not the only possibility.

“Transparent” pricing is a newer term for the classic pricing strategy followed in most other areas. It refers to choosing a list price that is at a value that the seller will accept for the home; the expectation is not that there will be a bidding war and the price will get bid up.

In deciding which of these strategies makes more sense for a particular property, the biggest consideration is whether there will be multiple interested buyers for the property. If you go with a low price and only get one offer, that offer may very well be at, or even below, the (low) list price. For this reason, for a property that is not something that a typical buyer is looking for (because of size, style, customization, etc.), or for properties in the upper price ranges (that are too expensive for most buyers), it makes sense to choose a transparent price. Listing a property low is only a good idea if there are likely to be multiple buyers bidding the price up.

For properties of broad interest, there are several reasons why the “price it low and generate bidding” strategy is beneficial. Multiple offers push up the price to the upper limit of what the buyers are willing to pay, so you know you’re getting top dollar. They also give the buyer with the winning offer confidence that the property is a good one (“If all these other people also want it, it must be good!”), and buyer confidence is important in holding deals together. Buyers may also waive contingencies they do not need and choose shorter time periods.

If you’re choosing a transparent price, the right price to choose is the market value of the home, determined by what other similar properties have sold for. If you’re pricing low, though, the inevitable question is “How low do you go?”

The most advantageous “low” list price is one that is similar to what other properties like yours are listed at. You want your home to look good relative to other homes that are for sale. If you list it at a price higher than similar properties, it will end up being compared by buyers to other homes that are bigger or otherwise more expensive, and it won’t compare favorably.

In normal times for this area, “low” list prices have been around 20-30% below market value. Lately, though, list prices are a lot further below market value. Why?

Sale prices/market values have shot up since the beginning of 2021, but typical list prices move more slowly. So far this year, homes are selling quite commonly for 30%, 40%, 50%, or even more above list price, up to double! Why haven’t list prices gone up as the market has risen? It’s a coordination problem. When other properties on the market are still choosing the same list prices as last year, a strategic seller will do the same, so that their home is compared by buyers to the right segment of the market.

REAL ESTATE ANSWERS: What is home fire hardening, and do I need to do it?

What is home fire hardening, and do I need to do it?

“We’ve learned from recent fires. Hardening your home and keeping the 5 feet closest to your house clear of flammable materials (including patio furniture and décor) greatly improves its chance of surviving a fire.” CALIFORNIA FIRE SAFE COUNCIL

Fire hardening is making changes to an existing home to make it more resistant to wildfire. According to the Fire Safe Council, your home can catch fire in 3 main ways: from ember storms, where small pieces of burning material are blown in front of a fire (embers can apparently travel more than a mile!) and create spot fires when they land; from radiant heat, where the heat from nearby burning plants or structures is so intense that it can ignite a house without direct contact (this is especially problematic in densely populated areas, where homes are close together); and from direct flame, which can enter a home when plants under windows burn, breaking the glass and allowing the fire inside the home.

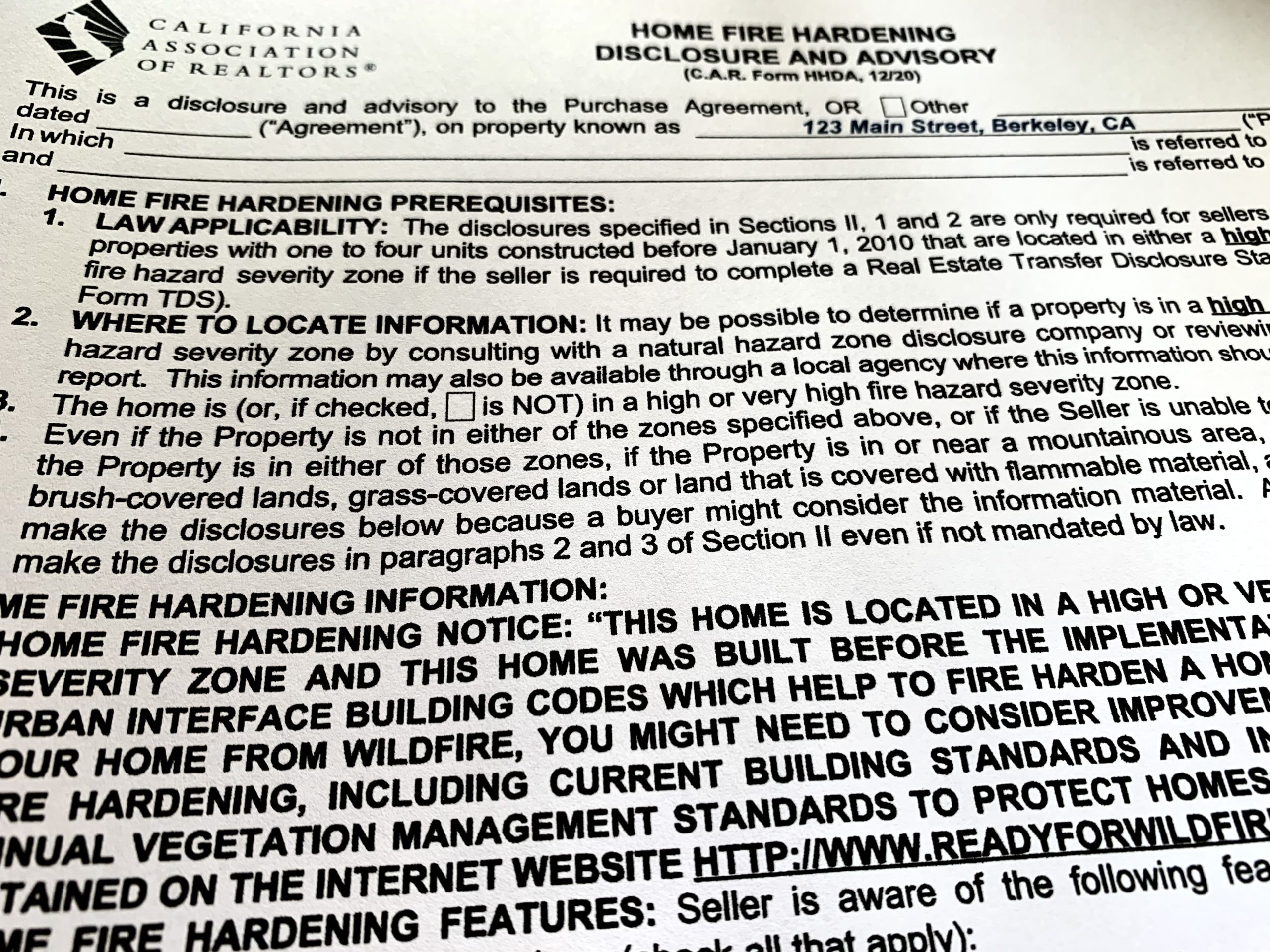

If your home was built in 2010 or later, your home should be pretty “hard”, because building codes were changed then to include hardening requirements. Most of the homes around here are much older than that, but even if you have an older house, you’re not required make changes for the sake of fire hardening. It is worth considering, though, given the massive fires we’ve seen around the state in recent years.

Since the start of 2021, there is a new disclosure requirement related to fire hardening for sellers of properties that are located in a high or very high fire hazard severity zone (and that were built before 2010). Sellers of those properties are required to disclose to buyers if a home has certain features that make it more susceptible to wildfire and flying embers. The features are: (1) eave, soffit, and roof ventilation where the vents have openings in excess of 1/8” or are not flame and ember resistant; (2) roof coverings made of untreated wood shingles or shakes; (3) combustible landscaping or other materials within 5 feet of the home or under the footprint of any attached deck; (4) single pane or non-tempered glass windows; (5) loose or missing bird stopping (which closes off the open ends of tiles on a tile roof) or roof flashing; and (6) rain gutters without metal or noncombustible gutter covers.

You’re only required to disclose vulnerabilities that you know of, and only if the property is in a high or very high fire hazard severity zone, and of course only if you’re selling. However, it’s a good starter list for all of us to consider for improving the fire safety of our homes, even if they’re not going to be for sale.

A state map showing fire hazard zones can be found at https://egis.fire.ca.gov/FHSZ/. You can zoom in on Berkeley and find a specific property, or look at the boundaries of what they consider the red VHFHSZ (Very High Fire Hazard Severity Zone) area.

For more information on fire hardening, check out ReadyForWildfire.org.

REAL ESTATE ANSWERS: How are property tax assessment transfer rules changing due to Prop. 19?

How are property tax assessment transfer rules changing due to Proposition 19?

If you are one of the many people in California who at some point considered moving but decided not to because your property taxes would increase sharply, you could be in luck now. Proposition 19, which passed in the last election and goes into effect April 1, 2021, allows a homeowner who is 55 or older, severely disabled, or whose home was substantially damaged by wildfire or natural disaster to transfer their property tax assessment to a new replacement home with fewer restrictions than is currently the case. Here are the main ways the rules will be different when it goes into effect:

(1) Currently, to be eligible for an assessment transfer, your new property must be either in the same county as the home you sell, or in one of the very few counties that allow transfers in from other counties. Under Prop. 19, your new residence can be anywhere in the state.

(2) Under the current rules, you can only transfer your assessed value one time. Under Prop. 19, you can transfer your assessed value up to three times (or potentially more for those who lost a home to fire).

(3) Under the current rules, your new property must be of “equal or lesser value,” or else you do not qualify for a transfer. Under Prop. 19, the new property can be of any value. If you pay more for your new home than what your old home sells for, you keep your old tax assessment for the portion of the new property up to the value of your old property, and the amount over is added to your tax base. Here’s an example. Suppose your old house sells for $1M, and the assessed value on that property was $500K. If you qualify for a transfer and buy a new home for $1.2M, the assessment on the new property will be $700K (your old assessment of $500K on the first $1M, plus the amount over the value of your old house, $200K). If you buy a property that is of equal or lesser value, you keep your old assessment with no adjustment. To complicate things a bit more, it may end up being the case (as it is now) that there is an inflation factor if you sell your old property first. Under current rules, you can actually spend 5% more than the sale price of your old property in the first year, or 10% more in the second year, and still keep your old assessed value. Whether this will be the case under Prop. 19 is yet to be completely determined.

There are, of course, some restrictions. To do an assessment transfer at all, you need to be 55 or over, severely disabled, or have lost a home to wildfire or natural disaster. You have to buy your replacement home within two years of the sale of your previous home, and both properties have to be your primary residences. You can, though, buy the new property before selling the old property, or vice versa.

Prop. 19 is a great opportunity, but if you’re thinking of taking advantage of it, be sure to talk to a qualified California real estate attorney and/or a professional tax advisor about how this applies to your specific situation. While you’re talking to your tax professional, make sure you also discuss what capital gains taxes may be triggered by a sale.

REAL ESTATE ANSWERS: Why (and how) do so many local sellers spend so much money getting their homes ready for sale?

Why (and how) do so many local sellers spend so much money getting their homes ready for sale?

Sellers in our area routinely spend tens of thousands of dollars on work and staging in preparation for putting their home on the market. (The amount obviously depends on the size and condition of the home, but $50,000 is pretty common these days). Why spend so much, when there are so many buyers out there?

The first part of the answer is that yes, there are lots of buyers, but there are also other homes for sale, so it’s important that your home compares well to the competition.

The next part of the answer is that cosmetic upgrades can significantly increase the sale price. If someone is approaching a home purchase in a very rational, logical way, they’ll look at what a reasonable price per square foot for the property would be, and use that to decide what they’re willing to pay. In contrast, someone who is in love with a property thinks about it with emotion. The properties that sell for crazy-high, top-dollar prices are not selling to buyers who are doing rational calculations. They’re selling to buyers who are in love, and what makes buyers fall in love is not square footage or room counts, but rather style and design, and the ability to see themselves blissfully living in the home. Most buyers can’t envision how much a property can be improved with basic changes. If parts of a home are not to their liking, they picture major remodeling, at high expense, requiring lots of time and attention (which many buyers don’t have to spare).

Here’s one example. If the buyers don’t like the kitchen in a listed property, they almost always factor in the cost of a complete kitchen re-do, which can reduce their willingness to pay by $100K+. Most kitchens can be radically improved in a short period of time for much less, by doing things like painting and replacing things like counters, faucets, flooring, hardware and/or appliances. If you spend $20K (to choose a round number) to refresh the kitchen, and it makes the buyer content with the space, they won’t have to subtract that $100K+ from their offer (and they’re more likely to fall in love!). To create the overall picture and get buyers to fall in love, sellers around here routinely do some combination of painting, floors, staging, gardening, and refreshing the kitchen and bath(s). If a seller ends up spending $50K and gets an extra $200K from the sale, the return from the investment is 300%. That’s why they do it!

Note though that it’s not enough just to spend money on preparation and staging. The work done needs to be well-chosen, and targeted to the buyer pool. I’ve seen far too many houses where they’ve done lots of prep work, but it’s badly chosen, so there’s little return. A good agent understands what appeals to buyers, and will guide the process to make sure the final look is one that will bring you top dollar in a sale.

How do sellers pay for the preparation work? Many sellers pay up front, but there are also ways to borrow the funds or defer payment for the work done until the close of escrow. The best option varies with the circumstances, but I’m happy to discuss the possibilities with you if you’re thinking of making a move.

REAL ESTATE ANSWERS: Why should you pull a permit for work done on your home?

Why should you consider pulling a permit for work done on your home?

The #1 reason you should get a permit if you’re having work done on your home that requires it is the obvious one: it’s required by law, and you can have problems with the City if they discover you don’t have a permit, either as the work is being done, or after the fact. That said, it’s definitely the case that many homes in our area have work that was done without permits. Homeowners choose to skip permits for a variety of reasons, including the cost of a permit, the additional property taxes that might be triggered, the possibility that the work might not be allowed by the city for zoning or code reasons, etc..

Here are the top three reasons to consider getting a permit, though, beyond just that you’re supposed to do it:

(1) It’s good to have an external check on the work being done. Note that having a permit and the related inspections is not a guarantee that everything is done correctly, but at least someone with some knowledge is looking things over.

(2) If you’re adding square footage, and/or bedrooms and baths, the new space won’t have as much value in a sale if it is not permitted. An appraiser looking at a property doesn’t give full value to space if it’s not included in the public record and you can’t show that it was added with permits. Likewise, buyers may not value the space as highly because of potential issues with the appraisal, and because they may be uncertain about the quality of the work done.

(3) A permit sets the clock for the building code when the work is done. Suppose you add a bathroom without a permit, and the city discovers this at some later date. Possible outcomes could be that they require that the bathroom be removed, or that the work be inspected and brought up to current code and requirements. Even if the work was done really well, and complied with all building codes and zoning requirements at the time it was completed, those codes and requirements may have changed, and past work without a permit is not “grandfathered in” (i.e. allowed to stay because it conformed with past regulations). And, even if the codes or zoning have not changed, you still might be required to open up walls and undo things so that the underlying work can be inspected.

To permit or not to permit? I leave you to decide. One last thought though. If you are having work done with a permit, be sure to follow up with your contractor, and get a copy of the final inspection sign-off after the work is done. When I look at the online permit record for a particular property, I often see records for permits that were pulled, but never finaled. Sometimes the work was not completed, but many other times, the final city inspection was never done, or the city’s database doesn’t show that final inspection. By getting a copy of the final sign-off from your contractor, you know that the final inspection was done and passed, and you can prove it if something gets lost in the city records.

REAL ESTATE ANSWERS: I’m considering selling my home next year. What should I start doing now to get ready?

I’m considering selling my home next year. What should I start doing now to get ready?

It’s a well-known fact that right now is not the optimal time to sell a home in our area. It is, however, the right time to start getting things in place if you’re thinking of selling next year, so that you’re ready for the very busy selling season. Here are the first things to do to get ready.

(1) Think about where you’ll be when your home is on the market. Do you already have your next home set? Are you renting or buying the next place? If you’re buying, do you need to sell before you buy? (This is a question most people need to explore with a good loan professional.) If you’re going to sell before buying a new home, will you be moving to a short term rental, or will you be living in the home when it is for sale? Most sellers in our area move out before selling. It’s not required or absolutely essential, but it makes the process of preparing the home for sale, and of showing it looking its absolute best to prospective buyers, much easier.

(2) Choose your timetable. When will your home come on the market? The schedule will depend on the timing of any preparation work to be done, and should factor in the best time to hit the market. For

some homes, that’s during the busy spring season. For other properties, it may be better to be a bit earlier, when there are fewer other homes on the market.

(3) Hire the right stager (well in advance). Great staging will bring top dollar in a sale, but it needs to be the right staging for your particular home. Bad staging is a waste of money, while good staging pays for itself many times over with a higher sale price. The best stagers book far in advance, but they’re worth planning ahead for! Also, a good stager will suggest improvements to the property that will add value, and choose colors and finishes so that the final look is cohesive and attractive to buyers.

(4) Do non-cosmetic repairs now. Cosmetic improvements and painting are best done in consultation with the stager, usually just before the home hits the market. If, however, there are functional repairs that you know are needed (for example, an electrical issue, a leaking skylight, rodents in the subarea, dual pane windows that have fogged) that will affect buyers’ perception of your home, now is a great time to get those repairs done. If the repairs require choosing surfaces or fixtures (for example, replacing a light or a faucet), the stager can help choose the best reasonably-priced but stylish options.

(5) Decide what needs to be repainted, and choose a painter. Painters, like stagers, get booked up early in the months leading to the busy spring selling season.

(6) Hire a great agent who specializes in your area. Your agent can help you with steps 1 to 5 above, and also get you ready for the next steps. If you’d like to see all the steps in selling a house, email me at marilyn@marilyngarcia.com, and I’d be happy to send you the detailed list!

REAL ESTATE ANSWERS: Why do list prices sometimes increase after a property has been on market for a while?

Why do list prices sometimes increase after a property has been on the market for a while?

In most parts of the country, properties come on the market, and if they don’t sell after a period of time, motivated sellers will reduce the list price to attract buyers. Around here, if a property is not getting the interest the seller hoped for, sometimes the seller will reduce the list price, but other times the list price will increase. What’s going on?

The answer lies in the strategy that was followed in choosing the original list price. In other areas, the typical strategy is to choose a list price around market value, or sometimes a little above market value “to leave room to negotiate.” If the property doesn’t sell after a certain period of time, that’s a signal that the list price is too high, so the right response is to reduce the price.

Around here, things are more complicated because there are different strategies for choosing the list price. Some properties follow the strategy I just described, going with a list price at market value. This strategy makes sense for properties where we don’t necessarily expect there to be multiple offers, perhaps because the price point is high, or there’s something specific about the property that the right buyer would find appealing, but that wouldn’t work for everyone. For properties where the list price is around market value, the correct response if they don’t sell in a reasonable amount of time is a price reduction. (Note that “a reasonable amount of time” in this case might be somewhat longer than the two-week marketing period we often see in Berkeley, because with this strategy, you’re waiting for the one right buyer to come along.)

The other strategy, which is of course the most common one in Berkeley, is to choose a list price that is below market value, to attract multiple offers and competitive bidding on a specified offer date. What if a seller chooses a low list price, but doesn’t get any offers on the offer date, or gets just one offer at the low list price? In this case, one reasonable response is to increase the list price. After the offer date passes, the likelihood of getting multiple competing offers is quite low. Sellers in this case can switch to the other list price strategy, and increase the list price to market value. Note that there probably is some information in the fact that the property didn’t get multiple offers, and that information should be taken into account in choosing the new price.

The right list price strategy for a particular property depends on the characteristics of the property itself, and how the market is doing. Choosing the right list price is key. The houses that are priced correctly from the start are the ones that sell quickly and for the most money.

REAL ESTATE ANSWERS: How have the massive fires in recent years affected homeowner’s insurance locally?

How have the massive fires in recent years affected homeowner’s insurance locally?

I spoke with Ruth Stroup with Farmers Insurance, who is always a great source of information about the insurance world, and asked her what changes she’s seen as a result of the tragic fires we’ve had in California over the last few years.

Ruth said that the huge claims in back-to-back years from the fires have affected insurance companies’ ability to get reinsurance. (Reinsurance pays a share of the claims in the case of massive losses like with the fires, and is a critical component of the insurance business.) As a result, many of the big-name insurance companies are not selling new policies in high-risk locations.

Insurers use a scoring system that evaluates how much risk of loss there is in a particular location. A property is given a risk score based on characteristics like accessibility (how easily fire-fighting equipment can get to a property—Ruth said this is the biggest factor), slope, and the amount of fuel nearby.

New insurance policies are available for properties with high risk scores, but one has to go to a specialty insurer, at a much higher cost. Ruth has not seen any issues of this type for properties in the Berkeley “flats,” where the lack of slope, easier road access and fewer areas of dense vegetation lead to more favorable risk scores. This can, though, be an issue right now for homes in the Berkeley hills. (If you live in the hills, this is probably not the time to shop for a new insurance carrier!).

Ruth recommends that everyone periodically review their insurance policy, to make sure you have enough coverage. Building costs have increased substantially in recent years, so it’s important to make sure your replacement value reflects that. Ruth also suggests that everyone check the endorsements on their current insurance, to see if you have enough coverage for building code upgrades. She recommends getting building code upgrade coverage of at least 25%, due to newer ordinances that would require expensive improvements if you had to rebuild, such as interior sprinklers, greater seismic resistance and higher energy efficiency.

I live in the hills, so I asked Ruth how much it would cost to insure my house, if I were buying a new insurance policy today. My home’s risk score turned out to be on the low side for the hills (there are some wide and fairly straight roads between me and the nearest fire stations), but she still estimated that a new policy would cost me double what I am now paying. I think some of that additional cost is the current situation, and some is probably that I am underinsured in light of higher construction costs. Time to call my insurance agent!

REAL ESTATE ANSWERS: How old is the housing stock in Berkeley?

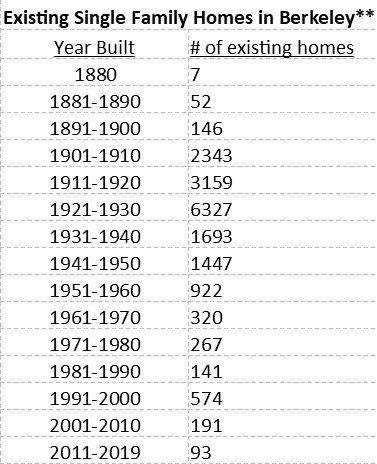

Many times over the years, when counseling new buyer clients, I have pointed out that the majority of the homes in Berkeley are older, built in the early part of the 1900s. I know this anecdotally, and from looking at so many homes over the years, but I had not seen any actual figures. I thought it would be interesting to look at the data, so I went to my handy public records database and looked at records for the single family homes in Berkeley.

A couple things to keep in mind: (1) I only looked at structures that are currently listed as single family homes in the database. Homes that have been converted to business use, or to condos or apartments, or that were destroyed over the years, are not included. (2) The numbers that follow are derived from information from the public records database, but the data there is not completely accurate. Please take all these numbers as approximations, to give a sense of the magnitudes, rather than exact counts.

The total number of single family homes in the database for Berkeley is 17,682. The 7 oldest homes listed in the data have a “Year Built” of 1880. I was surprised to see that these 7 homes are scattered around Berkeley. I expected most of the oldest homes to be in the Oceanview area, but I think many of the historic properties there are no longer single family homes.

The next oldest homes in the current Berkeley housing stock are the 198 homes built from 1881 to 1900. Building in Berkeley increased substantially after that, giving us 5502 single family homes built from 1901-1920. The greatest concentration of homes in our current housing stock were built between 1921 and 1930 (6327 homes). The Bay Bridge opened in 1936, but by then the biggest wave of construction had already passed. Today, the City of Berkeley has 3140 homes that were built from 1931-1950, and the number of homes built per decade tapers from there.

Overall, the average “year built” of the single family homes still in existence (according to this database) is about 1930, so that gives us the answer. Our stock of single family homes is, on average, approaching 90 years old!

REAL ESTATE ANSWERS: What’s changing as a result of the Berkeley measures on the 2018 ballot?

There were 2 local measures on the November 2018 ballot that were approved by voters that will impact local real estate going forward.

The first was Measure P, which passed with 72% of voters saying yes. Measure P increases the Berkeley city transfer tax on property sales at prices over $1.5M, from 1.5% of the sale price, to 2.5%. Property sales at prices of $1.5M or less will still be taxed at the old rate of 1.5%. The measure says that the funds raised are intended to be used for “general municipal purposes such as navigation centers, mental health support, rehousing and other services for the homeless, including homeless seniors and youth.” It also establishes a Homeless Services Panel of Experts to recommend services.

Berkeley now has the highest transfer taxes in the state except for properties that sell for more than $10M in San Francisco or Richmond. San Francisco properties that sell for less than $10M have a lower transfer tax than in Berkeley. In Richmond, properties selling for less than $3M have a lower transfer tax, and properties in the $3M-$10M range match Berkeley’s 2.5% tax.

As a result of Measure P, I think we’ll be seeing a real discontinuity in the market at $1.5M. The difference between a sale at $1,500,000 and a sale at $1,500,001 is an extra $15,000 in transfer taxes! I expect that a lot of buyers who might have made an offer in the low $1.5M range will decide instead to not go over $1.5M. Since the city transfer tax is typically split 50/50 between the buyer and seller, both parties have an incentive to keep a sale price under that figure. Buyers will be trying to find creative ways to sweeten their offer in a multiple-offer situation without crossing that threshold. For properties valued well above $1.5M, the buyers will just have to factor in the higher costs (and the sellers the lower proceeds).

The other local real estate measure that passed was Measure Q. Measure Q was written to address how Berkeley rent control would proceed if the statewide proposition to repeal the 1995 Costa Hawkins Rental Housing Act passed. The statewide proposition did not pass, so Costa Hawkins is still in effect and most of Measure Q ended up being not relevant. (You likely saw this when you voted in November, but if you’d like a refresher, Costa Hawkins most notably prevents rent control from being imposed on single family homes and condominiums, allows rents to be reset to market rates when a unit is rented to new tenants, and prevents rent control from being imposed on units constructed after February 1995.)

However, one part of measure Q, intended to encourage construction of new accessory dwelling units (ADUs), will go into effect. For properties with one legal and permitted ADU, if the owner resides on the property, the rental unit will be exempt from rent and eviction controls. The exemption will apply to tenancies that started November 7, 2018 or later.

REAL ESTATE ANSWERS: Why are there so many wild turkeys around these days?

This is not exactly a real estate question, but it is something I have been really wondering about myself! When I was growing up, I don’t remember ever encountering a wild turkey. Now it seems they’re everywhere, not just in the Bay Area, but in other parts of the country as well. A quick google search turns up articles about the abundance of wild turkeys in Massachusetts, Alabama, Chicago, Tennessee, Ohio, and lots of other places. Just a few days ago, I sat in my car at a stoplight and watched a gang of turkeys cross Marin Avenue at the very busy intersection of San Pablo. They were even using the crosswalk!